So I think that will bring huge efficiencies, not only in terms of the workforce and benefiting the safety, health of the workforce to make it a better job to work at, but it will allow us to do multi-shift and other things because all of our plants today work a single-shift operation. So we can staff a different way, we can run a different way, which will bring greater efficiencies that are outside of just the products and streamlining the simplification.

Greg Palm: Yes okay great. Looking forward to getting more updates on that going forward. And then just lastly, more of a clarification, I think you mentioned that backlogs on community and builder developer were actually up on a sequential basis. In terms of that top 100 builder win that you talked about last year, were there any orders associated with that specifically or are those still yet to come?

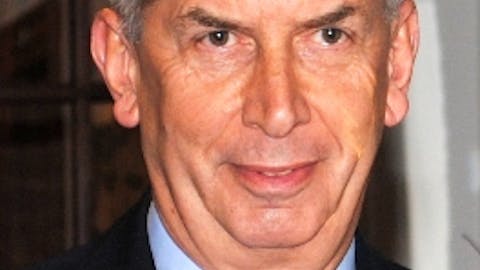

Mark Yost: Yes, Greg, I think the community and builder channels have been very strong. Actually, our builder developer channel was up year-over-year in the quarter, 25%. Our community channel year-over-year in the quarter was up 37%. We even saw growth in our Park Model tiny home channel during the quarter. And I think very importantly, as you mentioned, the backlogs for community and builder developer actually increased during the quarter. So it was really all of a, retail issue during the quarter as far as backlogs go. The top 100 builder that we signed up has not put orders into the backlog yet. We anticipate those probably in the March, maybe rolling into April time period when they really start rolling in. So I would expect it late in the fourth quarter, if not early first fiscal quarter of next year in April.

Operator: Our next question is from Phil Ng with Jefferies.

Phil Ng: Can you hear me now?

Operator: Yes, please go ahead.

Phil Ng: Sorry about that. Another really strong quarter, Mark, I think once we kind of flush out some of this retail destock, when we kind of look out to fiscal 2024, how are you thinking about the components from a demand standpoint after you kind of strip out FEMA? Certainly, your commentary sounds, a lot more upbeat than perhaps some of your traditional site-built builders they’ve talked about what was driving pretty hard at this point?

Mark Yost: Yes. I think I’m pretty optimistic on fiscal ’24 going forward. I think right now today, just overall, we see kind of we’re at a half-century low in terms of supply of homes for sale and rental properties — vacant rental properties. So we’re at a half-century low on the supply side for housing in general. I don’t expect the Fed to make major downward moves on interest rates, employment levels are high, so people will have jobs – for the foreseeable future, they’ll just be able to afford less, which puts them into our price point of homes where the traditional site-built builders can’t hit those price points. So I expect us to gain share versus the traditional site-built builders after we flush through this destocking.

So I think it’s shaping up very well for us vis-a-vis traditional builders. And we heard that same commentary Phil, at the International Builders’ Show, where we were last week. The number of builders that were very interested in our solutions and the advantages on the cost side and the time side we can provide them were very real and very material. So I think we’ll start to gain share in partnership with some of those builders as well to help them solve their challenges during these difficult times for them.

Phil Ng: Got it. Mark, outside of just the HUD code dynamic going through, are there any real bottlenecks on your end from a production standpoint to meet some of that demand if you’ve got a pretty sizable order from the builder side of things?