When I’m looking for investment ideas, I like secular themes. Big ideas that give me the confidence to hold on during the occasional market panics.

And it doesn’t get any bigger than China.

Between 2000 and 2010, China’s gross domestic product, or GDP, grew at an astounding 10% annually.

According to estimates provided by the World Bank, China’s GDP is expected to grow at a high single-digit clip over the next decade, more than doubling the size of the nation’s economy.

And this represents a big opportunity for these two restaurant stocks.

The opportunity

China’s rapid pace of industrialization has created an increasingly wealthy middle class that is growing at an enormous rate.

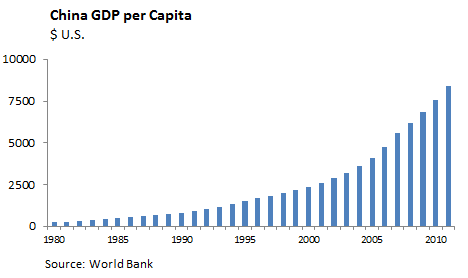

According to the World Bank, Chinese GDP per capital grew from $250 annually in 1980 to $8,400 per year today. Over the next 15 years, 500 million Chinese are expected to enter the middle class.

And they all want Western-style products.

In addition, the average Chinese consumer saves 35 cents of every dollar they earn. With a population of 1.3 billion people, that presents a largely untapped market for some American companies.

Starbucks Corporation (NASDAQ:SBUX)

Starbucks Corporation (NASDAQ:SBUX) has been one of the most successful American companies in China.

Just like it did in the U.S. and Japan, Starbucks Corporation (NASDAQ:SBUX) is single-handedly inventing coffeehouse culture in China. Coffee is now viewed as an affordable luxury and Starbucks Corporation (NASDAQ:SBUX) cafes are seen as a high-end detestation to hold meeting and take dates.

Starbucks Corporation (NASDAQ:SBUX) has accomplished this by tailoring its strategy to local tastes with more spacious stores and unique menu offerings like moon cakes, iced rice dumplings, and black sesame green tea frappuccinos. Yummy!

The effort is paying off. Chinese consumers are now the company’s most loyal customers with 2,000 reward club members per store. That’s the highest of any country. Last quarter, Asian same store sales grew 8% led in large part by China.

By 2015, the company plans to nearly double in Chinese store count to 1,500 locations.

But that’s just a foothold.

In the United States there’s one Starbucks Corporation (NASDAQ:SBUX) cafe for every 25 thousand consumers. Assuming Starbucks Corporation (NASDAQ:SBUX) can achieve one third of its U.S. penetration in China, the market could support over 15,000 locations.

That’s larger than the company’s entire North American business today.

McDonald’s Corporation (NYSE:MCD)

Investors often mistakenly assume McDonald’s Corporation (NYSE:MCD) is a mature business, destined for slow-growth after saturating the U.S. market. But many fail to grasp the scale of its expansion possibilities in emerging markets.

Today, McDonald’s Corporation (NYSE:MCD) has more than 1,700 restaurants in China and is aiming for over 2,000 locations by the end of this year.

How many stores could China support?

In the United States, McDonald’s Corporation (NYSE:MCD) has one location for every 17 thousand consumers. Assuming McDonald’s Corporation (NYSE:MCD) an penetrate China at a third of the rate it has in the United States, the company could build 30,000 locations in the Middle Kingdom.

That’s a long growth runway!

In addition, McDonald’s Corporation (NYSE:MCD) recently announced that it shifting towards a franchise business model in China. Today, nearly all McDonald’s Corporation (NYSE:MCD) locations are company owned. But by 2015, management is aiming to have between 20%-25% of its Chinese stores franchised.

What does this mean for investors?

A less capital intensive expansion. That frees up funds for shareholder friendly activities like dividends and share buybacks.

Foolish bottom line

But aggressive expansion comes with risk. China is notoriously challenging to operate in and fortunes can change quickly.

Yum! Brands, Inc. (NYSE:YUM) illustrates this problem perfectly.

In January, the company reported a 41% plunge in China same store sales after it was announced that its KFC brand chicken contained high levels of antibiotics. It may take years for the company to repair its reputation.

Yum! Brands, Inc. (NYSE:YUM)’s Chinese comp sales fell another 29% in April following Avian flu fears. That’s particularly alarming for investors because China now accounts for 50.6% of the company’s revenues.

This highlights the importance of execution. Slip-ups can derail growth plans with devastating consequences for shareholders.

But if Starbucks and McDonald’s can pull it off, China represents an incredibly huge addressable market. That means at least a decade of double-digit earnings and dividend growth for shareholders.

The article 2 American Restaurants Set to Conquer China originally appeared on Fool.com.

Robert Baillieul has no position in any stocks mentioned. The Motley Fool recommends McDonald’s and Starbucks. The Motley Fool owns shares of McDonald’s and Starbucks. Robert is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.