Steve Cohen is a hedge fund legend. SAC Capital has been nearly consistently delivering high returns for its investors since 1992. Just the other day we saw an article mentioning that Cohen had only 3 losing months during the past 29 months. The readers were questioning whether his “spectacular” performance is a result of illegal insider trading. The best thing about the article was that it provided SAC’s monthly returns. When we have monthly returns we don’t need anybody telling us anything about how “awesome” a fund manager is. We can measure it ourselves.

Comparing raw return numbers may give you an idea about a hedge fund’s performance but you need to do an in-depth analysis to see the source of a hedge fund’s returns. Maybe, they owe their success to investing in high beta stocks in bull markets, or they consistently invest in value or momentum stocks.

We calculated Steve Cohen’s alpha for the 2004-2007 and 2008-2011 periods using Carhart’s four factor model. Carhart’s model tries to dissect returns into four compartments: market return, size effect, value effect, and momentum effect. We pay special attention to the last 3.5 years for two reasons. First, it includes 2008 which provided us a unique opportunity to see how funds fared under extreme stress. Second, hedge funds’ recent performances are better proxies for what they can deliver today. As hedge funds grow they can’t deliver at the same level because they can’t invest a large proportion of their portfolios in small cap stocks where the opportunities are better. Previously when we analyzed returns for several fund managers we noticed that their alphas went down as the funds and the hedge fund industry got bigger. After all most hedge funds follow similar strategies and compete for the same stocks.

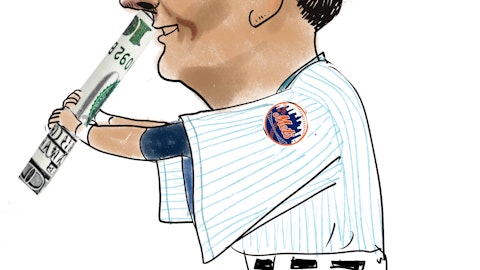

Steve Cohen had a monthly alpha of 91 basis points between 2004 and 2007. This is 11.5% annualized. Absolutely amazing! You have to be a stock market genius to achieve these kinds of returns. Cohen’s portfolio had a market beta of 0.41, meaning he isn’t hedging his stock market risk entirely. His investors had to pay an arm and a leg for him to assume the market risk that Vanguard charges a fraction of a percentage point in fees. Nevertheless his investors still enjoyed an 11.5% annualized excess return after fees and expenses, so they shouldn’t really complain about it. How did Cohen perform since the beginning of 2008?

That’s what we are really interested in. Steve Cohen had a monthly alpha of -2 basis points since 2008. That is -0.25% annualized. Cohen’s alpha disappeared during the past 3.5 years. During the same time period Dan Loeb generated close to 10% in annual alpha, so it wasn’t impossible to have alpha when the markets were really tough. Cohen had a market beta of 0.5, meaning half of his returns are derived from market exposure. He was also investing in growth stocks during this time period, with a growth beta of 0.38. His portfolio was also slightly exposed to momentum stocks with a momentum beta of 0.09. This doesn’t mean that Steve Cohen can’t pick stocks. It just means that his alpha is equal to the fees he charges. He has some skill in picking stocks but his clients can’t benefit from this anymore.