But we’re not going to defy gravity. If the market falls down to a certain level, then obviously, our growth would be similarly impacted. So I don’t believe I was that precise with double-digit over five years. But I do feel bullish about the ability for us to continue to be a very high-growth business.

Operator: Our next question comes from Matt Miksic with Barclays. Your line is now open.

Matt Miksic: Hi, thanks so much for taking the questions and congrats on a really strong quarter. And which looks to me like a lot of the feedback I’m getting is that it really is just all about comps. I mean double-digit organic growth against low teens, low to mid-teens organic growth last year that is at least present to us. So congrats on the continued momentum. I had one follow-up, if I could, on the MAKO robot and maybe just the nature of the launch. If you could walk us through, is that you’re expecting a limited launch and then sort of picking up momentum in 2025? And then Kevin, if you could maybe talk about some of the either new aspects of that platform or some of the other products that you’re kind of excited about in the next couple of quarters that they will start coming to market and adding to growth in the back half in ’25. I appreciate it.

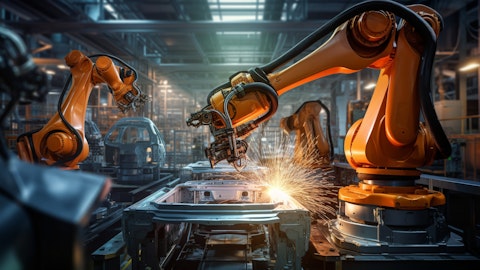

Kevin Lobo: Yes, sure. Thanks. Jason, every quarter, we’ll talk to you about new products. And any highlighted a couple of this quarter with the LIFEPAK 35 and Pangea in our Trauma business, both of which are really super exciting products that are going to contribute to growth for at least a few years to come. As it relates to Mako, so the new spine robot will be two parts. One part is the actual robot with a different attachment that will enable the pedicle screw guidance. The second part is the Q guidance trade that’s already being sold today. So that is used first-line procedures. It’s a very lightning-fast camera. You saw it at NASS. It’s being sold today to do navigated spine procedures. So those two components will make up the Mako Spine system.

And then in addition to that, the CoPilot product will be able to do discectomy and bone preparation with haptic feedback to be able to protect you from getting close to vital structures, spinal cord, et cetera. So that — and that, again, is going to be compatible with the Q camera in the same screen. So it’s a comprehensive ecosystem that will be launched. And we’re already seeding the market with 1/2 of the system with the Q Guidance and then the second half is really whether you’re doing makeover pedicle screw placement or using Q Guidance to do the bone preparation. So those are the three pieces of our enabling technology solution, part of which we’re already selling today. So every time we’re selling Q, which is contributing to our spine growth, it’s part of the solution that will then be able to be used both with CoPilot as well as with Mako.

So hopefully, that clarifies things for you.

Matt Miksic: Thanks so much.

Operator: Our next question comes from Danielle Antalffy with UBS. Your line is now open.

Danielle Antalffy: Hi, good afternoon, everyone. Thanks so much for taking the question. Congratulate on a really strong start to the year. I guess, Glenn, this is probably a question for you on that 150 bps target for operating margin expansion. I mean, just based — I know it’s early, you guys just see this about six months ago. So not trying to be too greedy, but 80 bps year-over-year in Q1, it sounds like things are actually only getting better from here as it relates to super cycle of product inflation presumably starts to continue to ease, hopefully. So I guess, just any comments you can make about that 150 bps target based on what you guys did here in Q1. And that’s it for me. Thanks so much.

Glenn Boehnlein: Okay. Yes, first, just so we’re clear, the target is 200 basis points over the next two years, ’24 and ’25 and that’s what we presented back at Analyst Day back in November. It’s also the kind of the guidance we brought out in January. I think if you do the rough math, just based on our guidance, you’ll see that we’re in the realm of 100 basis points or 100 basis points plus in this first year. And you’re correct, 80 basis points is a great start to the year. Seasonally, as we think about how this plays out for this year, we expect sort of second half margin expansion to be stronger than first half just given the seasonality of earnings that we see as the year plays out. No change in sort of our overall approach.

If you think about what we did in 2023, you saw margin expansion coming through gross margin. 2024, we think and we expect that we’ll see op expenses will lead more of the margin expansion. And then our goals in 2025 will likely be more balanced between gross margin and operating expenses. There are lots of programs we have in place. You’ve seen the results that we’ve had in price. We also have low-cost greenfield site, strategic in-sourcing. We’ll continue to push shared services efficiencies IT harmonization. And then honestly, if you just look at the natural leverage that we drive when we’re growing at the high levels, that also is a piece of this equation. So we’re excited about the Q1 performance. We will still continue to be working on it through the remainder of this year and into next year, and we’ll update you quarterly as the earnings calls play forward.

Operator: Our next question comes from Matt Taylor with Jefferies. Your line is now open.

Matthew Taylor: Hello. Thanks for taking the question. I was hoping you could talk a little bit more about Pangea and LIFEPAK has two upcoming catalysts and maybe frame any acceleration or pickup we could see from those products, how material could they be?

Kevin Lobo: Yes. Well, I’d say — if you look at our trauma business, core trauma, so excluding upper extremities and lower extremities, if you look at core trauma, we’ve been historically the leading nailing company in the marketplace. But we haven’t been the leading plating company. Now we have some terrific places, whether it’s our clavicle platters, our pelvic products. But we didn’t have a comprehensive system of variable angle plating. This is an amazing product launch, very comprehensive and will really be a shot in the arm for plating, which, by the way, is more than half of the procedures in trauma are plating versus nailing. And so we are wildly excited about this launch. We already have an incredibly high-performing Core Trauma business, fabulous leadership in our Core Trauma.

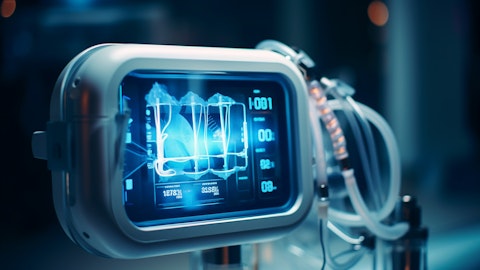

And now we have a fabulous comprehensive plating solution. We’ve done roughly 40 cases so far. Feedback has been excellent from the surgeons. We — it will take us time. We have to build out the sets and these kind of launches take time to sort of fully roll out. But you’re going to start to see the impact as early as Q3. We’re going to have some procedures obviously done in Q2. It won’t be too big of an impact, but it will start to have more of an impact in Q3, Q4 and beyond. And as it relates to LIFEPAK, we are bringing in our sales force for a full sort of launch preparation in May, and we’ll start to have our first shipments sometime in June. So there won’t be much of an impact at all in Q2, but certainly started going into Q3, Q4, we did show the product that a recent fire display conference, firehouses and the feedback was overwhelmingly positive.

People were 7 and 8 rows deep looking at the product, it is — we’re really getting fantastic feedback. And so we’re building the product right now and getting ready for a launch. And these kind of launches because of the price point. You’re not going to see probably as big an impact this year as you would see — you’ll see some, obviously, Medical is already performing incredibly well. But you’ll see some impact this year, but you’re going to see a lot more in the next 2 to 3 years after that. These are long-cycle products, they last a long time, and we know how to replace capital equipment at Stryker, and we’re going to be doing that. It’s incredibly exciting. The last sort of big defibrillator that we launched was almost 20 years ago. So there is a huge replacement market for this modern and really fully featured product.

Matthew Taylor: Great. Thanks for the call again.

Operator: Our next question comes from Caitlin Cronin with Canaccord. Your line is now open.

Caitlin Cronin: Hi. Thanks for taking the questions and congrats on the strong performance this quarter. Just trying to upper extremity, you noted strong performance there. Any changing dynamics with the CMS ruling and ASC’s hospital patient earlier this year? And can we also get a refresher on the new products coming in your Shoulder portfolio and the timing of those?

Jason Beach: Caitlin, it’s Jason. As we think about upper extremities, this continues to be a fast grower for us. As we think about kind of transition and the opportunity in the ASC, no change from that perspective. And we expect this will continue to be a fast-growing business for us.

Kevin Lobo: Yes. And as it relates to product launches, I think we talked about this on the last call, but we have about 5 products that are either going into full launch that we’re in partial launch are being launched. We have a perform tractor system, which is really exciting, a reverse stemless product. We have the pyrocarbon which is hemiarthroplasty product. We have the hollow lens, which is you can visualize the surgery in the operating room. That was a limited launch last year. That’s going to move to full launch. And I think it’s the fifth one,

Jason Beach: Those were the — those were the things.

Kevin Lobo: Those are the main four ones. But there’s a fifth one, I can’t remember right now. But if you look go back to the last call, I think we did highlight all of those products. And — but — so this is a business that’s been growing roughly 20% every single quarter. That continued to be a very strong first quarter. And we expect that to continue not seeing any real change in the market dynamics at all where we have tremendous momentum, and we expect that momentum to continue.

Caitlin Cronin: Great. And then just a question on going to post close now what the strengths do you really see that bringing to your Hip portfolio going forward?

Kevin Lobo: Yes. Well, so firstly, if you look at our business in Europe, it gives us tremendous market share in France and the dual-mobility, they were the originators of dual-mobility, and they have a terrific portfolio of products not just for France, but certainly, they’re well known throughout Europe and then eventually even some of those products will be looking to bring those to the United States. So it really gives us a shot in the arm in Europe where — as you know, we’ve historically had lower market shares than other parts of the world. So we’re very excited about this product. The feedback so far from surgeons has been excellent. They’re very differentiated products that are — that have a lot of history behind them and are really well received in the marketplace.

Operator: Our next question comes from Richard Newitter with Truist. Your line is now open.

Sam Brodovsky: Hi, guys. Thanks for taking the question. This is actually Sam on for Rich. I appreciate the commentary you guys gave earlier on margins being stronger or expansion being stronger in the second half. But just as we think about the 80 basis points of expansion this quarter, is that reasonable to think about it as a floor on a quarterly basis this year? Or maybe should we think about a step back in 2Q?

Jason Beach: Hi, Sam. It’s Jason. I’ll take this one, and Glenn can pile on anything additional here. But again, to Glenn’s comments as you think about the margin expansion getting to 100 bps on a full year basis being second half weighted. It certainly would imply that you could have a quarter less than that from a margin expansion standpoint. Certainly, margin expansion in every quarter, but I wouldn’t necessarily say it be to the levels of what you saw in Q1 every quarter.

Operator: Our next question comes from Joshua Jennings with Cowen. Your line is now open.

Joshua Jennings: Hi, good afternoon. Thanks for taking the questions. I was hoping to just dig into the 20 bps of pricing pressure experienced by the Orthopaedics and Spine units. Any chance you can help us think more — provide more details on the pricing headwind experienced by the total joint franchise Knees and Hips? And then at AOS, it seems like there’s — and still with your guidance that there’s optimism that the macro device industry may be in a new kind of era of pricing. And any updated thoughts there? And then just one follow-up.

Glenn Boehnlein: Sure. If you think about pricing, we do sort of there are sort of a tale of two cities. On the MedSurg side, we generally are able to gain pricing there’s certainly a premium placed on technology, and we work through contracts that provide bands of pricing that allow us to approach customers. On the ortho side, you’re right. Traditionally, it’s been a market that has had price declines. I would say that as we think about our ortho business, 5 years ago or even 6 years ago, we were looking at price declines that were in the 3% to 5% range. And I would say now what we’re feeling and based on the contract sort of discipline that we have put in place with customers as well as sort of maybe a little bit of the impact of Mako being a closed system.

We’re feeling that we see sort of less negative price performance on the ortho side of our business. But we don’t necessarily anticipate that ortho will ever get to positive, but we are feeling confident about less negative.

Josh Jennings: And maybe just a follow-up. I was hoping you could share your outlook on the knee and hip markets I think our interpretation of some comments from your team and other orthopedic management teams was that we could see a higher level of growth in those markets relative to the pre-pandemic era. Just wanted to follow up. Any updated thoughts there? And also there’s been concerns about just the utilization headwind after a strong second half last year, broadly in the macro devices industry. And any thoughts on whether we should be thinking about a slowdown in utilization or procedure volumes in orthopedics in the second half here this year? Thanks for taking the questions.

Jason Beach: Josh, it’s Jason. I’ll take this one. I’d say a couple of different things here. As we think about the market, our view has really not changed at all here. Even if you go back to Investor Day in November of last year, we said the ortho markets would grow, call that mid-single digit area. And we would outperform that 200 bps to 300 bps above that. So as we think about the full year this year, that’s kind of how we’re looking at the markets, and we feel as good as ever about that.

Operator: Our final question comes from Andrew Ranieri with Morgan Stanley. Your line is now open.

Q – Andrew Ranieri: Hi, thanks for taking the questions Kevin, just two for you. Would you mind just talking about the trends you’re seeing internationally in Mako, any plans for geographic expansion in 2024? And really kind of like what utilization levels you’re seeing with the Mako system outside the U.S.? And then second, just with the Golf Surgical product, you touched on that. But can you also give us any more cover on where you think you can take the product next within your MedSurg portfolio?