The 2000s were the decade of the low-cost carrier in the American airline industry. Southwest Airlines Co. (NYSE:LUV) has been in business since 1971, but it was a niche player until the 1990s. In the past 10-15 years, Southwest has expanded rapidly, going from less than $5 billion of revenue in 1999 to more than $12 billion of revenue in 2010, and $17 billion in 2012. Meanwhile, new upstart JetBlue Airways Corporation (NASDAQ:JBLU) began service in 2000 and grew at an astonishing pace to become one of the top-six carriers in the country today, with annual revenue of $5 billion.

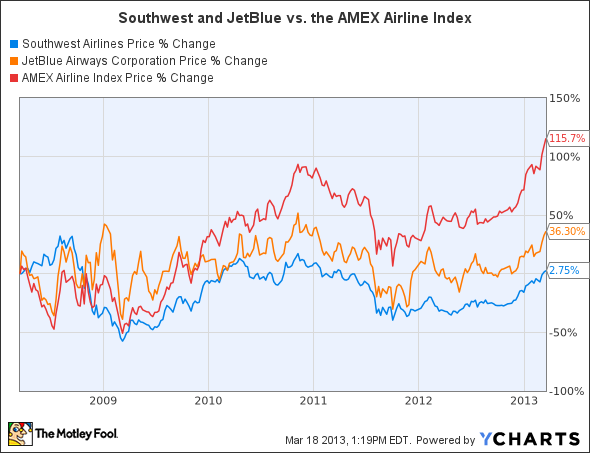

However, Southwest Airlines Co. (NYSE:LUV) and JetBlue Airways Corporation (NASDAQ:JBLU) have hit some bumps in the past few years. The large network carriers have dramatically reduced their expenses as they have gone through the bankruptcy process during the past decade while adding fees for checked baggage and other services, boosting ancillary revenue. These developments have allowed the network carriers become quite competitive on price with Southwest and JetBlue for domestic flights. A recent study found that Southwest offered the lowest prices for a given route only 40% of the time. As a result of this more competitive fare environment, Southwest and JetBlue shares have dramatically lagged the industry benchmark over the past five years.

Southwest and JetBlue vs. the AMEX Airline Index, Five-Year Price chart; data by YCharts

Beyond “low-cost”

As legacy carriers have closed the cost and price gap with Southwest Airlines Co. (NYSE:LUV) and JetBlue, the term “low-cost carrier” has become somewhat of a misnomer. Indeed, Southwest and JetBlue Airways Corporation (NASDAQ:JBLU) have been ceding their leadership on price to a new group of so-called “ultra-low-cost carriers”: principally Spirit Airlines Incorporated (NASDAQ:SAVE) , Allegiant Travel (NASDAQ:ALGT) , and most recently, Frontier Airlines (a subsidiary of Republic Airways (NASDAQ:RJET) ). The differences between LCCs and ULCCs can be seen most dramatically by comparing the seating on Airbus A320s used by JetBlue, Spirit, and Frontier. JetBlue offers best-in-class legroom by putting only 150 seats on an A320. By contrast, Frontier has 168 seats on its A320s, and is looking to expand that to 174. Spirit has pushed the envelope even further, with 178 seats on each A320.

Low prices are thus no longer distinctive features for Southwest and JetBlue. However, the two carriers do differ from competitors in that they provide benefits and amenities that cannot be found on most other U.S. airlines. To maintain their profitability in today’s competitive environment, LCCs need to capitalize on this differentiation, and market themselves as “premium service” carriers. JetBlue Airways Corporation (NASDAQ:JBLU) has embraced this ideal, and emphasizes its premium amenities heavily in its marketing. By contrast, Southwest has had more trouble distinguishing itself from other carriers now that it is no longer a clear price leader. This messaging problem could continue to drag down Southwest’s performance if it does not clarify what it stands for.