In this article you are going to find out whether hedge funds think Sierra Oncology, Inc. (NASDAQ:SRRA) is a good investment right now. We like to check what the smart money thinks first before doing extensive research on a given stock. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to predict the winners in the stock market.

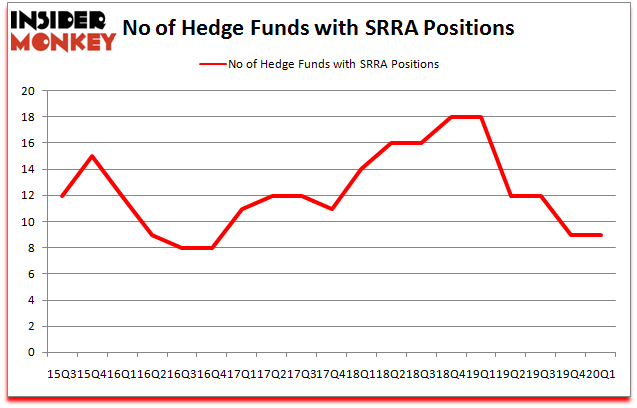

Sierra Oncology, Inc. (NASDAQ:SRRA) shares haven’t seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 9 hedge funds’ portfolios at the end of March. At the end of this article we will also compare SRRA to other stocks including Drive Shack Inc. (NYSE:DS), Ceragon Networks Ltd. (NASDAQ:CRNT), and Cassava Sciences, Inc. (NASDAQ:SAVA) to get a better sense of its popularity.

Video: Watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 58 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 36% through May 18th. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Nathaniel August of Mangrove Partners

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, We take a look at lists like the top 15 defense contractors in the world to identify the compounders that are likely to deliver double digit returns. We interview hedge fund managers and ask them about their best ideas. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. For example we are checking out stocks recommended/scorned by legendary Bill Miller. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 in February after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind we’re going to review the latest hedge fund action surrounding Sierra Oncology, Inc. (NASDAQ:SRRA).

Hedge fund activity in Sierra Oncology, Inc. (NASDAQ:SRRA)

At the end of the first quarter, a total of 9 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards SRRA over the last 18 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Sierra Oncology, Inc. (NASDAQ:SRRA) was held by Vivo Capital, which reported holding $18.8 million worth of stock at the end of September. It was followed by OrbiMed Advisors with a $14.5 million position. Other investors bullish on the company included Mangrove Partners, Frazier Healthcare Partners, and 683 Capital Partners. In terms of the portfolio weights assigned to each position Vivo Capital allocated the biggest weight to Sierra Oncology, Inc. (NASDAQ:SRRA), around 1.71% of its 13F portfolio. Mangrove Partners is also relatively very bullish on the stock, dishing out 0.6 percent of its 13F equity portfolio to SRRA.

Seeing as Sierra Oncology, Inc. (NASDAQ:SRRA) has witnessed falling interest from the entirety of the hedge funds we track, logic holds that there exists a select few hedgies that slashed their entire stakes by the end of the first quarter. At the top of the heap, Neil Shahrestani’s Ikarian Capital said goodbye to the biggest investment of the “upper crust” of funds watched by Insider Monkey, comprising about $0.1 million in stock. David Harding’s fund, Winton Capital Management, also said goodbye to its stock, about $0.1 million worth. These moves are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Sierra Oncology, Inc. (NASDAQ:SRRA) but similarly valued. We will take a look at Drive Shack Inc. (NYSE:DS), Ceragon Networks Ltd. (NASDAQ:CRNT), Cassava Sciences, Inc. (NASDAQ:SAVA), and SuRo Capital Corp. (NASDAQ:SSSS). This group of stocks’ market caps resemble SRRA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DS | 3 | 711 | -1 |

| CRNT | 3 | 4412 | -1 |

| SAVA | 5 | 7572 | 0 |

| SSSS | 8 | 8303 | 0 |

| Average | 4.75 | 5250 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 4.75 hedge funds with bullish positions and the average amount invested in these stocks was $5 million. That figure was $43 million in SRRA’s case. SuRo Capital Corp. (NASDAQ:SSSS) is the most popular stock in this table. On the other hand Drive Shack Inc. (NYSE:DS) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Sierra Oncology, Inc. (NASDAQ:SRRA) is more popular among hedge funds. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks returned 13.4% in 2020 through June 22nd but still managed to beat the market by 15.9 percentage points. Hedge funds were also right about betting on SRRA as the stock returned 43% so far in Q2 (through June 22nd) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Sierra Oncology Inc. (NASDAQ:SRRA)

Follow Sierra Oncology Inc. (NASDAQ:SRRA)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.