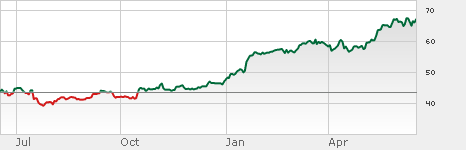

State Street Corporation (NYSE:STT) is one of the leading bank holding companies that serves institutional investors. The company has over $25 trillion in assets under custody and $2 trillion in assets under management, with operations in 26 countries worldwide. With shares up about 70% over the past year, should shareholders cash in and take their profits, or is there still more room to the upside? Would our investment dollars be better spent on another financial institution?

About State Street

State Street Corporation (NYSE:STT) provides services to institutional investors as a custodian bank through its subsidiary State Street Bank and Trust Company, and provides investment management services to mutual funds and other asset managers through State Street Global Advisors. The company’s customers include mutual funds, other collective investment funds, pension funds, insurance companies, and non-profits.

State Street operates in two distinct lines of business. The company’s investment servicing business makes up 66% of the company’s net revenues and provides such services as custody, accounting, administration, record keeping, foreign exchange, brokerage services, financing, analytics and more. State Street Corporation (NYSE:STT)’s investment management business accounts for 11% of the company’s revenues; it offers a variety of investment management and research services, and includes the State Street family of ETFs, which is the second largest ETF family in the U.S. in terms of assets under management. The remaining 23% of State Street’s revenue comes from the interest income on the company’s investment portfolio.

Ambitious growth plans

State Street Corporation (NYSE:STT) has set some pretty ambitious goals for itself. At the end of 2010, the company set the goal of doubling its international revenues over the following five year period (by the end of 2015), using both acquisitions and organic growth to accomplish this. As of the end of fiscal year 2012, the company’s non-U.S. assets under custody were 38% of the company’s total, and the company is well on its way to meeting its goal. The company has been especially aggressive in trying to grow its business in under-served European and Asian markets.

Also, the trend towards ETFs and away from traditional mutual funds should help the company grow its assets under management domestically, and State Street’s broad array of ETF offerings should allow for a faster growth rate than its competitors.

The numbers: cheap or expensive?

State Street is expected to report earnings of $4.53 for the 2013 fiscal year, an increase of 14.7% from 2012 on a combination of 10% growth in assets under custody and improved operating efficiency. If State Street meets expectations, that means that shares are currently trading for 14.8 times current year earnings. The company is projected to grow its EPS to $5.19 and $5.96 in fiscal years 2014 and 2015, respectively. These figures correspond to a three-year average forward earnings growth rate of just less than 15%, which is a fantastic sustained growth rate for any company, especially one with such a low P/E like State Street. Before we go diving in, let’s check out a couple of alternatives.

Alternatives: BlackRock, Inc. (NYSE:BLK) and Franklin Resources, Inc. (NYSE:BEN)

BlackRock is another leading investment management company, with a total of $3.9 trillion in assets under management. BlackRock specializes in fixed-income and equity funds, which it offers to both institutional and individual investors. The company’s business model is slightly different than State Street’s and is oriented more toward investment management and less toward the investment servicing side of the business, like State Street is known for.

BlackRock trades at a P/E of 17.1 times this year’s projected earnings and is projected to grow at a slightly slower, but still impressive, rate of 11% annually going forward. It is also worth noting that BlackRock is a better dividend payer, with a yield of 2.5% annually, as opposed to 1.57% from State Street.

Franklin Resources also generates most of its revenue by investment management, with one major difference. The company is highly dependent on the strength (or lack thereof) of the U.S. dollar, with 55% of assets invested internationally. Analysts are somewhat cautious about the company’s earnings growth over the next few years, as the rising U.S. dollar could be bad news for investments held in other currencies. This is offset by the company’s low debt and high cash reserves, which are among the best in the business.

Franklin Resources trades at the “cheapest” valuation of the three, at just 14 times this year’s earnings, and is projected to grow its earnings very nicely, at a 12% rate over the next several years. However, bear in mind that the risks related to the company’s international investments may be the reason for this “discount.”

Buy, sell, or hold?

If you are currently a State Street Corporation (NYSE:STT) shareholder, there is absolutely nothing wrong with cashing in at least some of your position and taking profits. Having said that, State Street has a very profitable business model, and the combination of increasing assets under management due to its ETF offerings, as well as its ambitious international expansion plans, should provide shareholders with even better gains over the next several years and beyond.

Matthew Frankel has no position in any stocks mentioned. The Motley Fool recommends BlackRock.

The article This Financial Is One of the Best Bargains in the Industry originally appeared on Fool.com.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.