We recently compiled a list of the 14 Best 52-Week High Stocks to Buy According to Short Sellers. In this article, we are going to take a look at where Texas Instruments Incorporated (NASDAQ:TXN) stands against the other 52-week high stocks.

The U.S. stock market has been on a roll, with major indices clocking double-digit gains even with the U.S. economy showing signs of weakness. The gains have come from investors shrugging off the uncertainty around the U.S. presidential election and monetary policy to continue betting on various counters.

Consequently, the S&P 500 is already up more than 17% for the year, driven by gains in the communication services and financial services sectors. Likewise, technology stocks have also contributed to driving the overall market high as investors continue paying close attention to some of the big plays around artificial intelligence.

READ ALSO: 18 Best 52-Week Low Stocks to Buy Now According to Short Sellers and Top 10 ADR Stocks To Buy According to Hedge Funds.

The tech-heavy NASDAQ index, which gained 18% for the year, comes on growing expectations that the U.S. Federal Reserve has hit the peak of its monetary policy tightening spree. With expectations that the central bank will start cutting interest rates by as much as 50 basis points, according to CNBC, investors’ sentiments around tech stocks have improved significantly for September.

Investors remain optimistic about the stock market outlook heading into year end because of the positive impact of low interest rates. The Fed’s cutting interest rates will result in a significant drop in borrowing costs, which bodes well for capital-intensive businesses looking to access cheap capital.

The central bank aims to achieve a soft landing for the economy. In this situation, inflation must return to the 2% goal without the U.S. economy sliding into a downturn. If the central bank reduces interest rates prematurely, it faces the danger of a severe surge in inflation. Conversely, if it reduces rates too late, it might cause a severe recession.

While interest rate cuts are expected to offer a much-needed boost, disappointing earnings, and lackluster guidance could curtail market gains, especially for the best 52-week high stocks to buy, according to short sellers.

Several companies are under immense pressure after their valuation skyrocketed amid the artificial intelligence frenzy. Consequently, any concerns about slow earnings and revenue growth should send jitters, triggering significant pullbacks.

Adam Turnquist, the head of technical strategy at LPL Financial, mentioned that the S&P 500 typically experiences about three annual declines of at least 5%. On average, it has seen around one 10% decline each year.

“Expressing this data another way, 94% of years since 1928 have experienced a pullback of at least 5%, and 64% of years have had at least one 10% correction,” Turnquist said, according to USA Today. “We believe that how common these occurrences are should provide comfort to equity investors, allowing them to be patient.”

Looking forward to the rest of the year, experts predict that the best 52-week high stocks to buy, according to short sellers, could keep rising, but they caution about the dangers of premium valuations.

At the same time, financial experts believe that although economic expansion will slow down in the next few months, they don’t see a situation that could cause a recession.

Our Methodology

To compile the list of the best 52-week high stocks to buy now, according to short sellers, we first screened for stocks that were trading near their 52-week highs (0-10% range) using the Finviz stock screener. Next, we looked at their short interest and picked the stocks with the lowest short interest that were the most popular among elite hedge funds. The stocks are ranked in descending order based on their short interest.

At Insider Monkey, we are obsessed with the stocks that hedge funds pile into. The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

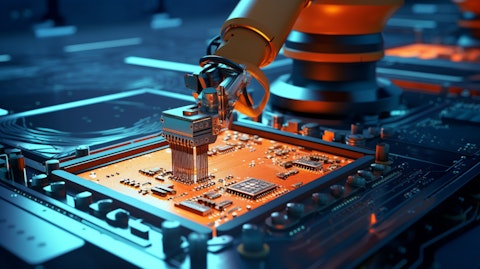

A robotic arm in the process of assembling a complex circuit board – showing the industrial scale the company operates at.

Texas Instruments Incorporated (NASDAQ:TXN)

52 Week Range: $139.48 – $214.41

Current Share Price: $211.09

Short interest rate: 2.04%

Number of Hedge Fund Holders: 50

Texas Instruments Incorporated (NASDAQ:TXN) is a technology company that designs, manufactures, and sells semiconductors to electronic designers and manufacturers. It is one of the best 52-week high stocks to buy, according to short sellers, for any investors eyeing exposure amid the artificial intelligence frenzy. The stock is currently trading close to its 52-week highs as investors react to strong demand for its semiconductor products and a positive outlook that affirms underlying growth.

Texas Instruments Incorporated (NASDAQ:TXN) has set out on a long-term spending plan to increase its investment over a four-year period, expected to reach approximately $5 billion annually. The goal was to allocate funds towards building facilities in the U.S. to produce essential semiconductors used in various industrial and automotive sectors to reduce the expense per chip. The firm has chosen to focus more on the industrial and automotive markets, which made up 75% of its income in 2023 compared to just 40% in 2014.

The company delivered mixed second-quarter results. Revenues decreased 16% yearly to $3.82 billion, mostly due to weakness in the automotive and industrial segments. However, earnings per share of $1.22 were above consensus estimates of $1.16.

Texas Instruments Incorporated (NASDAQ:TXN) exited the quarter with a cash flow of $6.4 billion, affirming the core business’s strength and the product portfolio’s quality. Free cash flow, on the other hand, stood at $1.5 billion. Owing to the strong balance sheet, the company announced a 55 increase in its dividend payout last year, marking the 20th straight year of a dividend hike.

While the company has been facing revenue headwinds in recent quarters, it has affirmed its commitment to returning value to shareholders, as evidenced by the 2.50% dividend yield. Its dividend payout currently stands at about 90%.

At the end of Q2 2024, 50 hedge funds in Insider Monkey’s database owned stakes in Texas Instruments Incorporated (NASDAQ:TXN), up from 49 in the preceding quarter. With more than 4.2 million shares, First Eagle Investment Management was the company’s most significant stakeholder in Q2.

Here is what The London Company said about Texas Instruments Incorporated (NASDAQ:TXN) in its Q2 2024 investor letter:

“Texas Instruments Incorporated (NASDAQ:TXN) – TXN rallied in 2Q despite declining revenue in its latest update. TXN is beginning to see some encouraging signs of destocking nearing an end and some sub segments of the market are experiencing improving demand. TXN continued to spend on capex and should begin to see positive benefits to cash flow next year from the CHIPS Act.”

Overall TXN ranks 14th on our list of the best 52-week high stocks to buy according to short sellers. While we acknowledge the potential of TXN as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for a promising AI stock that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: $30 Trillion Opportunity: 15 Best Humanoid Robot Stocks to Buy According to Morgan Stanley and Jim Cramer Says NVIDIA ‘Has Become A Wasteland’.

Disclosure: None. This article is originally published at Insider Monkey.