We came across a bullish thesis on Teck Resources Limited (TECK) on Stock Picker’s Journey’s Substack by Gregg Jahnke. In this article, we will summarize the bulls’ thesis on TECK. Teck Resources Limited (TECK)’s share was trading at $40.12 as of Dec 18th. TECK’s trailing and forward P/E were 19.73 and 24.51 respectively according to Yahoo Finance.

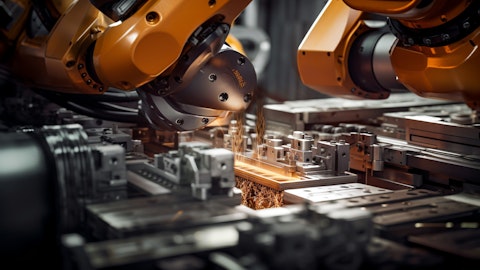

An aerial view of a copper mine, showing the intricate workings of heavy machinery.

Teck Resources (TECK), priced at $43, presents a compelling investment opportunity with its shareholder-focused approach and strong financial standing. Unlike many of its peers in the mining industry, TECK has embraced a strategy that prioritizes returning value to shareholders, rather than issuing more shares to fund new projects. This approach, coupled with a rare net cash position following the sale of its coal assets, sets TECK apart from other major mining companies like Rio Tinto, Glencore, and BHP, which typically carry significant debt loads.

TECK’s copper business is a key driver of its investment appeal. While global copper demand has been rising, TECK is particularly well-positioned to benefit from the supply shortage, as there has been insufficient mine development in recent decades to meet the world’s growing needs. Even without China’s continued growth, copper demand remains strong, and TECK’s assets in Chile—despite the political risks associated with the region—place it in a favorable position to capitalize on this trend.

In addition to its copper assets, TECK’s dominant zinc business, which contributes 20-30% of EBITDA, generates consistent cash flow to support its copper development projects, further reinforcing its growth potential. Its relative stability in a highly cyclical industry enhances its appeal, and its strategic size and value make it an attractive acquisition target for larger players like Glencore, which is actively seeking to expand its copper portfolio. Whether through operational success or a potential buyout, TECK offers significant upside, with its stock having the potential to reach $70. In the current market environment, this presents a compelling risk/reward profile, solidifying TECK as a standout investment in the materials sector.

Teck Resources Limited (TECK) is not on our list of the 31 Most Popular Stocks Among Hedge Funds. As per our database, 68 hedge fund portfolios held TECK at the end of the third quarter which was 69 in the previous quarter. While we acknowledge the risk and potential of TECK as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than TECK but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 8 Best Wide Moat Stocks to Buy Now and 30 Most Important AI Stocks According to BlackRock.

Disclosure: None. This article was originally published at Insider Monkey.