Tesla Motors Inc (NASDAQ:TSLA) has been on a roll since the beginning of April. As I write this, the stock has surged $32 per share since the beginning of the month to create a gain of 73% for shareholders.

The recent rally has come off of the back of the company’s impressive first quarter results that beat expectations. Furthermore, the company revised its sales and earnings outlook upwards for the full year. A full rundown of the adjustment can be found here.

Tesla Motors Inc (NASDAQ:TSLA) may be a hot company offering a great technology to consumers, but in my opinion it simply is not growing fast enough to justify its valuation. Moreover, the commodity market is moving both with and against Tesla as oil is getting cheaper and drawing consumers back toward gas-powered autos while the price of copper is falling which increases Tesla Motors Inc (NASDAQ:TSLA)’s profit margins.

Tesla Motors Inc (NASDAQ:TSLA)’s recent performance lies in the success of its Model S vehicles, which achieved sales of 4,900 in the first quarter that were well above the company’s guidance of 4,500. I’m not surprised at the sales figures, to be honest; the Model S is a revolutionary vehicle and it has a huge market. This is a good review of the vehicle, showing the huge potential that the car has.

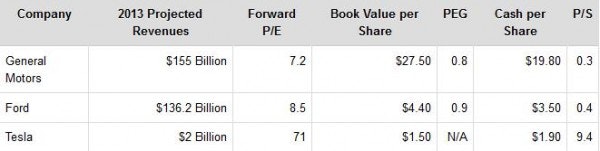

The reason for my bearish view on the company’s stock is Tesla’s valuation, not its products. While the model S and Tesla are both new and impressive, the company is currently significantly overvalued compared to the rest of the automotive sector. As I mentioned above, Tesla is currently trading on a forward earnings multiple of 71. Meanwhile, it’s larger, older and more diversified peers such as General Motors Company (NYSE:GM), Ford Motor Company (NYSE:F), Toyota Motor Corporation (ADR) (NYSE:TM), Nissan Motor Co., Ltd. (ADR) (PINK:NSANY) and Honda Motor Co Ltd (ADR) (NYSE:HMC) are all trading on an average forward earnings multiple of 11.7 – indicating that Tesla would have to drive its earnings higher by 600% to bring is valuation in line with that of its peers.

Near-term success is not just limited to Tesla

While Tesla has benefited from strong sales during the first quarter, sales growth is not just limited to this one company. Sales figures are rising rapidly across the auto industry.

For example, the auto industry continued to benefit from improving economic activity during April and sales hit six-year highs. Ford Motor Company (NYSE:F), General Motors Company (NYSE:GM) and Chrysler all reported double-digit sales growth, with Chrysler sales up by 11% while Ford’s numbers grew by 18% and GM sales climbed 23% higher.

While the auto industry as a whole is growing, Tesla is able to piggy-back on the increase in automotive spending to achieve some growth as well. That said, I am not trying to put Tesla or its technology down; I am simply highlighting that some of Tesla’s rapid growth during the past few quarters could be influenced more by general market conditions rather than its own activities.

Valuation looks stretched

I have already mentioned Tesla’s stretched valuation above, but I want to go a bit more in-depth in regard to a comparison against GM and Ford. These are major competitors, both of which are making swift recovery progress and are looking like increasingly tempting buys.

It is not possible for me to calculate Tesla’s PEG ratio due to negative earnings during the previous year.