So, I took on the liberty of explaining Icahn Enterprises LP (NASDAQ:IEP)‘ deal versus Michael Dell’s in excruciating detail so investors can fully comprehend just what’s going on.

Some background information

Shareholders have been dismayed by the declining stock performance. Dell Inc. (NASDAQ:DELL) is both an asset and cash-flow rich company that trades at depressed valuations due to declining earnings growth. Most stock valuation models takes into consideration the future growth of a company, but when a company like Dell is unable to grow earnings, the stock tends to trade at a deeper-discount. However, the terminology of a discount is pretty relative, some believe a discount means a low PEG value, other focus on low P/E’s, while some focus on the book value of a balance sheet.

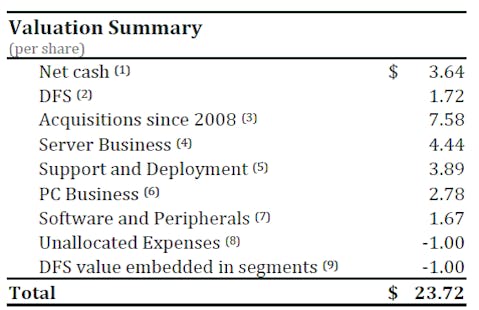

Southeastern Asset Management breaks down the valuation of the company’s business.

Source: Southeastern Asset Management

Southeastern Asset Management breaks down the analysis of Dell Inc. (NASDAQ:DELL), and states that Dell should be trading at $23.72 per share according to its letter to Dell’s board of directors. Because of this, Southeastern Asset Management will vote against Michael Dell’s $24 billion buy-out of the company.

Michael Dell’s Offer

Michael Dell’s offer is pretty simple. Michael Dell plans to borrow money from a third-party source and plans to partner with Silver Lake to take the company private at a price of $13.65 per share. The deal could be lucrative to Dell Inc. (NASDAQ:DELL) as Southeastern Asset Management argues that its businesses outside of PC still represents substantial growth opportunities.

Part of the problem with Michael Dell’s deal is that it doesn’t provide much intrinsic value to shareholders. The stock is currently trading at $13.37 per share at the time of writing. Would it really make sense for Dell shareholders to sell the stock at $13.65 per share when the stock is already trading near the buy-out value? By the time Aug. 2 rolls by (shareholder meeting, whereby shareholders will determine whether or not to accept Michael Dell’s deal) ,the stock could trade at a value that exceeds $13.65 per share.

I mean, would it make sense for investors to sell their shares at $13.65, when the investors could just as easily go to the open-market and sell the stock for more? If the open-market, Dell Inc. (NASDAQ:DELL) trades at a valuation that exceeds $13.65, kiss Dell’s proposed acquisition good-bye.

Southeastern Asset Management and Carl Icahn Proposal

Source: Southeastern Asset Management

So here’s what the smart folks at Southeaster Asset Management in partnership with Carl Icahn have come up with. It believes that Dell should offer a special one-time dividend and keep the stock trading on the open market. So, let’s break down what happens.

1. Dell incurs $9 billion in additional debt in order to finance the dividend.

2. Dell issues a special one-time dividend of $21.35 billion.

3. Dell pays-off the debt over-time while shareholders get the option of holding onto the stock or liquidating it.

4. Where does Dell get financing for the $9 billion? (Maybe Icahn Enterprises LP (NASDAQ:IEP) will lend money to Dell)

So, what is the probable outcome? Well probable outcome is pretty simple. Investors in Dell Inc. (NASDAQ:DELL) collect $12 in dividend per share. Hopefully, after Dell incurs a $9 billion liability, issues $22 billion in dividends, the stock will still be able to trade at a valuation that exceeds $1.65 per share (the difference between the one-time dividend and Michael Dell’s $13.65 per share buy-out value).

For example, if Dell Inc. (NASDAQ:DELL) is able to trade at $12 per share after giving out a $12 per share dividend, investors will be able to realize $12 in dividends, and then sell Dell stock on the stock market for $12. Combine the $12 sold in stock plus the $12 collected in dividend equal $24, which is close to the valuation estimate that Southeastern Asset Management provided.

Remember, the illustrated case assumes that Dell will trade at $12 per share.

What will happen to Dell’s price post special dividend?

If Dell Inc. (NASDAQ:DELL) were to issue a special dividend, there’s no telling what would happen to the stock price. However, I provided analysis of Microsoft Corporation (NASDAQ:MSFT)’s stock performance in 2004 after the company announced its dividend, so we can get an idea of what could potentially happen to Dell’s stock if Icahn’s proposal was to go through.

At that time, the dividend was worth $3.08 (basically 10%-15% of Microsoft’s value). However, after the company offered its shareholders a dividend worth 10% to 15% of the company’s stock valuation, the stock declined 3%.

This implies that if Dell offers its shareholders a dividend, the market value might not decline in proportion to the value of the dividend. This should be seen as advantageous.

Conclusion

Based on the analysis of Microsoft Corporation (NASDAQ:MSFT), we can come up with a simplified conclusion. First, if Dell were to give its shareholders a one-time 90% dividend-yield. The value of the stock will decline by around 30% (maybe down to $10 per share). Making that assumption, when combining the dividend, and the future market value of the stock, investors come ahead with $22 in total value, which puts investors way ahead of the $13.65 offered by Michael Dell.

There could be substantial upside in Dell Inc. (NASDAQ:DELL)’s stock if the company is able to deliver the special one-time dividend.

The article The Full Run Down of Dell’s Special One-Time Dividend originally appeared on Fool.com.

Alexander is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.