Hedge funds run by legendary names like Nelson Peltz and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small caps are where they can generate significant out-performance. These stocks have been on a tear since the end of June, outperforming large-cap index funds by more than 10 percentage points. That’s why we pay special attention to hedge fund activity in these stocks.

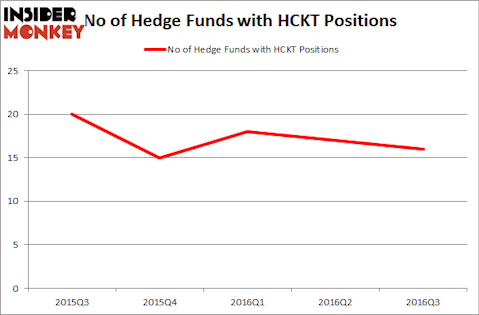

Is The Hackett Group, Inc. (NASDAQ:HCKT) worth your attention right now? Hedge funds are getting less optimistic. The number of bullish hedge fund positions dropped by 1 in recent months. HCKT was in 16 hedge funds’ portfolios at the end of September. There were 17 hedge funds in our database with HCKT positions at the end of the previous quarter. At the end of this article we will also compare HCKT to other stocks including KEYW Holding Corp. (NASDAQ:KEYW), FairPoint Communications Inc (NASDAQ:FRP), and Peoples Bancorp Inc. (NASDAQ:PEBO) to get a better sense of its popularity.

Follow Hackett Group Inc. (NASDAQ:HCKT)

Follow Hackett Group Inc. (NASDAQ:HCKT)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Zadorozhnyi Viktor/Shutterstock.com

How have hedgies been trading The Hackett Group, Inc. (NASDAQ:HCKT)?

Heading into the fourth quarter of 2016, a total of 16 of the hedge funds tracked by Insider Monkey were long this stock, a fall of 6% from the second quarter of 2016. By comparison, 15 hedge funds held shares or bullish call options in HCKT heading into this year. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Jim Simons’ Renaissance Technologies has the number one position in The Hackett Group, Inc. (NASDAQ:HCKT), worth close to $9.8 million. The second most bullish fund manager is Chuck Royce of Royce & Associates, with an $8.6 million position. Remaining hedge funds and institutional investors that are bullish comprise Cliff Asness’ AQR Capital Management, Israel Englander’s Millennium Management and Robert B. Gillam’s McKinley Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.