Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the third quarter. You can find articles about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves over the last 4 years and analyze what the smart money thinks of The Home Depot, Inc. (NYSE:HD) based on that data.

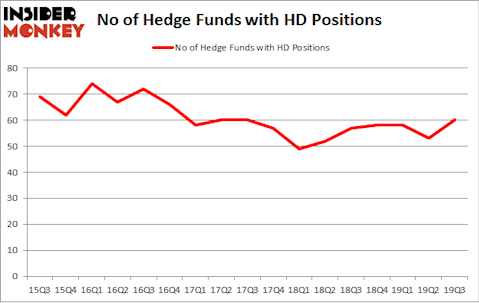

Is The Home Depot, Inc. (NYSE:HD) a bargain? The smart money is becoming hopeful. The number of long hedge fund bets went up by 7 lately. Our calculations also showed that HD isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings). HD was in 60 hedge funds’ portfolios at the end of the third quarter of 2019. There were 53 hedge funds in our database with HD positions at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Phill Gross of Adage Capital Management

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to check out the new hedge fund action regarding The Home Depot, Inc. (NYSE:HD).

How are hedge funds trading The Home Depot, Inc. (NYSE:HD)?

At the end of the third quarter, a total of 60 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 13% from the second quarter of 2019. The graph below displays the number of hedge funds with bullish position in HD over the last 17 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Fisher Asset Management was the largest shareholder of The Home Depot, Inc. (NYSE:HD), with a stake worth $1423.5 million reported as of the end of September. Trailing Fisher Asset Management was Two Sigma Advisors, which amassed a stake valued at $463.3 million. AQR Capital Management, Adage Capital Management, and Arrowstreet Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Chilton Investment Company allocated the biggest weight to The Home Depot, Inc. (NYSE:HD), around 5.95% of its portfolio. BlueSpruce Investments is also relatively very bullish on the stock, setting aside 5.6 percent of its 13F equity portfolio to HD.

As industrywide interest jumped, specific money managers were breaking ground themselves. Junto Capital Management, managed by James Parsons, assembled the most outsized position in The Home Depot, Inc. (NYSE:HD). Junto Capital Management had $63.1 million invested in the company at the end of the quarter. Kenneth Tropin’s Graham Capital Management also initiated a $7 million position during the quarter. The other funds with new positions in the stock are Jeffrey Talpins’s Element Capital Management, Parvinder Thiara’s Athanor Capital, and Donald Sussman’s Paloma Partners.

Let’s go over hedge fund activity in other stocks similar to The Home Depot, Inc. (NYSE:HD). We will take a look at Verizon Communications Inc. (NYSE:VZ), Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM), The Walt Disney Company (NYSE:DIS), and Royal Dutch Shell plc (NYSE:RDS). This group of stocks’ market values resemble HD’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VZ | 56 | 2373783 | 2 |

| TSM | 52 | 5161771 | 10 |

| DIS | 105 | 4233957 | -8 |

| RDS | 29 | 1386135 | -5 |

| Average | 60.5 | 3288912 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 60.5 hedge funds with bullish positions and the average amount invested in these stocks was $3289 million. That figure was $4350 million in HD’s case. The Walt Disney Company (NYSE:DIS) is the most popular stock in this table. On the other hand Royal Dutch Shell plc (NYSE:RDS) is the least popular one with only 29 bullish hedge fund positions. The Home Depot, Inc. (NYSE:HD) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately HD wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); HD investors were disappointed as the stock returned -5% during the first two months of the fourth quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.