Jay McCanless: Yes good traffic through the models was pretty amazing. I guess my second question, now with the acquisition earlier this year, some more wholly owned retail units. Could you maybe level set it for all of this and talk to how many wholly owned retail dealerships you have now? Is there a potential, because it sounds like the homes sold through the wholly owned channel had a higher gross margin. Is that something we should expect going forward? And at some point, might not bracket that out so we can see wholly owned retail versus wholesale sales?

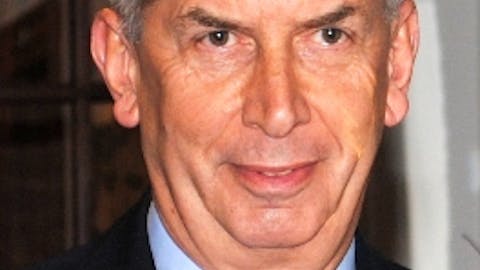

Mark Yost: Yes, I think there are obviously the more vertical you can get with your integrated model, the more of the value chain margin capture. With the acquisition of Factory Expo, I think we’ve grown our retail footprint to 31 retail locations. So we have expanded, especially on the digital side of things. Factory Expo is more of a digital retailer that we acquired. As retailers, I think, phase out of the business, there’s a lot of aging retailers, there’s, a lot of locations and geographies that we can meet, especially more digitally. I think there’s, definitely expansion opportunities into retail. Should retailers want to retire or exit the business in some way. And we want to make sure to ensure our distribution and supply for the future.

Operator: Our next question is from Matthew Bouley with Barclays.

Matthew Bouley: That was a helpful quantification you gave on the REIT and builder channels. I guess just focusing on the REIT channel, I think in the past, you talked about some supply chain issues that were maybe preventing that channel from basically holding that channel back on the order side a little bit, maybe now that’s behind you? Is the expectation that channel can continue to grow like this in the coming quarters? What are you hearing from those customers? And how should we think about that over your fiscal ’24?

Mark Yost: Yes, thanks, Matt. The REIT channel and the community channel, I think, has high demand currently. It’s the most affordable, high-quality housing solution, I think, out there for people and they’re renting and both selling on a land lease basis. Most of the communities greenfields are starting to expand. We’re starting to see transformers which, was probably the critical bottleneck, electrical transformers are starting to come in. It hasn’t fully been resolved. There’s, still shortages and delays. And I think that concrete is also a limiting factor for some of them, but that’s easing up a little bit. But I think concrete and transformers will be the critical bottleneck, which is starting to ease, but it will kind of normalize throughout the calendar year, I believe.

Their demand is very strong, and I think it will continue to grow as they have the most greenfield expansions they’ve planned in the past 20 to 30 years. So I think a lot of greenfield activity is happening in the communities, let alone the repair and replacement of units that are coming upon 40, 50 years old in many of these communities. And then compounding that is obviously the horrible damage that happened with Hurricane Ian in Florida and the number of homeowners who are impacted in communities down there. The REITs have done an amazing job at cleaning and getting those properties organized and getting people into temporary shelter that they can in those divisions. So I think there is substantial demand coming from communities for the foreseeable future.

Matthew Bouley: Got it. That’s very helpful color there. Second one, just to kind of zoom into Q4. I know you gave the guide, you gave some kind of early January trends, order cancellation subsiding and quoting, getting better. Presumably, when you say order cancelations have subsided, that’s related to the retail channel? But I’m just curious, when you say some trends have improved. Is that across all channels? Is it better than seasonality? Is this kind of what you normally see in January relative to the holidays, just kind of what do you think has driven that sort of uptick and any kind of detail around that?