Aristotle Capital Management, LLC, an investment management company, released its “International Equity Strategy” second quarter 2024 investor letter. A copy of the letter can be downloaded here. Aristotle Capital International Equity returned -0.85% gross of fees (-0.96% net of fees) in the second quarter lagging behind the MSCI EAFE Index’s -0.42% return, and the MSCI ACWI ex USA Index’s 0.96% return. Both allocation effects and security selection led the portfolio to relatively underperform the MSCI EAFE Index from a sector perspective. Regionally security selection drove the underperformance, while allocation effects had a positive impact. In addition, you can check the top 5 holdings of the fund to know its best picks in 2024.

Aristotle Capital International Equity Strategy highlighted stocks like Cameco Corporation (NYSE:CCJ), in the second quarter 2024 investor letter. Cameco Corporation (NYSE:CCJ) provides uranium for electricity generation. The one-month return of Cameco Corporation (NYSE:CCJ) was -0.34%, and its shares gained 58.53% of their value over the last 52 weeks. On July 15, 2024, Cameco Corporation (NYSE:CCJ) stock closed at $52.22 per share with a market capitalization of $22.722 billion.

Aristotle Capital International Equity Strategy stated the following regarding Cameco Corporation (NYSE:CCJ) in its Q2 2024 investor letter:

“Cameco Corporation (NYSE:CCJ), one of the world’s largest publicly traded uranium producers, was the top contributor during the period. Support from governments and policymakers for nuclear energy has continued to increase in 2024 as countries realize it can play a crucial role in both promoting energy security and lowering dependence on fossil fuels to meet environmental goals. With higher demand for uranium across the world, Cameco’s production was up more than 25% year-over-year, and its long-term supply contracts have increased (annual commitments now standing at 28 million pounds per year through 2028). We view these fundamental improvements as further proof Cameco is making progress on our catalyst of increasing its uranium volume sold at higher prices, all while lowering production costs through scale and its access to some of the highest-grade ore on the planet. In addition, we believe the company’s continued integration of Westinghouse Electric Company’s market-leading downstream capabilities will allow it to offer a highly competitive nuclear fuel solution. In our opinion, this puts Cameco on track to enjoy higher levels of FREE cash flow and the ability to de-risk its balance sheet as it meets global energy needs.”

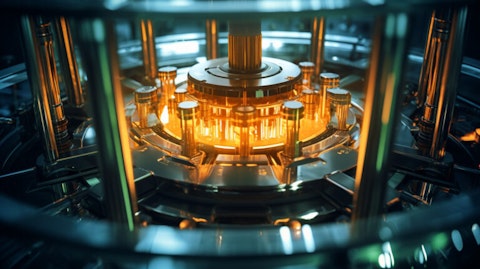

A close up of the reactor core, highlighting the complexity of the uranium power process.

Cameco Corporation (NYSE:CCJ) is not on our list of 31 Most Popular Stocks Among Hedge Funds. As per our database, 56 hedge fund portfolios held Cameco Corporation (NYSE:CCJ) at the end of the first quarter which was 58 in the previous quarter. While we acknowledge the potential of Cameco Corporation (NYSE:CCJ) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

In another article, we discussed Cameco Corporation (NYSE:CCJ) and shared the list of biggest Canadian mining companies. In addition, please check out our hedge fund investor letters Q2 2024 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.