We recently published a list of 7 Best Metal Stocks to Buy According to Analysts. In this article, we are going to take a look at where Teck Resources Limited (NYSE:TECK) stands against other best metal stocks to buy according to analysts.

The metals industry, which supplies vital materials for manufacturing, renewable energy, and construction, is a major contributor to the expansion of the world economy. This market has grown remarkably in the last several years. The Business Research Company projects that the worldwide metals market will increase by 5.9%, from $4,392.33 billion in 2024 to $4,651.03 billion in 2025. Growing demand for industrial and precious metals, particularly in the construction, automotive, and renewable energy industries, is driving this growth.

Since copper is still one of the most sought-after metals, the growing demand for the metal is a major factor in this development. The copper market is projected to increase by 7.8% during the period 2024-2025, reaching $190.72 billion, according to The Business Research Company. This increase is mostly attributable to the growth of infrastructure worldwide and the extensive use of copper in electrification projects.

At the same time, there is a high demand for metals like copper, aluminum, and steel, especially from the expanding construction sector. According to the U.S. Census Bureau, the value of monthly construction activities in the United States increased by 4.3% on a YoY basis in December 2024. Thus, the global acceleration of infrastructure projects is anticipated to support the metals market for the foreseeable future due to this increasing demand.

Along with industrial metals, precious metals have done noticeably better than the overall market, driven by investor demand for safe-haven assets and inflationary fears. For example, gold ETFs had their greatest gain since 2010 in 2024, rising a whopping 26%. It is anticipated that this trend will continue into 2025 if inflationary pressures continue to drive demand for gold as a protective investment. Similarly, as of February 26, 2025, silver futures experienced a 40.34% year-over-year rise while gold futures produced an impressive 43.64% return, as reported by S&P Global. These figures highlight the rising demand for gold and silver as investments against an unstable economic landscape.

Simultaneously, the metals sector is undergoing a surge in sustainability efforts and technological breakthroughs. Metal production is being revolutionized by innovations such as generative AI in additive manufacturing, which is making it more sustainable and efficient. On the other hand, the global market for recycled scrap metal is expected to rise at a robust 6.4% annual growth rate from $70.5 billion in 2024 to $75.5 billion in 2025. By 2035, the recycling industry is predicted to account for 72.5% of the market value as environmental restrictions and sustainability drive companies to use recycled metals, especially ferrous metals.

Beyond technological innovations, metals like lithium, copper, and zinc are at the center of industry transformation as a result of the move toward cleaner energy and electrification. Lithium is becoming more affordable and widely available because of new extraction techniques, which are enhancing its use in energy storage applications. For instance, the lithium market is expected to expand by 16.3%, from $7.75 billion in 2024 to $9.01 billion in 2025. Meanwhile, as reported by Zinc.org, the demand for zinc in solar power is predicted to reach 568,000 tons by 2030, demonstrating the rising significance of zinc in renewable energy.

Therefore, the overall metal market is experiencing strong demand, technological breakthroughs, and increased focus on sustainability and clean energy initiatives. Therefore, experts are enticed to pick the best metal stocks with the potential for rapid growth to capitalize on bright future prospects of the market.

Our Methodology

To curate our list of the 7 Best Metal Stocks to Buy According to Analysts, we picked the top companies having a substantial exposure to extraction, processing, and manufacturing of metals. Furthermore, we made sure that we pick companies with strong market capitalization. Finally, we ranked the stocks based on the upside potential predicted by a healthy number of analysts, as of writing this article.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 373.4% since May 2014, beating its benchmark by 218 percentage points (see more details here).

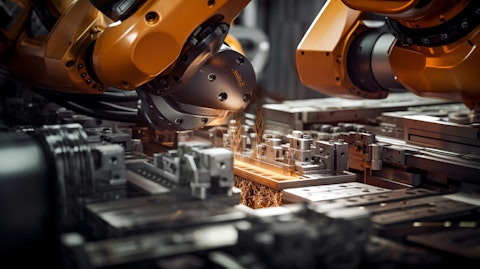

A close up of an automated machine processing other Industrial Metals & Mining resources.

Teck Resources Limited (NYSE:TECK)

Average Upside Potential: 21.43%

Number of Hedge Fund Holders: 66

Teck Resources Limited (NYSE:TECK), an industry leader in diversified mining, operates in Chile, Peru, and Canada. Although coal, copper, and zinc are among its primary products, the company is undergoing a major transition. In an effort to slowly lessen its need for coal used in steel production and satisfy the rising demand brought on by the global energy transition, Teck is shifting its focus to copper.

This shift in strategy is already beginning to provide encouraging outcomes. Teck Resources Limited (NYSE:TECK) reported a 40% increase in its sales during the year ended December 31, 2024. A 50% increase in copper output, which reached 446,000 tons, drove this growth. Additionally, stable operations at the Red Dog mine also contributed to a strong increase in zinc output, sales of which rose 24% during Q4 on a YoY basis. The company’s Adjusted EBITDA increased by 104.3% to $2 billion due to strong base metal prices, and its balance sheet was further strengthened by operational cash flow of $1.9 billion.

Furthermore, Teck Resources Limited (NYSE:TECK) is speeding its transition to a pure-play copper producer to capitalize on this momentum. The company was able to concentrate more on its copper portfolio after recently finishing the spin-off of Elk Valley Resources. Additionally, it has planned $1.0-1.2 billion in capital expenditures for 2025, for the early stages of the San Nicolás copper-zinc project in Mexico and the expansion of its QB2 project in order to facilitate this shift. Keeping up with its capital allocation strategy, Teck also paid $1.25 billion through share repurchases and dividends.

Looking ahead, the company is still dedicated to its expansion goals. It plans to invest in its resource growth and exploration in 2025, with an emphasis on increasing the output of zinc and copper. Teck Resources Limited (NYSE:TECK) is in a good position to keep generating wealth for shareholders in the years to come because of its solid asset base and obvious shift towards base metals, which are in high demand.

Overall, TECK ranks 6th on our list of best metal stocks to buy according to analysts. While we acknowledge the potential of TECK, our conviction lies in the belief that certain AI stocks hold greater promise for delivering higher returns, and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than TECK but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 20 Best AI Stocks To Buy Now and Complete List of 59 AI Companies Under $2 Billion in Market Cap

Disclosure: None. This article is originally published at Insider Monkey.