We recently compiled a list of the 15 Best Lumber Stocks To Buy Now. In this article, we are going to take a look at where Sylvamo Corporation (NYSE:SLVM) stands against the other lumber stocks.

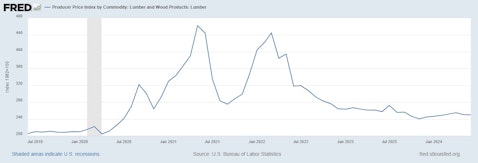

The lumber market has faced considerable volatility in recent years, driven by a confluence of dynamic and interconnected factors. In 2021, lumber prices surged to unprecedented levels due to the COVID-19 pandemic disrupting supply chains, a surge in home construction boosting demand, and logistical challenges further straining the market. However, this peak was followed by a dramatic price correction as these extraordinary conditions began to stabilize. Currently, lumber prices have plummeted 75% from their May 2021 record high of $1,514 per thousand board feet to just $366, closely matching pre-pandemic levels. The futures market has mirrored this decline, with contract prices for July falling 28% to $466. The following chart by U.S. Bureau of Labor Statistics clearly depicts the change in lumber prices over a five year horizon.

The sharp drop in lumber prices reflects a slowdown in both new home construction and renovations, largely due to high home prices and elevated mortgage rates that have reduced housing affordability. This has led to decreased demand for lumber, with a notable 52% year-over-year plunge in multi-family housing starts and a 2% decline in single-family starts as of May, reported by Fortune. Furthermore, the home renovation market, which had previously supported high lumber prices, is now also weakening. Retailers like Home Depot are seeing declines in sales, particularly for larger projects.

On the supply side, the lumber industry expanded production capacity during the boom years, expecting continued high demand. However, this new supply is now coming to market at a time when demand is low, exacerbating the oversupply situation. Experts predict that lumber prices may stagnate near current levels through the end of 2024, with a possible minor increase. Looking ahead to 2025, some sawmills might cut back production, and interest rate reductions could spur a modest recovery, potentially pushing prices between $500 and $600 per thousand board feet. Investors should be mindful of the ongoing volatility and regional price variations as they consider opportunities in the lumber market. For those looking to navigate the best lumber stocks to buy, the S&P Global Timber & Forestry (GTF) Index provides a valuable benchmark. Designed to measure the performance of companies involved in the ownership, management, or upstream supply chain of forests and timberlands, the index targets a constituent count of 100. This includes forest products companies, timber REITs, paper products firms, paper packaging companies, and agricultural businesses engaged in these sectors. As of August 1, 2024, the index has demonstrated a robust 10-year annualized return of 4.24%, currently valued at 2,012.10. This performance highlights the index’s stability and growth potential, making it a key consideration for investors in the timber and forestry sector.

According to the report from Timberland Investment Resources, investing in timberland presents several notable benefits and considerations. Timberland is a tangible asset that serves as a natural hedge against inflation. As inflation increases, the value of timberland often rises, helping to preserve purchasing power. This characteristic makes timberland an appealing option for investors seeking protection against inflationary pressures. Additionally, timberland offers substantial portfolio diversification due to its typically lower volatility compared to traditional equities. This reduced volatility can contribute to more stable long-term returns, making timberland an attractive choice for investors looking to balance risk and reward. Beyond capital appreciation, timberland investments can also generate a consistent income stream through timber harvesting. This dual benefit of income and appreciation makes timberland a valuable asset class for long-term investors.

The report also underscores the significance of sustainable management practices in timberland investments. Effective management is crucial for maintaining the health and productivity of forestlands while adhering to environmental standards and promoting ecological balance. Sustainable forestry practices, such as selective logging and reforestation, ensure that timberland remains productive and environmentally responsible over the long term. By implementing these practices, investors can mitigate negative environmental impacts and support the economic viability of their timberland assets. Sustainable management not only helps preserve the asset’s value but also aligns with growing environmental and regulatory expectations.

However, the report also identifies several risks associated with timberland investments. Timber prices can be highly variable, influenced by fluctuations in supply and demand, which can impact profitability. Additionally, timberland is vulnerable to natural disasters, such as wildfires, storms, and pest infestations, which can cause significant damage and affect returns. Regulatory changes and evolving environmental policies also pose risks, potentially impacting the operational aspects of timberland management. To effectively navigate these risks, the report emphasizes the importance of selecting well-managed timberland properties and partnering with experienced forestry professionals. Proper due diligence and active management are essential for mitigating these risks and maximizing the potential of timberland investments. Overall, while timberland offers stable growth and diversification benefits, it requires careful management and a long-term perspective to fully realize its potential.

The Food and Agriculture Organization (FAO) predicts a 37% increase in the consumption of primary processed wood products by 2050, according to their latest report. This growth includes materials such as sawnwood, plywood, and wood pulp, expected to reach 3.1 billion cubic meters. The rise is projected to be even higher, up to 23%, if modern wood products like mass timber and man-made cellulose fibers gain greater traction in replacing non-renewable materials. Wood’s renewable and versatile nature makes it a key player in efforts to replace non-renewable resources and address climate change. The FAO emphasizes the need for sustainable forest management and increased production from both naturally regenerated and planted forests to meet future demand. Investments totaling around $40 billion annually will be necessary to expand production, with an additional $25 billion for modernization. The sector might face challenges in maintaining employment levels and ensuring adequate training for a more sophisticated workforce. As demand for wood energy grows, especially in developing regions, balancing traditional fuelwood use with modern biomass energy will be crucial.

According to the National Association of Home Builders (NAHB), single-family home construction is expected to rise in 2024 despite ongoing supply-side challenges. Higher interest rates have impacted the housing market over the past two years, but with the Federal Reserve anticipated to lower rates in the latter half of 2024, mortgage rates are expected to decrease. This should stimulate homebuilding, although supply-side issues like rising prices and shortages of materials and labor will persist. The NAHB projects single-family starts to increase by 4.7% in 2024 and by 4.2% in 2025, but notes that this growth will not fully address the nation’s housing deficit of approximately 1.5 million units. Despite the forecasted increase in construction, the multifamily housing market faces challenges, with a 19.7% decline in multifamily starts anticipated for 2024 due to tight credit conditions. However, with a high volume of apartments currently under construction, rent growth is expected to slow, potentially easing inflation. Builders remain optimistic, with a majority planning to increase their activities, although they face hurdles including high regulatory costs and fluctuating land prices. The demand for housing continues to shift, with varying generational preferences influencing market dynamics. Addressing these challenges requires balancing new construction with sustainable practices and increased housing supply.

Our Methodology

We shortlisted the holdings of iShares Global Timber & Forestry ETF, ranked them by the number of hedge funds in each stock, and shared the 15 most popular timber and forestry stocks below. Basically our articles presents the best lumber and timber stocks to buy according to hedge funds.

A landscape of a large paper mill at sunrise, a sign of the size and importance of the industry.

Sylvamo Corporation (NYSE:SLVM)

Number of Hedge Fund Holders: 16

Sylvamo Corporation (NYSE:SLVM) produces and markets uncoated freesheet for cutsize, offset paper, and pulp across Latin America, Europe, and North America, operating through segments in these regions. Recently, Memphis-based Sylvamo Corporation (NYSE:SLVM) completed a series of refinancing actions on July 31, 2024, to extend debt maturity and optimize liquidity. The restructuring included amending existing credit facilities, issuing a new term loan, and redeeming senior notes. The company reduced its revolving credit facility from $450 million to $400 million, extended the maturity to 2029, and rolled $36 million of Term Loan A into a new $235 million Term Loan F-2 Facility due in 2031. Sylvamo also used part of this new loan to redeem $90.1 million of its 7% 2029 Notes. The Accounts Receivable Finance Facility was extended to 2027 and reduced to $110 million.

Sylvamo Corporation (NYSE:SLVM) offers a forward dividend yield of 2.44%, with an annual payout of $1.80 and a payout ratio of 21.70%. This indicates a solid dividend policy, reflecting the company’s ability to distribute a portion of its earnings to shareholders while retaining a majority for reinvestment and operational needs. Year-to-date, Sylvamo Corporation (NYSE:SLVM) stock has performed exceptionally well, delivering a price return of 46.55%, significantly outperforming the S&P 500’s 14.19% increase. This strong performance underscores investor confidence in the company’s strategic financial decisions and overall business stability.

During Q1, 2024 the count of hedge funds holding positions in Sylvamo Corporation (NYSE:SLVM) grew to 16 from 13 in the prior quarter, as reported by Insider Monkey’s database encompassing 920 hedge funds. These holdings collectively amount to around $84.62 million. Chuck Royce’s Royce & Associates emerged as the leading shareholder among these hedge funds during this timeframe.

Overall SLVM ranks 9th on our list of the best lumber stocks to buy. While we acknowledge the potential of SLVM as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than SLVM but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: Analyst Sees a New $25 Billion “Opportunity” for NVIDIA and Jim Cramer is Recommending These 10 Stocks in June.

Disclosure: None. This article is originally published at Insider Monkey.