U.S. utilities are in a rut and, according to recent energy projections, aren’t about to dig themselves out any time soon. But if you’re looking for a solid dividend with growth potential, you may find a match in U.S. utilities with international assets. I’ll highlight five utilities with different degrees of foreign forays and let you decide which fix fits your fancy.

America doesn’t want your energy

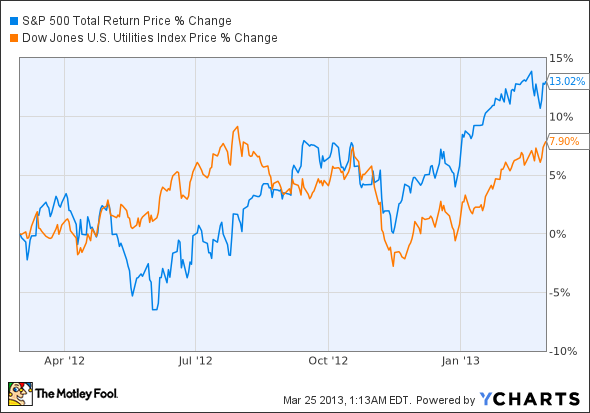

When Exelon Corporation (NYSE:EXC) CEO Chris Cane recently said “2012 was a difficult year on the economic front for our sector,” he wasn’t just making excuses for his company. Falling sales were a common trend for utilities last year, and the sector lagged the S&P 500 by more than 5 percentage points.

Looking ahead, projections aren’t peachy. A recent Department of Energy report predicts that electricity demand will clock in at 0.58% compound annual growth over the next decade, dulled by both America’s economy and advancements in energy efficiency.

The Federal Reserve announced last week that it expects U.S. GDP to fall between 2.9% and 3.7% by 2015, child’s play compared with many emerging markets. And although many utilities are overhauling their energy portfolios to set themselves up for a profitable future, some companies are looking abroad to propel top line growth.

Yes to The AES Corporation (NYSE:AES)?

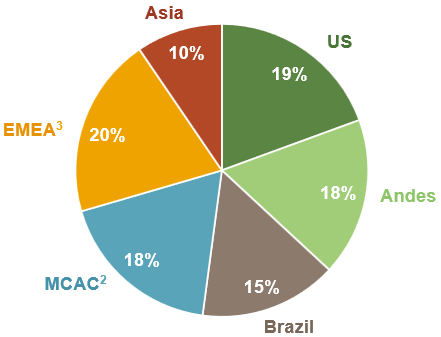

When looking for utilities with international exposure, The AES Corporation (NYSE:AES) is the elephant in the room. Its 27-country spread offers formidable international exposure.

Source: AES Earnings Presentation (MCAC is Mexico, Central America, and the Caribbean. EMEA is Europe, Middle East, and Africa)

But diversification doesn’t make bad business good, and The AES Corporation (NYSE:AES) is currently working to cut costs. Its 4.9 debt-to-equity ratio is higher than 98% of its peers, and the company’s decision to sell 14 assets in nine countries over the past year is no coincidence. The utility’s stock jumped 6% on solid Q4 earnings, and BRIC bulls would do well to give The AES Corporation (NYSE:AES) a closer look.

Feeling Chile?

Hailing from my home state, North Carolina-based Duke Energy Corp (NYSE:DUK) offers investors a nibble of internationalism with a big serving of Southern sauce. Its International Energy subsidiary is primarily focused on generation in Latin America, but it also owns a 25% stake in Saudi Arabian National Methanol Company. Duke Energy Corp (NYSE:DUK) axed a similar 25% stake in a Greek gas company in Q1 2012, while adding on a 240 MW thermal plant and 140 MW hydropower facility to its Chilean operations.

In total, Duke Energy Corp (NYSE:DUK) directly or indirectly generates 4,900 gross MW of international energy. That’s approximately 10% of the utility’s U.S. generation capacity, a significant slice of its portfolio pie. The utility beat top-line and earnings estimates last quarter and could be ready for some serious growth with its $12 billion of modernization projects well under way.

(Inter)National Grid

National Grid plc (ADR) (NYSE:NGG) is anything but, unless you’re based in the United Kingdom. This utility is listed on the U.S. stock exchange, but its blood runs British blue. Its U.K. transmission and gas distribution collectively account for 67% of total operating profit, compared with 29% for its Northeast U.S. regulated companies.

A bet on National Grid plc (ADR) (NYSE:NGG) is, in many ways, a bet on Europe’s recovery. National Grid plc (ADR) (NYSE:NGG) earned The Motley Fool’s Income Investor stamp of approval way back in 2005, and it has ticked up nicely since its Great Recession correction. With its dividend at a 10-year high, now might be the perfect time to pull some profit from the ‘ol motherland.

Canada, eh?

As a final note, who could ignore the diversification in our Northern neighbor? Exelon and Atlantic Power Corp (NYSE:AT) have hopped across the border to make electricity alongside maple syrup. Canada’s proximity allows for inputs and outputs to flow easily and freely, creating a unique international opportunity.

Canada and the U.S. are two of the most closely tied economies in the world, but there are other reasons to head abroad. Exelon’s 20-state and three-province spread create a myriad of regulation options for the utility to choose from as it reorients its generation portfolio.

Source: Exelon EEI presentation.

Atlantic is reeling from a dismal quarter and slashed dividend, and it plans to invest heavily in natural gas and renewables to put itself back in the black. With 13 states and two provinces to choose from, a decent dose of strategy could help Atlantic to generate profit in addition to electricity.

Source: Atlantic Power Investor Relations.

Global growth

Growth rates aren’t what they used to be in the U.S., and a dash of international assets could go a long way to pushing your dividend stocks past mediocre margins. Including utilities in your diversification plan is one of the easiest ways to balance steady income with growth opportunities, so make your move today.

The article 5 Dividend Stocks for International Growth originally appeared on Fool.com.

Fool contributor Justin Loiseau has no position in any stocks mentioned, but he does use electricity. You can follow him on Twitter, @TMFJLo, and on Motley Fool CAPS, @TMFJLo. The Motley Fool recommends Exelon and National Grid.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.