Janus Henderson Investors, an investment management company, released its “Janus Henderson Contrarian Fund” second quarter 2024 investor letter. A copy of the letter can be downloaded here. The fund returned -1.92% in the second quarter, compared to the S&P 500® Index’s 4.28% return. Along with an accommodative monetary policy, the profits forecast for companies other than the mega-cap tech giants is improving and may act as a catalyst to expand market returns. In addition, please check the fund’s top five holdings to know its best picks in 2024.

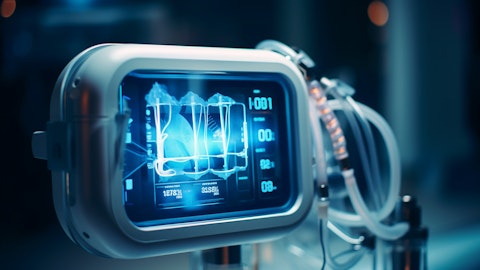

Janus Henderson Contrarian Fund highlighted stocks like Teleflex Incorporated (NYSE:TFX), in the second quarter 2024 investor letter. Teleflex Incorporated (NYSE:TFX), with a market capitalization of $11.538 billion, designs, develops, manufactures, and supplies single-use medical devices. One-month return of Teleflex Incorporated (NYSE:TFX) was 1.27%, and its shares gained 22.44% of their value over the last 52 weeks. On September 23, 2024, Teleflex Incorporated (NYSE:TFX) stock closed at $244.87 per share.

Janus Henderson Contrarian Fund stated the following regarding Teleflex Incorporated (NYSE:TFX) in its Q2 2024 investor letter:

“Teleflex Incorporated (NYSE:TFX), a medical device company, was among the top relative detractors. The stock underperformed in the quarter despite reporting earnings results that were in line with estimates. In a period of very high levels of medical utilization post-Covid 19 for many companies, Teleflex’s results, particularly from its key product, UroLift, have been underwhelming. Also weighing on the stock is conservative 2024 guidance due to the impact of recent acquisitions on the business. We remain attracted to the company from a valuation standpoint, as we believe its longer-term growth prospects are undervalued by the market; however, we are monitoring the company’s capital allocation decisions to include further M&A and/or share repurchases.”

A doctor in their office, consulting with a patient about the benefits of the company’s interventional urology products.

Teleflex Incorporated (NYSE:TFX) is not on our list of 31 Most Popular Stocks Among Hedge Funds. As per our database, 36 hedge fund portfolios held Teleflex Incorporated (NYSE:TFX) at the end of the second quarter which was 24 in the previous quarter. In the second quarter, Teleflex Incorporated (NYSE:TFX) reported $749.7 million in revenues, up 0.9% year-over-year on a GAAP basis. While we acknowledge the potential of Teleflex Incorporated (NYSE:TFX) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

In another article, we discussed Teleflex Incorporated (NYSE:TFX) and shared Aristotle Atlantic Core Equity Strategy’s views on the company. In addition, please check out our hedge fund investor letters Q2 2024 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.