Dividend stocks outperform non-dividend-paying stocks over the long run. It happens in good markets and bad, and the benefit of dividends can be quite striking: Dividend payments have made up about 40% of the market’s average annual return from 1936 to the present day. But few of us can invest in every single dividend-paying stock on the market, and even if we could, we might find better gains by being selective. That’s why we’ll be pitting two of the Dow Jones Industrial Average‘s dividend payers against each other today to find out which Dow stock is the true dividend champion. Let’s take a closer look at our two contenders now.

The Home Depot, Inc. (NYSE:HD) joined the Dow in 1999 as the lone old-economy stock in a tech-heavy reshuffling, and in the aftermath of the dot-com crash it became the best-performing new addition of the four. Operating out of the suburbs of Atlanta, The Home Depot, Inc. (NYSE:HD) is one of the Dow’s youngest components, as it was founded in 1978. Since then, it has grown to become the largest home-improvement retailer in the world (and the fourth-largest retailer in the U.S., period) with more than 2,200 stores located throughout the U.S., Canada, and Mexico — and a few in China as well. It’s often seen as a bellwether for the American housing industry, as so many homebuilders, homebuyers, and specialized contractors shop at The Home Depot, Inc. (NYSE:HD).

Hewlett-Packard Company (NYSE:HPQ) joined the Dow two years earlier than The Home Depot, Inc. (NYSE:HD), in 1997, but its roots are the roots of Silicon Valley itself and can be traced all the way back to 1939. Hewlett-Packard Company (NYSE:HPQ), too, is known for its “hardware,” but this computer maker is a bellwether of a different sort: Hewlett-Packard Company (NYSE:HPQ)’s diverse operations give it claim to the title of “world’s largest technology company.” Until very recently, it was the world’s largest PC-manufacturer. It’s still the global leader in consumer printers, and it also maintains a major presence in servers, software, and business services.

| Statistic | Home Depot | Hewlett-Packard (NYSE:HPQ) |

|---|---|---|

| Market cap | $118.1 billion | $49.1 billion |

| P/E ratio | 26.5 | N/A |

| TTM profit margin | 6.1% | (10.9%) |

| TTM free-cash-flow margin* | 7.8% | 7.1% |

| Five-year total return | 234.7% | (42.3%) |

Source: Morningstar and YCharts. N/A = not applicable due to negative earnings. TTM = trailing-12-month.

*Free cash flow margin is free cash flow divided by revenue for the trailing 12 months.

This may not be much of a contest. Hewlett-Packard Company (NYSE:HPQ) has been down in the dumps lately, and although its turnaround is proceeding faster than expected, the company still finds itself looking up at The Home Depot, Inc. (NYSE:HD) on every metric. But are there any hidden advantages Hewlett-Packard Company (NYSE:HPQ) brings to the dividend game? Let’s find out.

Round one: endurance

According to Dividata, The Home Depot, Inc. (NYSE:HD) began paying dividends in 1987 and has been paying ever since for a solid 25-year streak. Hewlett-Packard Company (NYSE:HPQ), on the other hand, has been consistently paying its shareholders back since 1965 — first on a biannual basis, and then quarterly beginning in 1970. There aren’t many tech companies with better records.

Round two: stability

Paying dividends is well and good, but how long have our two companies been increasing their dividends? The same dividend payout year after year can quickly fall behind a rising market, and there’s no better sign of a company’s financial stability than a rising payout in a weak market (so long as it’s sustainable, of course). Home Depot held its dividend payment steady from 2006 through 2009, so its streak of annual increases only begins in 2010. That’s actually better than beleaguered HP, which held dividends steady for more than a decade (with the exception of one special dividend in 2000) before increasing its payouts in 2011. This round goes to the upstart.

Round three: power

It’s not that hard to commit to paying back shareholders, but are these payments enticing or merely token? Let’s take a look at how both companies have maintained their dividend yields over time as their businesses and share prices have grown:

HD Dividend Yield data by YCharts.

All in all, Home Depot has simply maintained a stronger dividend yield over time; HP’s spike coincides with a deep share-price slump, rather than an increase in the payout. Because Home Depot spent so much more time on top, and because its latest payout hike (a hefty 35% boost) took yields back to nearly 2%, it has to win this round, dispite HP’s current narrow lead.

Round four: strength

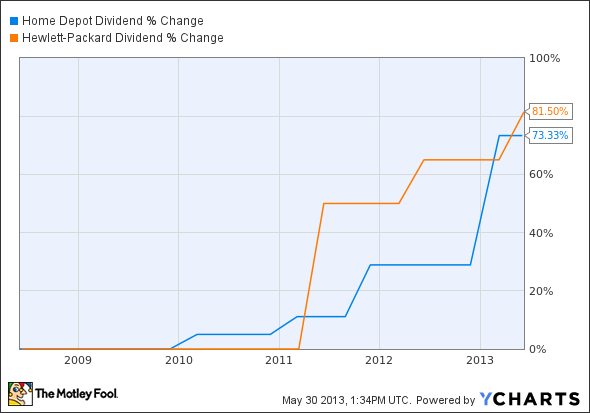

A stock’s yield can stay high without much effort if its share price doesn’t budge, so let’s take a look at the growth in payouts over the past five years. If you bought in several years ago and the company has grown its payout substantially, your real yield is likely to look much better than what’s shown above.

HD Dividend data by YCharts.

Surprisingly, HP sneaks ahead with a recent surge. You might not be too happy with the way share prices have been going since 2011, but at least you’re earning nearly twice as much each quarter as you used to.

Round five: flexibility

A company needs to manage its cash wisely to ensure that there’s enough available for tough times. Paying out too much of free cash flow in dividends could be a warning sign that the dividend is at risk, particularly if business weakens. This next metric analyzes just how much of their free cash flows our two companies have paid out in dividends over the past several quarters:

HD Cash Div. Payout Ratio TTM data by YCharts.

HP comes from behind to win in a squeaker. The venerable tech company has more wiggle room to raise its dividend — and if recent history is any guide, HP is likely to keep boosting its payouts in the future as well. Do you think HP has a stronger claim to the dividend crown, or are these numbers only obscuring an underlying business weakness that should tip investors toward Home Depot?

The article Home Depot vs. Hewlett-Packard: Which Dow Stock’s Dividend Dominates? originally appeared on Fool.com.

Fool contributor Alex Planes holds no financial position in any company mentioned here. Add him on Google+ or follow him on Twitter @TMFBiggles for more insight into markets, history, and technology.The Motley Fool recommends Home Depot.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.