We recently published a list of Diamond Hill Capital Stock Portfolio: Top 10 Stock Picks. In this article, we are going to take a look at where Texas Instruments Incorporated (NASDAQ:TXN) stands against other top 10 stock picks of Diamond Hill Capital.

Heather Brilliant, CFA, serves as CEO for Diamond Hill Capital and joined the firm in 2019, bringing over 20 years of domestic and international investment industry experience to this role. Most recently, she was the CEO of Americas with First State Investments. Before that role, she dedicated ~14 years with Morningstar where she was Global Head of Equity & Credit Research before advancing to CEO of Morningstar Australasia. Established in 1997, Diamond Hill Capital Management is a distinguished hedge fund manager based in Ohio.

Investment Philosophy & Process

Diamond Hill Capital has consistently applied an intrinsic value investment philosophy since its founding. The investment management firm focuses on buying ownership stakes in businesses that trade for less than what they are worth and then wait for that value to be realized over time. Under its intrinsic value philosophy, the firm treats every investment as a partial ownership interest in that organization and invests with a margin of safety. Apart from these, the firm possesses a long-term temperament (five years or longer) and believes that market price and intrinsic value will converge within an appropriate time frame. As of February 28, the investment management firm had assets under management of ~$30.9 billion.

Of the total AUM, ~$17.8 billion is allocated to large-cap strategy. Notably, around 23.1% is invested in the financial sector, while the industrial sector made up ~17.5%, as of December 31.

Diamond Hill Capital’s Equity Market Outlook

While several investors remain optimistic about the possibly more accommodative regulatory environment and tax cuts, Diamond Hill Capital believes the fact that the majority of the stocks aside from mega-cap technology companies gave back most of their Q4 2024 gains, which hints about optimism being outweighed by worries related to the potential for policy proposals in fields such as tariffs, taxes, and immigration to spur inflation. Moving forward, the investment management firm plans to assess government policies’ potential impacts, which can vary widely throughout businesses and industries. The company plans to seek attractive opportunities that trade at valuations it finds compelling relative to its estimates of intrinsic value and with the potential to deliver above-average returns.

With this in mind, let us now have a look at the Diamond Hill Capital Stock Portfolio: Top 10 Stock Picks.

Our Methodology

To list the Top 10 Stock Picks of Diamond Hill Capital, we selected the top 10 stocks in Diamond Hill Capital’s portfolio as per its Q4 2024 13F filing. We settled on the hedge fund’s 10 biggest holdings. Finally, we ranked the stocks in ascending order based on the value of Diamond Hill Capital’s equity stakes. Additionally, we have mentioned the hedge fund sentiment around each stock, as of Q4 2024.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 373.4% since May 2014, beating its benchmark by 218 percentage points (see more details here).

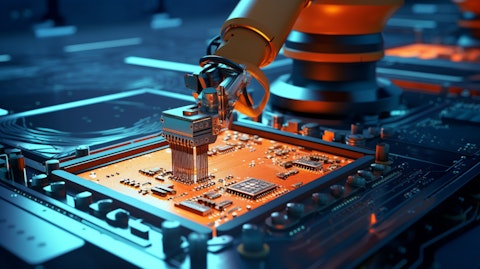

A robotic arm in the process of assembling a complex circuit board – showing the industrial scale the company operates at.

Texas Instruments Incorporated (NASDAQ:TXN)

Diamond Hill Capital’s Stake Value: $633.47 million

Number of Hedge Fund Holders: 66

Texas Instruments Incorporated (NASDAQ:TXN) is engaged in designing, manufacturing, and selling semiconductors to electronics designers and manufacturers. Citi Research named the company as its top pick after mentioning that it possesses the best risk-reward ratio compared to other analog semiconductor stocks. Analysts, led by Christopher Danely, are optimistic regarding the broader analog sector as they opine that inventory levels are low, the sales are about to recover, and profit margins and EPS have likely bottomed out. Therefore, they project upside revisions to consensus estimates. Also, analysts are seeing early signs of this recovery. Texas Instruments Incorporated (NASDAQ:TXN)’s exposure to large, fast-growing markets and its robust portfolio of analog and embedded place it well to capture the opportunity ahead.

Texas Instruments Incorporated (NASDAQ:TXN) is ~70% through its 6-year elevated CapEx cycle which, when completed, can uniquely position the company. Furthermore, the company has debuted new power-management chips to support the growing power needs of modern data centers. Diamond Hill Capital, an investment management company, released its Q4 2024 investor letter. Here is what the fund said:

“Other bottom Q4 contributors included Extra Space Storage, Texas Instruments Incorporated (NASDAQ:TXN) and Union Pacific. Semiconductor manufacturer Texas Instruments saw weaker demand in Q4, which pressured shares. However, we expect these demand trends to be transitory and maintain our favorable outlook on the company’s long term prospects and superior competitive position.”

Overall, TXN ranks 6th on our list of top 10 stock picks of Diamond Hill Capital. While we acknowledge the potential of TXN as an investment, our conviction lies in the belief that some deeply undervalued AI stocks hold greater promise for delivering higher returns, and doing so within a shorter time frame. If you are looking for a deeply undervalued AI stock that is more promising than TXN but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 20 Best AI Stocks To Buy Now and 30 Best Stocks to Buy Now According to Billionaires

Disclosure: None. This article is originally published at Insider Monkey.