Fashion retailers operate in one of the most difficult competitive environments in the entire economy. With no sustainable competitive advantages, companies in this industry must design new products to stay ahead of fashion trends while keeping an eye on efficiency of production. This is a difficult balancing act, but a few retailers have been able to achieve it.

For instance, The Gap Inc. (NYSE:GPS) is known for its prudent inventory management despite some merchandising missteps in the past. At the same time, Limited Brands, Inc. (NYSE:LTD) has been able to generate good returns from its signature Victoria’s Secret and Bath & Body Works brands, while keeping expenses low. Meanwhile, Abercrombie & Fitch Co. (NYSE:ANF) has carved out a niche that allows it to thrive.

Measuring efficiency

The long-term success of each of these companies ultimately comes down to efficiency. As part of its effort to achieve efficiency, Abercrombie sells its products at a higher price point than The Gap Inc. (NYSE:GPS) and Limited Brands, Inc. (NYSE:LTD).

Abercrombie’s higher price point allows it to earn higher profits during good times, but lower profits during bad times. This is because price-conscious consumers often favor lower-priced apparel when their income is down. As a result, of operating leverage — a cost structure that mainly consists of fixed costs — Abercrombie’s net income is extremely sensitive to consumer income levels.

Meanwhile, Limited Brands, Inc. (NYSE:LTD) and The Gap Inc. (NYSE:GPS) have broader consumer appeal due to a greater mix of price points. This allows them to earn more consistent operating profits.

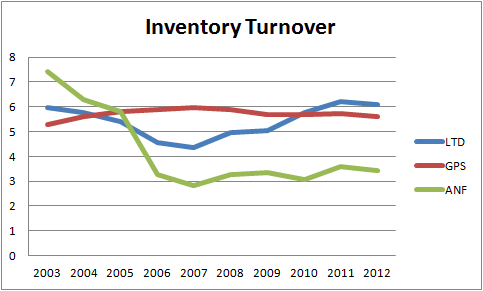

Another crucial metric of a retailer’s efficiency is inventory turnover. A high turnover ratio indicates that the retailer is able to replenish its inventory several times per year. Good inventory management limits a retailer’s downside in the event that the wrong trend is stocked in stores.

Limited Brands, Inc. (NYSE:LTD) and The Gap Inc. (NYSE:GPS) manage their inventory better than Abercrombie. This is because the two companies have worked to shorten lead times on ordered merchandise and maximize sales per square foot. Both companies have had merchandising mishaps, but neither were severely affected due to prudent inventory management.

Finally, investors should always consider a retailer’s cash conversion cycle. The cash conversion cycle measures how long it takes the company to acquire and sell inventory, collect accounts receivable, and pay accounts payable. A lower number indicates that the business quickly turns inventory purchases back into cash, whereas a higher number indicates a longer time between initial inventory purchase and re-conversion to cash.

It is calculated by adding the number of days it takes to collect receivables to the number of days it takes to sell inventory and subtracting how long until the company has to pay its payables.

While The Gap Inc. (NYSE:GPS) and Limited Brands, Inc. (NYSE:LTD) have cash conversion cycles lasting about one month, Abercrombie’s stretches to 75 days.

A company that operates in a fast-changing industry cannot create consistent shareholder value if it cannot turn its inventory into cash at least as quickly as its competitors. This is a major reason why Abercrombie’s free cash flow has fallen off a cliff in recent years, while Limited and Gap continue to produce ample free cash flow.

Bottom line

There are no sustainable competitive advantages in fashion retail; investors have to believe that companies will continue to maintain historical efficiencies — or improve historically poor efficiencies.

Limited, Gap, and Abercrombie each trade at around 14 to 15 times earnings, but Limited Brands, Inc. (NYSE:LTD) and The Gap Inc. (NYSE:GPS) are more attractive due to their superior efficiencies. If they can continue to be efficient retailers, their stock prices will reward investors more than Abercrombie’s stock rewards its investors.

The article Efficiency Is King in Fashion Retail originally appeared on Fool.com and is written by Ted Cooper.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.