In China, the future for solar power looks bright. There are reports that the country may increase its upper limit for installed solar capacity to 40 GW in 2015. China’s preoccupation with political stability, and thus job creation, means that it’ll likely favor domestic producers to meet this new demand. But even with government-mandated growth, Chinese solar manufacturers do not necessarily make great investments.

Heavy debt loads and opaque markets mar many of these companies. Investors need to be cautious and realize that there are a number of negative factors impacting the Chinese solar industry. The latest news is not enough to turn everything around.

SOL Operating Income Quarterly data by YCharts

SOL Revenue Quarterly data by YCharts

The government-sponsored investment in the solar industry caused oversupply and eventual price collapse. Additionally, various feed-in tariff structures have changed, and the U.S. has slapped import tariffs on Chinese panels. Previous overinvestment may come back to haunt the Chinese manufacturers, as low capacity utilization will reduce cash flows and the ability to purchase more efficient capital goods.

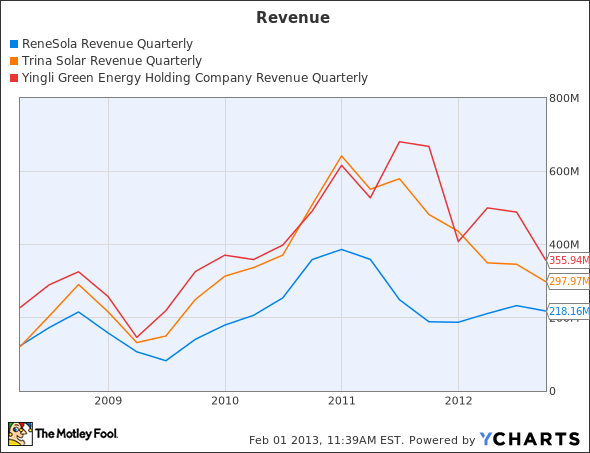

ReneSola Ltd. (NYSE:SOL) is active in many parts of the solar manufacturing business. In Q3 2012, it managed to bring their wafer processing cost down to $0.15/W, and increased volume to 378.5 MW of wafers shipped. In Q3 2012, they shipped 145.3 MW of modules, which is much better than the 33.7 MW of Q3 2011. Beijing’s increasing mandates for installed solar capacity should continue to help support volumes, but its unclear if cost decreases will be strong enough to bring back the black.

The company has only $134.5 million in long term debt, but its total debt to equity ratio of 1.90 is rather high. In its latest presentation, ReneSola mentions that the “Chinese Development Bank has indicated support for further solar projects.” This perfectly demonstrates the complexity of investing in a Chinese solar manufacturer. Essentially, you have the Chinese government as an ever-present business partner. ReneSola’s high debt-to-equity ratio and gross margins of 0.5% make it a firm better left for another day.

Trina Solar Limited (NYSE:TSL) is feeling the impact of the U.S. import tariffs. From Q2 2012 to Q3 2012, the U.S. went from 26.3% to 14.5% of sales. The increase in Chinese sales from 5.0% to 13.5% helped counteract the negative pressure. Trina’s EBIT margin of -25% is alarming, though not as alarming as the $14.5 billion dollars in off-balance-sheet purchase obligations found in the firm’s 2011 20-F.

Trina’s large network of foreign offices in Latin America, Australia, North America, and Europe show that the company is putting its best foot forward to find more sales. Some areas of Latin America like Chile and Brazil are promising. The firm’s quick ratio of 0.8 is better than their Chinese competitors, but these off-balance-sheet obligations are very large. It is unclear whether the government is willing to come in and prop up Trina. Without stronger prices, the company could blow through its cash reserves very quickly, and leave investors paying the price.

Yingli Green Energy Hold. Co. Ltd. (NYSE:YGE) looks very similar to its Chinese brothers. The company has a very high total debt-to-equity ratio of 4.39 and a low quick ratio of 0.3. From Q2 2012 to Q3 2012, China grew from 14% to 28% of revenues while Germany fell from 57% to 48%. These numbers show the impact of Germany’s lowered feed in tariffs.

Yingli’s efficiencies are slowly increasing, but when GT Advanced Technologies starts to sell its HiCz equipment, then Yingli’s debt load could hold them back and leave them competing with old technology. This could devastate overseas sales, where the Chinese government isn’t able to extend its protective arm. Yingli is trading at depressed levels, and the future is not looking exceptionally bright, given its high debt load and future need to purchase new capital equipment.

Conclusion

The slow removal of excess capacity and the next generation of more efficient manufacturing techniques are a plus for the solar industry as a whole. Chinese manufacturers have a large debt loads, and it is unclear whether increased government targets will be enough to ensure profits for them.

The geopolitical friction between the China and the U.S. and the EU are other negative factors. The changes in the German markets have only added to these companies’ problems. For now, these solar manufactures look risky and uncertain. It is best to hold off and wait to see whether the central government is able to push up prices and return these firms to profitability.

The article Take Chinese Solar with a Grain of Salt originally appeared on Fool.com and is written by Joshua Bondy.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.