When it comes to investing in the healthcare sector, there is lots of money to be made if investors choose wisely. Factors such as the current healthcare laws, which require a greater number of people to be insured, as well as an aging population should translate to higher spending on medical care over the next several years and beyond. My favorite way to play the sector over the long-term is through manufacturers of medical equipment, and although I like this business in general, one company that I think will do especially well is St. Jude Medical, Inc. (NYSE:STJ).

What do they make?

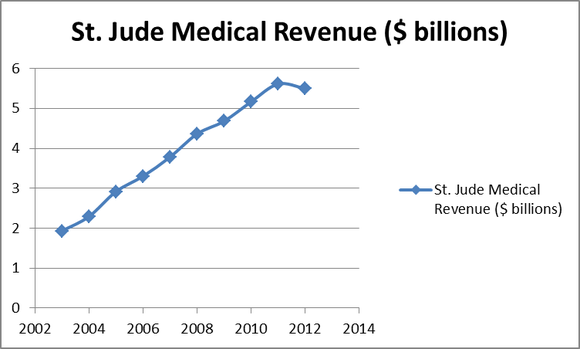

St. Jude Medical, Inc. (NYSE:STJ) makes a variety of medical devices having to do with cardiac management/surgery and pain management. Over the past decade or so, the company has experienced tremendous revenue growth with sales increasing almost every year, including the peak recession years of 2008-2010. Revenues dropped slightly last year due to a decreased demand for cardiac rhythm management products, but this trend is expected to reverse next year due to new, innovative products that are due to be released.

St. Jude Medical, Inc. (NYSE:STJ)’s business is reported in four segments, the largest being the CRM (cardiac rhythm management) segment, which accounts for 52% of the company’s sales and has been responsible for much of the revenue growth in recent years. Products made by this segment include implantable cardiac defibrillators, cardiac resynchronization therapy defibrillators, and pacemakers.

The Cardiovascular segment (24% of sales) produces vascular closure devices, compression assist devices, diagnostic imaging technology, replacement heart valves, and more. The AF (atrial fibrillation) segment (16% of sales) produces a variety of catheters that are used to treat abnormal heart rhythms. Finally, the Neuromodulation segment (8% of sales) produces implantable devices that deliver electric current to targeted nerve sites, as well as implantable drug infusion systems.

How are they going to grow?

As mentioned, demand for St. Jude Medical, Inc. (NYSE:STJ)’s products, particularly the CRM segment, has dropped recently all over the world. However, the company’s new products that it are set to release this year in the pacemaker and defibrillator segments are expected to make up for it. For example, the FDA recently approved St. Jude Medical, Inc. (NYSE:STJ)’s defibrillators with improved safety features, including extra insulation that prevents shorts. This should cause an influx of sales for St. Jude Medical, Inc. (NYSE:STJ), even if the overall market for defibrillators is not very strong worldwide.

Additionally, the company has been very conscious about cutting costs recently. In the second half of 2012, the company cut 5% of their total work force, which management has said will result in between $50 and $60 million in cost savings this year.

Valuation and growth projections

Due to the uncertainty in global demand for their products, St. Jude trades at a pretty cheap P/E of just 12.4 times the current fiscal year’s earnings, well below the company’s recent historical average of 14. St. Jude is expecting to earn $3.69 per share this year, rising to $3.92 and $4.23 over the next two years as a result of cost savings and buybacks. If global demand does pick up significantly between now and then, it will be a bonus. Speaking of buybacks, St. Jude has one of the best buyback programs in the business and has reduced the total number of shares from 344.4 million in 2009 to 282.9 million currently, a reduction of almost 18% in just four years.