We recently published a list of 10 Oversold Stocks to Buy in 2025 Amid Inflation Fears. In this article, we are going to take a look at where Skyworks Solutions, Inc. (NASDAQ:SWKS) stands against other oversold stocks to buy in 2025 amid inflation fears.

The stock market continues to face significant volatility, with major indices continuing their decline from last week. The S&P 500 is down nearly 2%, while the Nasdaq is equally struggling at over 2.5% in the red.

The implementation of new tariffs had already spooked the market. However, it was dealt an additional blow as the core Personal Consumption Expenditures index reading came in hotter than expected. Inflation and recession concerns are dominating the market, but this also presents an opportunity for outperformance.

Stocks that are oversold as a result of the current dip present a great opportunity for outperformance in 2025. We decided to come up with a list of such stocks.

To ensure that these stocks were suitable for a bear market, were it to persist, we also added an additional criterion of a strong dividend yield so that investors can accumulate dividends while they wait for a market turnaround. For this list, we only considered stocks with a market cap of at least $2 billion that are down considerably since the start of the year.

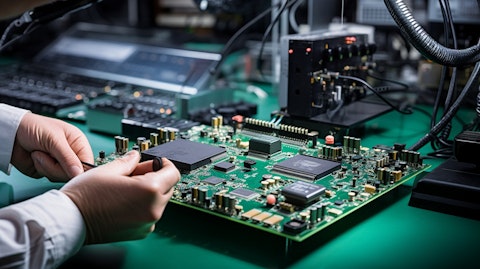

A technician using a specialized tool to mount a wireless analog system on chip.

Skyworks Solutions, Inc. (NASDAQ:SWKS)

Skyworks Solutions, Inc. (NASDAQ:SWKS) is a developer, manufacturer, designer, and marketer of proprietary semiconductor products. The company’s products include antenna tuners, automotive tuners and digital radios, demodulators, amplifiers, and other products. The stock is following a downward trend, falling about 25% this year.

Skyworks (NASDAQ:SWKS) has in the past relied on Apple for a good chunk of its revenue. In fiscal 2024, it generated 69% of its revenue from Apple. This is a huge liability for investors, especially considering how Apple eventually moves the production of its equipment in-house, or launches its own versions of the products it previously bought from others. We saw this with both the iPhone 16 and 17, where Apple reduced the number of RF solutions orders, tanking SWKS stock.

Apart from this, Skyworks (NASDAQ:SWKS) also faces tough competition from the likes of Qualcomm (NASDAQ:QCOM). Unfortunately, it is not simply a case of buying the dip for Skyworks investors. They need to see business improvement before jumping in. The management has announced a share buyback program worth $2 billion and expects healthy gross margins of over 45% in 2025. It could return to growth after Q2, as per the management, but betting on the stock remains a risky bet without clear plans to solve its Apple problem.

Overall, SWKS ranks 6th on our list of oversold stocks to buy in 2025 amid inflation fears. While we acknowledge the potential of SWKS as a leading investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns, and doing so within a shorter time frame. If you are looking for an AI stock that is as promising as SWKS but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 20 Best AI Stocks To Buy Now and 30 Best Stocks to Buy Now According to Billionaires.

Disclosure: None. This article is originally published at Insider Monkey.