We have been waiting for this for a year and finally the third quarter ended up showing a nice bump in the performance of small-cap stocks. Both the S&P 500 and Russell 2000 were up since the end of the second quarter, but small-cap stocks outperformed the large-cap stocks by double digits. This is important for hedge funds, which are big supporters of small-cap stocks, because their investors started pulling some of their capital out due to poor recent performance. It is very likely that equity hedge funds will deliver better risk adjusted returns in the second half of this year. In this article we are going to look at how this recent market trend affected the sentiment of hedge funds towards SPS Commerce, Inc. (NASDAQ:SPSC), and what that likely means for the prospects of the company and its stock.

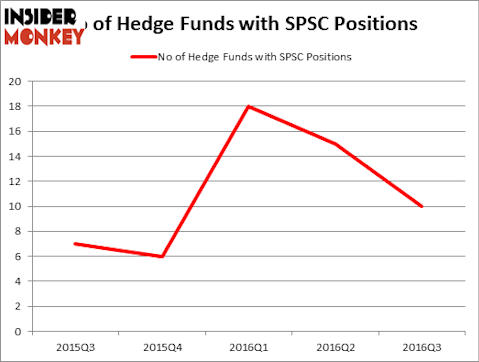

Is SPS Commerce, Inc. (NASDAQ:SPSC) a buy here? Money managers are thoroughly reducing their bets on the stock. The number of long hedge fund investments went down by 5 in recent months. SPSC was in 10 hedge funds’ portfolios at the end of September. There were 15 hedge funds in our database with SPSC holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Cynosure, Inc. (NASDAQ:CYNO), McDermott International (NYSE:MDR), and Seadrill Ltd (NYSE:SDRL) to gather more data points.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Maxx-Studio/Shutterstock.com

How have hedgies been trading SPS Commerce, Inc. (NASDAQ:SPSC)?

Heading into the fourth quarter of 2016, a total of 10 of the hedge funds tracked by Insider Monkey were long this stock, down by 33% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards SPSC over the last 5 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Matthew A. Weatherbie of Weatherbie Capital holds the number one position in SPS Commerce, Inc. (NASDAQ:SPSC). Weatherbie Capital has a $25.7 million position in the stock, comprising 3.2% of its 13F portfolio. The second largest stake is held by Jonathan Auerbach of Hound Partners, with a $21.7 million position. Some other members of the smart money that are bullish contain Renaissance Technologies, one of the largest hedge funds in the world, Ken Griffin’s Citadel Investment Group and Peter Muller’s PDT Partners. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.