Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of September. At Insider Monkey, we follow over 700 of the best-performing investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is SPS Commerce, Inc. (NASDAQ:SPSC), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

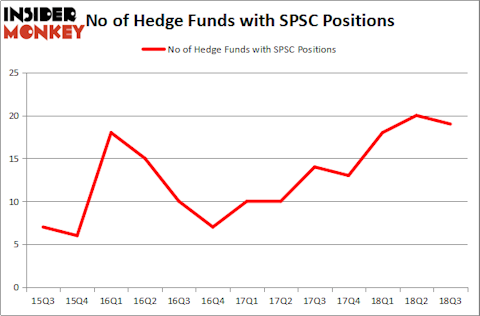

Is SPS Commerce, Inc. (NASDAQ:SPSC) going to take off soon? Money managers are getting less optimistic. The number of bullish hedge fund bets were cut by 1 recently. Our calculations also showed that SPSC isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to check out the fresh hedge fund action surrounding SPS Commerce, Inc. (NASDAQ:SPSC).

How are hedge funds trading SPS Commerce, Inc. (NASDAQ:SPSC)?

Heading into the fourth quarter of 2018, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -5% from the second quarter of 2018. On the other hand, there were a total of 13 hedge funds with a bullish position in SPSC at the beginning of this year. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Legion Partners Asset Management, managed by Ted White and Christopher Kiper, holds the number one position in SPS Commerce, Inc. (NASDAQ:SPSC). Legion Partners Asset Management has a $32.4 million position in the stock, comprising 6.9% of its 13F portfolio. Coming in second is D E Shaw, led by D. E. Shaw, holding a $28.1 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Remaining professional money managers with similar optimism encompass Jim Simons’s Renaissance Technologies, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital and John Overdeck and David Siegel’s Two Sigma Advisors.

Since SPS Commerce, Inc. (NASDAQ:SPSC) has experienced declining sentiment from hedge fund managers, we can see that there were a few hedge funds who sold off their positions entirely heading into Q3. Intriguingly, Jonathan Auerbach’s Hound Partners dumped the largest position of the 700 funds monitored by Insider Monkey, totaling an estimated $31.4 million in stock. Frederick DiSanto’s fund, Ancora Advisors, also dumped its stock, about $11 million worth. These transactions are interesting, as total hedge fund interest dropped by 1 funds heading into Q3.

Let’s check out hedge fund activity in other stocks similar to SPS Commerce, Inc. (NASDAQ:SPSC). These stocks are IAMGOLD Corporation (NYSE:IAG), Nevro Corp (NYSE:NVRO), Sangamo Therapeutics, Inc. (NASDAQ:SGMO), and Aircastle Limited (NYSE:AYR). All of these stocks’ market caps match SPSC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IAG | 12 | 107461 | -3 |

| NVRO | 24 | 381162 | 2 |

| SGMO | 26 | 143431 | -3 |

| AYR | 15 | 98038 | 1 |

| Average | 19.25 | 182523 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.25 hedge funds with bullish positions and the average amount invested in these stocks was $183 million. That figure was $161 million in SPSC’s case. Sangamo Therapeutics, Inc. (NASDAQ:SGMO) is the most popular stock in this table. On the other hand IAMGOLD Corporation (NYSE:IAG) is the least popular one with only 12 bullish hedge fund positions. SPS Commerce, Inc. (NASDAQ:SPSC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard SGMO might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.