The Clorox Company (NYSE:CLX) may not sound as interesting as some aggressive growth stocks, but its safe, strong cash flow shouldn’t be ignored either.

In the past 6 months the bleach manufacturer has only produced returns of 2.86%. This market price stagnation could make some investors doubt about the intrinsic value of the company. But how valuable is Clorox? Is it really safe to invest in this bleach manufacturer? The following reasons suggest The Clorox Company (NYSE:CLX) may be the perfect choice for the risk-adverse investor.

Well recognized, strong brand

Quality is a crucial factor when deciding the brand of the cleaning product we buy. Nobody is more aware of this than The Clorox Company (NYSE:CLX). In one hundred years, the company has positioned itself as a manufacturer of top-quality cleaning products, from its bleach to Glad garbage bags, Kingsford charcoal and Brita water filters. Each of these brands is itself well positioned in its respective segment.

Source: Clorox Investor Relations

The truth is that constant improvements in quality over one century have made Clorox brand a must-have in most households, and consequently the company has managed to build lifetime loyalty bonds among its consumers. For example, according to the latest earnings call presentation slides, as nearly as 90% of its portfolio holds the number-one or number-two spot. Furthermore, management has shown a strong commitment to allocate consistent advertisement spending to reinforce its brand strength. In the past 6 years, about 9% of total yearly sales has been used for advertisement.

The brand strength of The Clorox Company (NYSE:CLX) has made Matt Koppenheffer identify Clorox as one of Warren Buffett’s next big buys, which makes a lot of sense if you consider his preference for high-quality, stable companies.

Solid Fundamentals

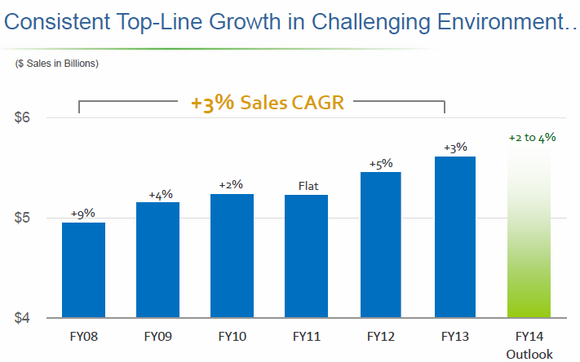

The Clorox Company (NYSE:CLX)’s brand strength is reflected in the company’s excellent fundamentals. First, Clorox has been able to keep consistent top-line revenue growth rates for the past 6 years. Even in 2008, when households were extremely price sensitive, Clorox grew in terms of revenue, while keeping prices well above generics.

Source: Clorox Investor Relations

Notice that between 2003 and 2012, annual revenue grew from $4.14 billion to $5.57 billion. This implies an average yearly growth rate barely above 3%, which could be regarded as too low to be attractive.

However, it is important to keep in mind the current scale of operations of the company (Clorox is three times the size of the next branded competitor in terms of market share) and the fact that growth, although slow, was very consistent, before judging Clorox’s growth rates.

Profitability is also strong. In the latest quarter, adjusted gross margins jumped 130 basis points to 44%. Most of this was due to the firm’s cost-saving efforts. And measures like using a Chlorine-free supply chain, packaging reduction and plant consolidation are set to add 2% to efficiency every year.

Amazing dividend

The Clorox Company (NYSE:CLX)’s dividend yield is well above the Standard & Poor’s 500 average (2%), offering around 3.4% in annual payouts. As a matter of fact, Clorox has increased its dividend every single year since 1977, and a recent increase of roughly 11% was announced in May this year.

Even better, dividends are not the only way management is using to return value to shareholders. Over the last 9 years, management has used cash to repurchase as many as 40% of outstanding shares. Considering the long track of commitment to increase returns to shareholders, I also expect the usage of cash in the future to continue being shareholder-friendly.