An interesting point has been brought up by MFP Investors LLC’s Michael Price, one of the most respected value investors since the 1980’s. Is Goldman Sachs Group, Inc. (NYSE:GS) high-priced? Should you buy Goldman Sachs Group, Inc. (NYSE:GS) shares now?

“They’re the smartest guys in the room,” Price said. “When you’re looking at financials – banks, brokers, insurance companies – who’s going to be smarter than Goldman? And you don’t want to pay more than one times book and 10 times earnings. That to me is the center point.”

But that certainly differs from the popular opinion, after the FY12 annual report was released on Jan. 16. As my colleague Colin Lokey wrote:

“While the rest of the banking world tries to figure out how to turn a solid, no frills profit in the post-crisis world, the smartest guys in the room are back to doing what they do best: making money. Goldman Sachs’ earnings rose 190% year-over-year (no that’s not a typo) and 94% sequentially as the firm raked-in $9.2 billion in revenue and earned $5.60 per share, laughably ahead of estimates which were just $3.64.”

Company Analysis

Although total revenue has increased 190% QoQ since previous year, it might not seem so when you dig deeper. The market making segment, which reported an increase of 109% QoQ since the previous year, includes a gain of approximately $500 million on the sale of the firm’s hedge fund administration business. If we exclude that, the total revenue falls down to $2.2 billion in Q4 FY12, a QoQ increase of 70%. But more importantly, the annual revenue from market making segment falls down to $10.85 billion, a YoY increase of 16.8%. This is not at all impressive when the 3-yr and 5-yr revenue growth are (8.32%) and (13.27%), respectively.

Most non-interest revenue is directly proportional to the fees charged and the amount of assets under supervision. Total assets under management increased only 3% to $854 billion in December last year. Other client assets increased 66% to $111 billion. Total “assets under management” indicate the amount of assets you supervise and manage for primary third parties (or direct clients). If this is not increasing, then how will the revenue increase?

Though other expenses (which include litigation costs, regulatory proceedings, and “charitable contributions”) declined 11% on QoQ basis, the annual compensation and benefits expenses were recorded at $2.44 billion, a YoY increase of 18%.

In fact, legal costs were expected to reach $3.4 billion last year over the firm’s research and actions during 2008 credit crisis. Here’s an excerpt from an article in 2011:

“The bank has been named as a defendant in lawsuits related to its actions during the 2008 credit crisis, its research coverage and the collapse of the cable company Adelphia Communications. It is being sued by the city of Cleveland for causing a “public nuisance” with its backing of sub-prime loans.”

Last year, history repeated itself and Goldman Sachs faced mortgage debt lawsuit action on misleading securitization on loans from New Century Financial Corp. This is just what happened in 2010, when the company gave $550 million as compensation to settle fraud charges by the U.S. Securities and Exchange Commission (SEC) over a collateralized debt obligation it sold–Abacus 2007-AC1 CDO.

The company even faces a Facebook IPO lawsuit, as per this article:

“The plaintiffs, who are seeking to proceed on behalf of a class of Facebook investors, said the company and the banks didn’t disclose lower revenue estimates before the share sale. The members of the proposed class have lost more than $2.5 billion since the initial public offering last week, according to a complaint filed today in Manhattan federal court.”

The most recent news, as reported on Jan. 16 this year, is that Goldman Sachs and Morgan Stanley will pay a combined $557 million to mortgage borrowers over shoddy foreclosure practices ($232 million in cash payments to homeowners, along with $325 million in other assistance, such as loan modifications and forgiveness of deficiency judgments).

In other words, more “other expenses” eat into the bottom line, and perhaps more of it is yet to come this year.

Competition Analysis

Before we move in, let’s take a look at the table below.

| Companies | Beta | P/E Ratio | P/B Ratio | Total Asset Turnover | Return on Total Capital | Net Margin(%) | Total Debt/Capital Ratio | Interest Coverage |

| GS | 1.4 | 9.98 | 0.65 | 0.04 | 0.88 | 12.07 | 85.98 | 2.1 |

| State Street Corporation (NYSE:STT) | 1.45 | 13.29 | 1.04 | 0.05 | 4.14 | 18.41 | 53.28 | 6.2 |

| JPMorgan Chase & Co. (NYSE:JPM) | 1.39 | 8.93 | 0.71 | 0.05 | 2.39 | 28.6 | 74.76 | 3.4 |

| UBS AG (USA) (NYSE:UBS) | 1.73 | 14.98 | 0.78 | 0.03 | 1.01 | 13.9 | 87.39 | – |

| Morgan Stanley (NYSE:MS) | 1.59 | 16.87 | 0.48 | 0.04 | 0.58 | 22.84 | 85.24 | 0.9 |

| Citigroup Inc. (NYSE:C) | 2.58 | 16.9 | 0.43 | 0.06 | 1.46 | 16.1 | 75.35 | 1.4 |

Valuation – The P/E ratio of 9.98 and the P/B ratio of 0.65 are pretty much below everyone else in the table. The company seems to be not overly valued at the moment.

Efficiency – Total asset turnover (shows total revenue to total assets) gives you an indication of how well the company is using its assets to build revenue. In this case, Goldman Sachs still has to catch up with the State Street Corporation, JPMorgan Chase & Co. and Citigroup Inc..

Profitability – Return on total capital (ROTC – EBIT to total capital) says how profitable a company is at utilizing its capital. ROTC of 0.88 and net margin of 12.07% are still lower than industry averages.

Leverage – While total debt to total capital ratio (which indicates how much of the total capital is through debt) is pretty high at 85.98, the company is not sufficiently covering for the interest expense as per interest coverage ratio of 2.1 and ROTC of 0.88.

Riskiness – The company’s stock is not too risky with beta at 1.4, compared to 2.58 at Citigroup and 1.73 at UBS.

In short, while the company’s stock is not risky, the fundamentals of the company still do not convince me that it is of value. The company needs to keep on improving its profitability and strive to restrain debt from growing further.

Street Analysis

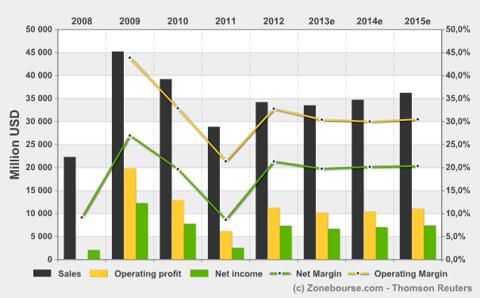

Revenue is expected to fall next year, yet keep on growing for the next couple of years until 2015. During this period, profitability margins will probably stay flat or rise nominally.

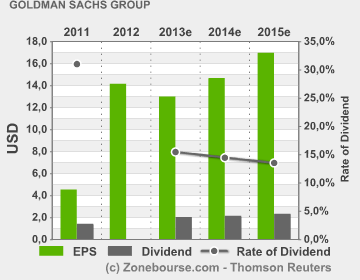

Even EPS is expected to grow in correspondence with the revenue growth.

But the main question is whether the P/E ratio will grow or not, because that will reflect in the stock price, right?

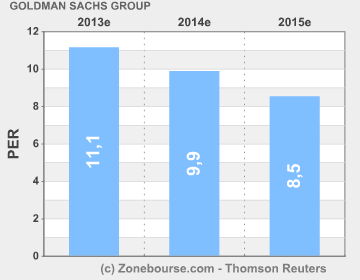

Looking at the image above, we can safely say that the stock price will gain sufficiently next year with the expected PER to reach 11.1, compared to the current PER of 9.98. But from 2014 onward, the PER is going down while the EPS is supposed to go up. Or, we can safely say that the price rise will flatten from 2014 onward. Or, it may go down if the EPS does not show sufficient appreciation.

Conclusion

If you are excited about QoQ revenue increase of 190%, think again. It might be a good time to buy the stock, but there still remains a question whether it still have become a high value play.

With the upcoming litigation costs, not-so-remarkable revenue growth, high leverage and lack of financial transparency, the company has still a lot more to show to be termed “high value.” Yes, it might be undervalued at the moment, which is stirring the buying craze. Still, questions on its performance in the next few years still remain.

In short, I am still neutral about this company.

The article Something To Know About Goldman Sachs originally appeared on Fool.com and is written by Suman Chatterjee.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.