Stanphyl Capital letter to investors for the month ended June 30, 2020, discussing their short thesis for Tesla Inc (NASDAQ:TSLA) and other positions in several small-cap stocks.

For June 2020 the fund was down 3.9% net of all fees and expenses. By way of comparison, the S&P 500 was up 2.0% while the Russell 2000 was up 3.5%. Year-to-date 2020 the fund is down 7.0% while the S&P 500 is down 3.1% and the Russell 2000 is down 13.0%. Since inception on June 1, 2011 the fund is up 43.0% net while the S&P 500 is up 178.6% and the Russell 2000 is up 93.0%. Since inception the fund has compounded at 4.0% net annually vs 11.9% for the S&P 500 and 7.5% for the Russell 2000. (The S&P and Russell performances are based on their “Total Returns” indices which include reinvested dividends. The fund’s performance results are approximate; investors will receive exact figures from the outside administrator within a week or two. Please note that individual partners’ returns will vary in accordance with their high-water marks.)

Our strategy during this economic depression is simple: own stocks that are cheap (typically on an EV-to-revenue basis) with great balance sheets and that are turnaround and/or acquisition candidates, and hedge that exposure by being short the very expensive Nasdaq 100 (via a short position in the QQQ ETF). Last month that strategy worked well; this month, poorly. Without that short hedge (and our relatively small Tesla short) the fund would have been up in June, but I refuse to be “naked long” one of the most overvalued stock markets in history as the economy enters a multi-year depression.

Those of you who think extremely low interest rates will put a floor under stocks despite the current no-growth environment may want to have a look at this paper from Verdad Capital, covering the 20 years since Japan’s BOJ initiated a zero interest rate policy. You’ll notice that despite those low rates there have been multiple massive draw-downs in stock prices, and that the best performing equity class by far was “small-cap value.” We’re well-positioned for both those events.

COVID-19 will have a terrible economic impact for several years, initially via altered behavior (crowd & travel avoidance) leaving the world in a severely depressed economy until there’s a vaccine widely available (hopefully in 12-18 months), followed by a still weak economy (relative to 2019) for a couple of years after that as the confidence necessary to start or expand businesses is slowly regained.

I thus wouldn’t want to own any business that’s overly consumer-facing or real estate-related (restaurants, theaters, etc. can’t make money if “social distancing” caps their capacity at 50%); instead we hold cheaply priced stocks involved with technology upgrade cycles that will happen regardless of how “the consumer” is doing—in fact, some of these companies (due to the 5G upgrade cycle) may benefit from the increased bandwidth requirements of working remotely, while others may do “just okay” but we’re buying them cheaply enough that (as noted above) I think they make terrific strategic acquisition targets in a world starved of “organic” growth.

Stanphyl’s Portflio Holdings

Here then are the fund’s specific positions; please note that we may add to or reduce position sizes as stocks approach or recede from our target prices…

We continue to own Aviat Networks, Inc. (NASDAQ:AVNW), a designer and manufacturer of point-to-point microwave systems for telecom companies, which in May reported a terrific Q3 for FY 2020, with revenue up nearly 14% year-over-year and a significant improvement in gross margin and operating earnings, as well as a reiteration of full-year guidance and expectations for growth in FY 2021 (beginning July). In January Aviat’s board (controlled by activist investor Warren Lichtenstein) appointed a new CEO and the accompanying press release made it quite clear (based on his experience) that he was brought in to dress up the company and get it sold. Aviat’s closest pure-play competitor Ceragon (CRNT) sells at an EV of approximately 0.6x revenue. If we assume $240 million in run-rate revenue for Aviat, $30 million of net cash and a $10 million valuation on a combination of $400 million of U.S. NOLs, $8 million of U.S. tax credit carryforwards, $212 million of foreign NOLs and $2 million of foreign tax credit carryforwards, we get an acquisition valuation of 0.6 x $240 million = $144 million + $30 million net cash + $10 million for the NOLs = $184 million divided by 5.4 million shares = $34/share.

We continue to own Data I/O Corporation (DAIO), a manufacturer of semiconductor programming devices. (Here’s a great recent overview published in Seeking Alpha.) We previously owned this stock in 2016 when we bought it in the $2s and sold it a year later in the $4s and $5s (it eventually ran to the $16s before collapsing, as it got way ahead of itself as new holders failed to account for its cyclicality), and now we’ve repurchased it in the $2s for another run. In 2019 (a year that without COVID would have marked a cyclical low for the company), DAIO did $21.6 million in revenue with a 58% gross margin. In April it reported its first COVID-19 affected quarter (Q1 2020), in which it did $4.8 million in revenue (still with a 58% gross margin) and ended the quarter with $13.8 million in cash and no debt. Using 2019’s revenue and valuing DAIO at 2x that cyclically low figure (this company is much more levered to customer technology cycles than economic cycles), then adding in $13 million of cash (after assuming $800,000 of COVID-related burn) makes this stock worth over $6.80/share.

We continue to own Amtech Systems, Inc. (ASYS), a manufacturer of semiconductor production and automation systems. Amtech recently sold its unprofitable solar divisions and is now a 38% gross margin company that does around $80 million a year in normalized (ex-COVID problems) revenue with around $4 million a year in operating income (again, ex-COVID) and around $44 million in net cash and over $80 million in NOLs. If we subtract $1 million from Amtech’s cash to account for two more quarters of “COVID hit,” then value the company at 1.5x revenue with $8 million for the NOLs, we get fair value of around $12/share. The biggest risk here (other than underestimating “the COVID effect”) is that management—which *is* acquisitive—blows that cash pile on something stupid!

We continue to own Westell Technologies Inc. (WSTL), a manufacturer of proprietary networking hardware products (here’s its latest corporate overview) which in June reported yet another lousy quarter, in this case Q4 of FY 2020 ending March 31st, with COVID-affected revenue down 14% sequentially and 36% (!) year-over-year. However, with $21.5 million in cash (estimated as of June 30th and inclusive of a forgivable $1.6 million PPP loan) and no debt, Westell has over five years of remaining cash runway to grow revenue and return to break-even (it’s projecting to do so in calendar year 2021), and obviously much more than that if it cuts the burn along the way. We continue to own Westell because it’s a $25 million/year, 33% gross margin business with an estimated $1.35/share in net cash that currently sells for a severely negative enterprise value. Assuming 15.81 million shares, an acquisition price (by a cost-eliminating strategic buyer) of just 0.5x revenue would (on an EV basis) be over $2/share. Preventing such an acquisition is that Westell suffers from a dual share class, with voting control held by moronic descendants of the founder who refuse to sell the company despite the stock’s horrible performance. However, I’m hopeful that someone will knock enough sense into their small brains to inspire them to salvage what’s left here, and thus walk away with at least something from what they’ve squandered. If they do the stock should be at least a double from here, and possibly more. In other words, it’s too cheap for me to sell but the board is too incompetent for me to buy more.

We continue to own Evolving Systems, Inc. (EVOL), a small telecom services marketing company that generates nearly $1 million/year in free cash flow on $26 million of 65% gross margin revenue. This company would make a great buy for a strategic acquirer, as $1.5 million/year in savings from eliminating the C-suite and cost of being a standalone public company would mean around $2.5 million/year in free cash flow. Thus, at an acquisition price of just $2/share (a nearly 100% premium to the current price) a buyer would be paying only around 10x free cash flow and 1x revenue. Also, management made clear on the May conference call that Evolving has been relatively unaffected by COVID-19 as it was already a highly decentralized business; thus the virus impact will be to draw out the sales cycle for new contacts, but shouldn’t affect revenue from existing ones.

We continue to own Communications Systems, Inc. (NASDAQ:JCS), an IOT (“Internet of Things”) and internet connectivity & services company (here’s the latest corporate overview), which in April reported a COVID-affected Q1 with revenue down 18% year-over-year (roughly in line with my expectations). Normalized (ex-COVID) run-rate revenue for this company is around $47 million a year (inclusive of $3 million from a small acquisition announced in May) with a gross margin in the low-to-mid 40%s. If we value JCS at 0.8x normalized revenue plus its $27 million of net cash (inclusive of the $4 million spent for the May acquisition and just under $1 million spent for a May partnership investment) and assume 9.3 million shares, we derive fair value of around $7/share. The company also pays a .02/share quarterly dividend and is in contract to sell its headquarters building for $10 million which, if it closes late this year or early next, will add another $1.07/share in cash to the balance sheet.

Finally on the long side, as central banks increase their money-printing to ever higher levels in order to fund multi-trillion-dollar annual deficits, we continue to hold a substantial long position in the gold ETF (GLD).

Tesla Short Thesis

We remain short Tesla Inc. (TSLA), which I still consider to be the biggest single stock bubble in this whole bubble market. The core points of our Tesla short thesis are:

- Tesla has no “moat” of any kind; i.e., nothing meaningfully proprietary in terms of electric car technology, while existing automakers—unlike Tesla—have a decades-long “experience moat” of knowing how to mass-produce, distribute and service high-quality cars consistently and profitably, as well as the ability to subsidize losses on electric cars with profits from their conventional cars.

- In 2020 Tesla will again lose money, as it has every year in its 17-year existence.

- Tesla is now a “busted growth story”; revenue growth is flatlining while unit demand for its cars is only being maintained via price cutting.

- Elon Musk is a securities fraud-committing pathological liar.

In June, courtesy of Business Insider, we once again learned how much of a sociopath Elon Musk is:

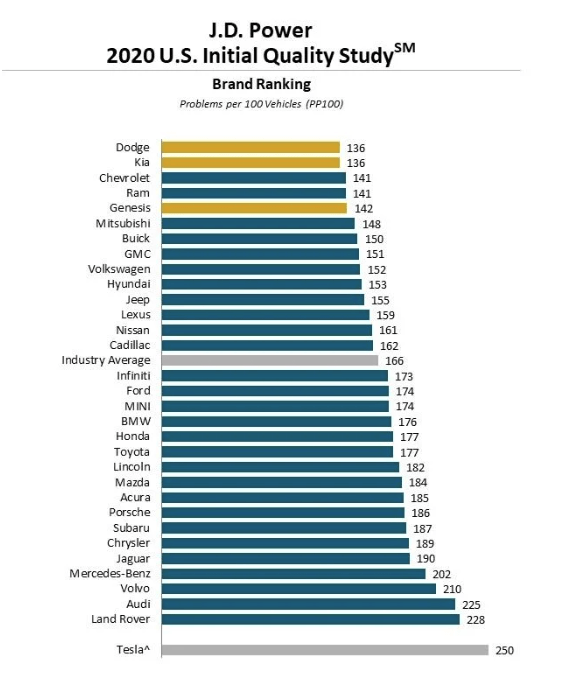

Then, courtesy of J.D. Power, we again learned about the atrocious quality of Tesla’s cars; it ranked dead last of 31 brands surveyed:

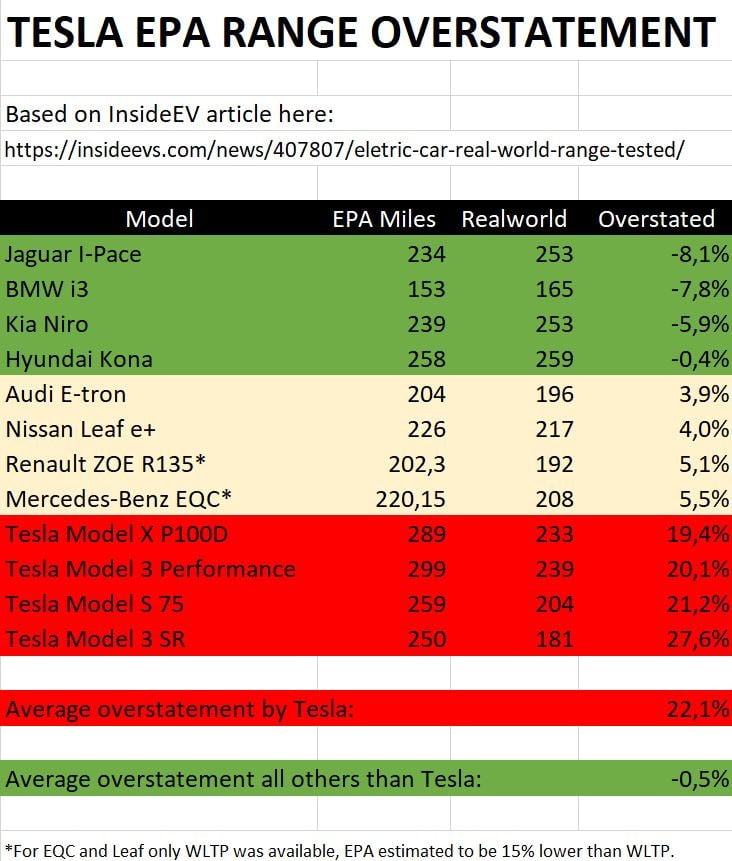

And here’s a great graphic from Twitter user @clausMller17 clearly demonstrating Tesla’s blatantly fraudulent EPA range claims for its cars:

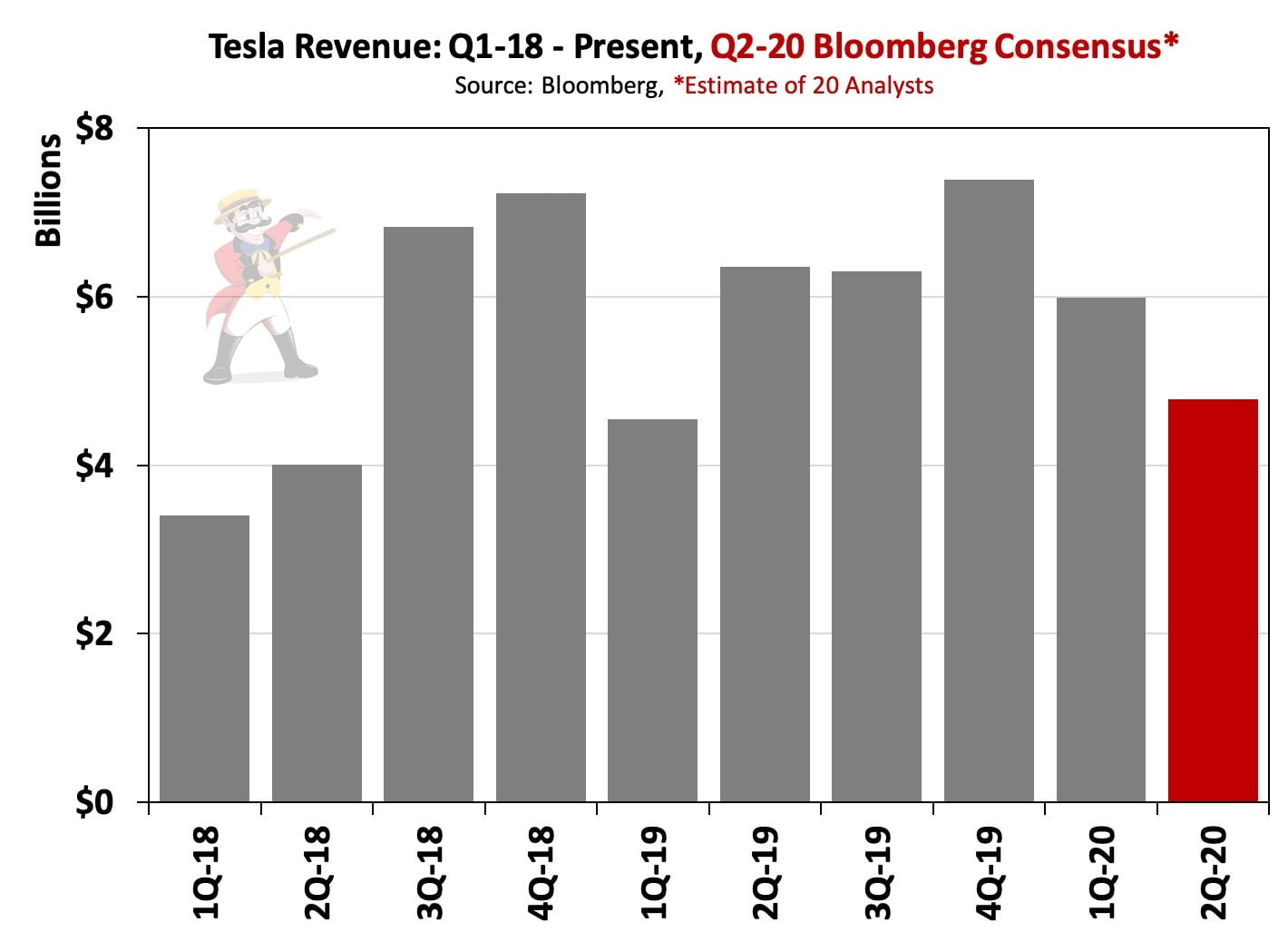

And as @TeslaCharts points out on Twitter, Tesla is no longer even a growth company:

In May, faced with a shortage of demand in an increasingly competitive (see the many links below) electric car environment during an economic depression, Tesla cut prices across the board. Nothing’s more amusing than seeing this giant stock promotion of a company continue to add capacity (expanding its Chinese factory while supposedly breaking ground on brand new factories in Texas and Germany) in order to desperately try to maintain an image of “limitless demand” as it continually slashes prices to unprofitable levels (excluding its unsustainable emission credit sales and accounting fraud) just to utilize its existing capacity.

In April Tesla reported $16M in Q1 “earnings” thanks entirely to the sale of $354M in 100% margin emission credits that disappear after next year when other automakers no longer need to buy them as they’ll have enough EVs of their own. Additionally, Tesla’s earnings are typically inflated by around $200M/quarter from its ongoing warranty fraud (here’s an excellent Seeking Alpha article and another one in Fortune explaining some of this), so adjusted for these two factors the company would have lost over $500M in Q1, while free cash flow was minus $895M. This is not a viable business.

In addition to the typcial quarterly warranty reserve fraud, Musk may generate a Q2 profit by recognizing part of $600 million in non-cash (it’s already on the balance sheet) deferred revenue from its fraudulently named “Full Self-Driving” (the capabilities of which offer nothing of the kind), thereby turning yet another a money-losing quarter into one showing paper profits. Meanwhile, God only knows how many more people this monstrosity unleashed on public roads will kill, despite February’s NTSB hearing condemning it as dangerous.)

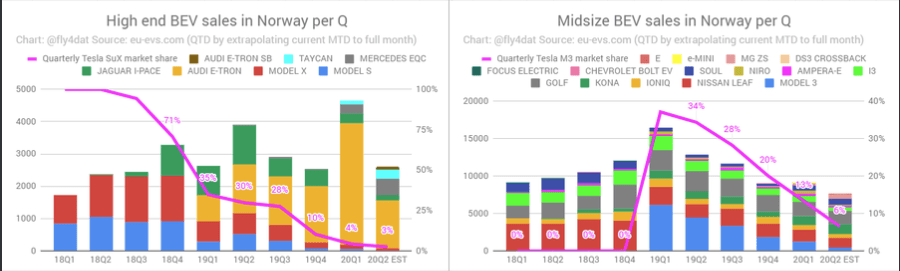

Meanwhile, a terrific chart from Twitter user @fly4dat illustrates how Tesla’s EV market share (the pink line below) in Europe (the world’s most competitive EV market) continues to erode as new competition arrives; this foreshadows what will soon happen to Tesla worldwide:

And for those of you looking for a resumption of growth from Tesla’s upcoming Model Y, demand for that car is reportedly disastrous. This is unsurprising, as it will both massively cannibalize sales of the Model 3 sedan and (later this year and in 2021) face superior competition from the much nicer electric Audi Q4 e-tron, BMW iX3 (in Europe & China), Mercedes EQB, Volvo XC40 and Volkswagen ID.4, while less expensive and available now are the excellent new all-electric Hyundai Kona and Kia Niro, extremely well reviewed small crossovers with an EPA range of 258 miles for the Hyundai and 238 miles for the Kia, at prices of under $30,000 inclusive of the $7500 U.S. tax credit. Meanwhile, the Model 3 will have terrific direct “sedan competition” later this year from Volvo’s beautiful new Polestar 2, the BMW i4 and the premium version of Volkswagen’s ID.3.

And if you think China is the secret to the resumption of Tesla’s growth, let’s put that market in perspective even without the coronavirus problem: prior to a recent 10% sales tax exemption Tesla was selling around 30,000 Model 3s a year there, and “the story” is that avoiding the 15% tariff and that 10% sales tax will allow it to sell a lot more. There’s also a $3600 EV incentive available (which will be reduced over the next two years), but China just cut to 300,000 yuan the maximum price allowed for an EV to get it; Tesla is thus slashing its Model 3 price from 323,000 yuan to qualify and will now make little-to-nothing on the car, and thus all volume increases will be profitless. Meanwhile the rule of thumb for the elasticity of auto pricing is that every 1% price cut results in a sales increase of up to 2.4%. If we assume a 2.4x “elasticity multiplier,” domestically produced Model 3s that are 40% cheaper (than the original price at the 30,000/year sales rate) would result in annual sales of just 59,000 (40% x 2.4 = 96% more than the previous 30,000), meaning Tesla’s new Chinese factory would be a massive money-loser vs. its initial 150,000-unit annual capacity and the 500,000/year capacity it will supposedly have in 2021. Even if we were to increase the previous sales rate by 150% to 75,000 cars a year, it would be massively disappointing for Tesla bulls and the factory will be a huge money-loser.

Meanwhile, sales of Tesla’s highest-margin cars (the Models S&X) will be down by over 50% worldwide this year vs. their 2018 peak, thanks to cannibalization from the less expensive Model 3 and direct high-end competition (especially in Europe and China) from the Audi e-tron, Jaguar I-Pace, Mercedes EQC and Porsche Taycan, with multiple additional electric Audis, Mercedes and Porsches to follow, many at starting prices considerably below those of the high-end Teslas. (See the links below for more details.)

And oh, the joke of a “pickup truck” Tesla introduced in November won’t be any kind of “growth engine” either, especially as if it’s ever built it will enter a dogfight of a market.

Meanwhile, Tesla has the most executive departures I’ve ever seen from any company, including in June its VP of Business Development; here’s the astounding full list of escapees. These people aren’t leaving because things are going great (or even passably) at Tesla; rather, they’re likely leaving because Musk is either an outright crook or the world’s biggest jerk to work for (or both). And in January Aaron Greenspan of @PlainSite published a terrific treatise on the long history of Tesla fraud; please read it!

In May Consumer Reports completely eviscerated the safety of Tesla’s so-called “Autopilot” system; in fact, Teslas have far more pro rata (i.e., relative to the number sold) deadly incidents than other comparable new luxury cars; here’s a link to those that have been made public. Meanwhile Consumer Report’s annual auto reliability survey ranks Tesla 23rd out of 30 brands (and that’s with many stockholder/owners undoubtedly underreporting their problems—the real number is almost certainly much worse), and the number of lawsuits of all types against the company continues to escalate– there are now over 800 including one proving blatant fraud by Musk in the SolarCity buyout (if you want to be really entertained, read his deposition!).

So here is Tesla’s competition in cars (note: these links are regularly updated)…

- Porsche Taycan

- Porsche Taycan Cross Turismo

- Porsche Macan EV to get Taycan platform and tech

- Audi e-tron: Electric Has Gone Audi

2020 Audi E-Tron Sportback debuts slick new roofline, a bit more range - AUDI E-TRON GT FIRST DRIVE: LOOK OUT, TESLA (available 2020)

- Audi’s Q4 e-tron previews entry-level EV for 2021

- Audi e-tron compact hatch to lead brand’s electrification plans

- Audi TT set to morph into all-electric crossover

- THE AWARD-WINNING ALL-ELECTRIC JAGUAR I‑PACE

- Jaguar Land Rover to invest £1bn in three new UK-built EVs

- Mercedes EQC electric SUV available now in Europe & China and in 2021 in the U.S.

- Mercedes EQV Electric Minivan Revealed – Available 2020

- Mercedes EQA electric SUV previewed in exclusive images

- Mercedes EQB Small SUV to boost brand’s electric line-up

- Mercedes EQS will be built in addition to the S-Class on a new dedicated electric platform

- Volvo Polestar 2 Arrives 2020

- Polestar 3 will be an electric SUV that shares its all-new platform with next Volvo XC90

- Volvo XC40 Recharge, a 408-HP Electric SUV comes in 2020

- Volvo confirms electric version of next XC90

- Volkswagen ID.3 Deliveries Begin September 2020

- VW ID.4: Wolfsburg’s Upcoming EV Crossover

- VW Group to launch 70 pure electric cars over the next decade

- GM Reveals New Ultium Batteries & a Flexible Global Platform to Rapidly Grow EV Portfolio

- GM to Revive Hummer Name on New Electric Pickup Model

- Chevrolet Bolt Now Offers 259 Miles of Range

- GM’s Detroit-Hamtramck plant expected to build electric Escalade, Sierra

GM is transforming Cadillac into an electric brand - GM & Honda to Jointly Develop Next-Generation Honda EVs Powered by GM Ultium Batteries

- Hyundai Kona Electric: 258-mile range & under $38,000 before subsidies

- Genesis Electric Luxury SUV Coming in 2022

- Kia Niro Electric: 239-mile range & $39,000 before subsidies

- Kia Soul Electric: 243-mile range

- New 2021 electric Kia SUV to offer Porsche Taycan pace with 0-62mph in 3s

- All-Electric Ford Mustang Mach-E Delivers Power, Style and Freedom for New Generation

- The Electric Ford F-150 Will Be Here by Mid-2022

- Ford to build two European EVs based on VW’s MEB platform

- Nissan LEAF e+ with 226-mile range is available now

- Nissan Ariya Electric SUV Concept Is Destined for Production

- BMW 1 Series Electric Coming As Early As 2021

- BMW iX3 electric crossover goes on sale in 2020

- The BMW i4 EV Will Be the Most Powerful 4-Series

- BMW’s 2021 iNEXT Returns In New Teasers Showing Prototypes Production

- Rivian electric pickup truck- funded by Amazon, Ford, Cox & others- is on the way

- Renault upgrades Zoe electric car as competition intensifies

- New all-electric Renault SUV to arrive in next 18 months

- Peugeot 208 to electrify Europe’s small-car market

- Peugeot to offer EV version of new 2008 small crossover

- Electric Mini Arrives 2020

- Toyota and Subaru Agree to Jointly Develop BEV-dedicated Platform and BEV SUV

- Mazda extends MX name to new MX-30 electric crossover

- SEAT will launch 6 electric and hybrid models and develop a new platform for electric vehicles

- Opel sees electric Corsa as key EV entry

- 2021 Vauxhall Mokka revealed as EV with sharp looks, massive changes

- Škoda electric Enyaq to come in 5 variants

- New Citroen C4 Cactus to be first electrified Citroen in 2020

- FCA to invest $788M to build new 500 EV in Italy

- BYD will launch electric SUV in Europe

- Maserati to launch electric sports car

- Bentley Will Offer Hybrid Versions of Every Car It Makes and Add an EV by 2025

- Lucid Motors closes $1 billion deal with Saudi Arabia to fund electric car production

- Meet the Canoo, a Subscription-Only EV Pod Coming in 2021

- Two new electric cars from Mahindra in India; Global Tesla rival e-car soon

- Former Saab factory gets new life building solar-powered Sono Sion electric cars

And in China…

- VW ramps up China electric car factories, taking aim at Tesla

- Volkswagen pumps 2 billion euros into China electric vehicle bet

- Audi Q2L e-tron debuts at Auto Shanghai

- Audi will build Q4 e-tron in China

- FAW-Volkswagen’s Foshan plant said to produce e-tron Sportback

- FAW Hongqi starts selling electric SUV with 400km range for $32,000

- FAW (Hongqi) to roll out 15 electric models by 2025

- China’s BYD launches six new electrified vehicles

- Top of Form

- Bottom of Form

- Daimler & BYD launch new DENZA electric vehicle for the Chinese market

- Geely, Mercedes-Benz launch $780 million JV to make electric smart-branded cars

- Mercedes styled Denza X 7-seat electric SUV to hit market

- Mercedes ‘makes mark’ with China-built EQC

- Daimler and BMW to cooperate on affordable electric car in China

- BMW, Great Wall to build new China plant for electric cars

- BAIC Goes Electric, & Establishes Itself as a Force in China’s New Energy Vehicle Future

- BAIC BJEV, Magna ready to pour RMB2 bln in all-electric PV manufacturing JV

- Toyota, BYD will jointly develop electric vehicles for China

- Lexus to launch EV in China taking on VW and Tesla

- GAC Toyota to ramp up annual capacity by 400,000 NEVs

- GAC Aion

- GAC NIO kicks off delivery of HYCAN 007 all-electric SUV

- Chevrolet Menlo Electric Vehicle Launched in China

- Buick Rolls Out First Electric Car for China

- General Motors’ Chinese Venture to Sink $4.3 Billion Into Electric Vehicles by 2024

- Nissan & Dongfeng to invest $9.5 billion in China to boost electric vehicles

- PSA to accelerate rollout of electrified vehicles in China

- Fiat Chrysler, Foxconn Team Up for Electric Vehicles

- Hyundai Motor Transforming Chongqing Factory into Electric Vehicle Plant

- Polestar said to plan China showroom expansion to compete with Tesla

- Nio

- Jaguar Land Rover’s Chinese arm invests £800m in EV production

- Renault reveals series urban e-SUV K-ZE for China

- Renault & Brilliance detail electric van lineup for China

- Renault forms China electric vehicle venture with JMCG

- Honda Debuts New Everus VE-1 All-Electric SUV, But Only For China

- Honda to roll out over 20 electric models in China by 2025

- Geely launches new electric car brand ‘Geometry’ – will launch 10 EVs by 2025

- Mazda to roll out China-only electric vehicles by 2020

- Xpeng Motors sells multiple EV models

- Changan New Energy

- WM Motors/Weltmeister

- Chery

- Seres

- Enovate

- China’s cute Ora R1 electric hatch offers a huge range for less than US$9,000

- Singulato

- JAC Motors releases new product planning, including many NEVs

- Seat to make purely electric cars with JAC VW in China

- Iconiq Motors

- Hozon

- EV maker Bordrin skips flash, keeps real-car focus

- Aiways

- NEVS launches electric-car output with Saab 9-3 platform in China

- Youxia

- CHJ Automotive begins to accept orders of Leading Ideal ONE

- Infiniti to launch Chinese-built EV in 2022

- Zotye Auto to roll out 10 plus NEV models by 2020

- Skywell makes inroads into China’s NEV domain

- Thunder Power

- Leapmotor

- Continental, Didi sign deal on developing EVs for China

- Mine Mobility (Thailand)

Here’s Tesla’s competition in autonomous driving…

- Consumer Reports finds Tesla’s Navigate on Autopilot is far less competent than a human driver

- Navigant Ranks Tesla Last Among Automakers & Suppliers for Automated Driving

- Tesla has a self-driving strategy other companies abandoned years ago

- Waymo and Lyft partner to scale self-driving robotaxi service in Phoenix

- Volvo, Waymo partner to build self-driving vehicles

- Jaguar and Waymo announce an electric, fully autonomous car

- Renault, Nissan partner with Waymo for self-driving vehicles

- Voyage Partners with FCA to Deliver Fully Driverless Cars

- Fiat Chrysler partners with Aurora to develop self-driving commercial vans

- Hyundai and Kia Invest in Aurora

- Aptiv and Hyundai Motor Group complete formation of autonomous driving joint venture

- Cadillac Super Cruise™ Sets the Standard for Hands-Free Highway Driving

- Honda Joins with Cruise and General Motors to Build New Autonomous Vehicle

- SoftBank Vision Fund to Invest $2.25 Billion in GM Cruise

- Ford’s electric Mustang will offer hands-free driving technology in 2021

- Ford-VW alliance with Argo could redraw self-driving sector

- VW taps Baidu’s Apollo platform to develop self-driving cars in China

- Amazon Buys Driverless Startup Zoox, Cites Ride-Hailing Goal

- Nvidia and Mercedes Team Up to Make Next-Gen Vehicles

- Daimler’s heavy trucks start self-driving some of the way

- SoftBank, Toyota’s self-driving car venture adds Mazda, Suzuki, Subaru Corp, Isuzu Daihatsu

- Continental & NVIDIA Partner to Enable Production of Artificial Intelligence Self-Driving Cars

- Mobileye & multiple OEMs

- Nissan gives Japan version of Infiniti Q50 hands-free highway driving

- Hyundai to start autonomous ride-sharing service in Calif.

- Uber unveils next-generation Volvo self-driving car

- Pony.ai raises $462 million in Toyota-led funding

- Baidu kicks off trial operation of Apollo robotaxi in Changsha

- Toyota to join Baidu’s open-source self-driving platform

- Baidu, WM Motor announce strategic partnership for L3, L4 autonomous driving solutions

- Baidu plans to mass produce Level 4 self-driving cars with BAIC by 2021

- DiDi completes over $500M fundraising round for its autonomous driving subsidiary

- Geely selects Volvo, Veoneer joint venture as autonomous tech supplier

- BMW and Tencent to develop self-driving car technology together

- BMW, NavInfo bolster partnership in HD map service for autonomous cars in China

- FAW Hongqi readies electric SUV offering Level 4 autonomous driving

- Tencent, Changan Auto Announce Autonomous-Vehicle Joint Venture

- Huawei steps up ambitions in self-driving vehicles race

- BYD partners with Huawei for autonomous driving

- Lyft, Magna in Deal to Develop Hardware, Software for Self-Driving Cars

- Deutsche Post to Deploy Test Fleet Of Fully Autonomous Delivery Trucks

- ZF autonomous EV venture names first customer

- Magna’s new MAX4 self-driving platform offers autonomy up to Level 4

- Groupe PSA’s safe and intuitive autonomous car tested by the general public

- Mitsubishi Electric to Exhibit Autonomous-driving Technologies in New xAUTO Test Vehicle

- Apple acquires self-driving startup Drive.ai

- Momenta – Building Autonomous Driving Brains

- JD.com Delivers on Self-Driving Electric Trucks

- NAVYA Unveils First Fully Autonomous Taxi

- Fujitsu and HERE to partner on advanced mobility services and autonomous driving

- Lucid Chooses Mobileye as Partner for Autonomous Vehicle Technology

- Nuro’s Robot Delivery Vans Are Arriving Before Self-Driving Cars

Here’s where Tesla’s competition will get its battery cells…

- Panasonic (making deals with multiple automakers)

- LG

- Samsung

- SK Innovation

- Toshiba

- CATL

- BYD

- Northvolt (backed by VW & BMW)

- Ultium (General Motors & LG joint venture)

- UK companies AMTE Power and Britishvolt plan $4.9 billion investment in battery plants

- Farasis

- Akasol

- Cenat

- Wanxiang

- Svolt

- Saft

- Romeo Power

- Toyota accelerates target for EV with solid-state battery to 2020

- ProLogium Technology Will Produce First Next Generation Lithium Ceramic Battery For EVs

- BMW invests in Solid Power solid-state batteries

- Ford invests in Solid Power solid-state batteries

- Hyundai Motor developing solid-state EV batteries

Most car makers will use those battery cells to manufacture their own packs. Here are some examples:

- Daimler starts building electric car batteries in Tuscaloosa – one of 8 battery factories

- GM picks Lordstown site for $2.3 billion battery plant

- GM inaugurates battery assembly plant in Shanghai

- PSA to assemble batteries for hybrid, electric cars in Slovakia

- Honda Partners on General Motors’ Next Gen Battery Development

- France’s Saft plans production of next-gen lithium ion batteries from 2020

- Sokon aims to be global provider of battery, electric motor, electric control systems

- BMW Group invests 200 million euros in Battery Cell Competence Centre

- BMW Brilliance Automotive opens battery factory in Shenyang

- Rimac is going to mass produce batteries and electric motors for OEMs

Here’s Tesla’s competition in charging networks…

- Electrify America is spending $2 billion building a high-speed U.S. charging network

- EVgo is building a U.S. charging network

- 191 U.S. Porsche dealers are installing 350kw chargers

- ChargePoint to equip Daimler dealers with electric car chargers

- GM and Bechtel plan to build thousands of electric car charging stations across the US

- Ford introduces 12,000 station charging network, teams with Amazon on home installation

- Petro-Canada Introduces Coast-to-Coast Canadian Charging Network

- Volta is rolling out a free charging network

- Ionity has over 150 European 350kw charging stations

- E.ON and Virta launch one of the largest intelligent EV charging networks in Europe

- Volkswagen plans 36,000 charging points for electric cars throughout Europe

- Smatric has over 400 charging points in Austria

- Allego has hundreds of chargers in Europe

- PodPoint UK charging stations

- BP Chargemaster/Polar is building stations across the UK

- Instavolt is rolling out a UK charging network

- Fastned building 150kw-350kw chargers in Europe

- Deutsche Telekom launches installation of charging network for e-cars

- Shell starts rollout of ultrafast electric car chargers in Europe

- Total to build 1,000 high-powered charging points at 300 European service-stations

- Volkswagen, FAW Group, JAC Motors, Star Charge formally announce new EV charging JV

- BP, Didi Jump on Electric-Vehicle Charging Bandwagon

- Evie rolls out ultrafast charging network in Australia

- Evie Networks To Install 42 Ultra-Fast Charging Sites In Australia

And here’s Tesla’s competition in storage batteries…

- Panasonic

- Samsung

- LG

- BYD

- AES + Siemens (Fluence)

- GE

- Bosch

- Mitsubishi Hitachi

- Toshiba

- ABB

- Saft

- Johnson Contols

- EnerSys

- SOLARWATT

- Schneider Electric

- Sonnen

- Kyocera

- Kokam

- NantEnergy

- Eaton

- Nissan

- Tesvolt

- Kreisel

- Leclanche

- Lockheed Martin

- EOS Energy Storage

- ESS

- UET

- electrIQ Power

- Belectric

- Stem

- ENGIE

- Redflow

- Renault

- Primus Power

- Simpliphi Power

- redT Energy Storage

- Murata

- Bluestorage

- Adara

- Blue Planet

- Tabuchi Electric

- Aggreko

- Orison

- Moixa

- Powin Energy

- Nidec

- Powervault

- Schmid

- 24M

- Ecoult

- Innolith

- LithiumWerks

- Natron Energy

- Energy Vault

- Ambri

So in summary, Tesla is about to face a huge onslaught of competition with a market cap approximately 2.5x that of Ford, GM and Fiat Chrysler combined, despite selling around 400,000 cars a year while Ford, GM and Fiat-Chrysler sell 5.4 million, 7.7 million and 4.4 million vehicles respectively. Thus, this cash-burning Musk vanity project is worth vastly less than its $200 billion market cap and—thanks to nearly $30 billion in debt, purchase and lease obligations—may eventually be worth “zero.”

Thanks and stay healthy,

Mark Spiegel

By