Kamunting Street Capital Management, L.P. is a Connecticut-based hedge fund founded in 2004 by Allan Teh. The fund focuses on public equity, fixed income, and alternative investment markets internationally. Kamunting’s portfolio was valued at $43.5 million as of the end of the second quarter. In the third quarter, the fund posted an impressive 18.69% return from its long positions in 8 companies which had a market cap of $1 billion or more on June 30. We’ll take a look at four of those positions in this article, in Alphabet, Inc (NASDAQ:GOOG), American Airlines Group Inc (NASDAQ:AAL), Goldman Sachs Group, Inc. (NYSE:GS), and Endo Health Solutions, Inc (NASDAQ:ENDP).

Out of the nearly 660 funds tracked by Insider Monkey which had at least 5 long positions in $1 billion companies on June 30, 627 of them delivered positive returns in the third quarter from those stock positions, with Kamunting ranking as one of the top performers. It should be noted that our calculations may be different from the fund’s actual returns, as they do not factor in changes to positions during the quarter, or positions that don’t get reported on Form 13Fs, like short positions.

First on the agenda is Alphabet, Inc (NASDAQ:GOOG), in which Kamunting increased its holding in the company’s class A shares by 3% in the second quarter, ending the period with a total of 23,425 class A shares of the internet giant in its portfolio. The total value of the investment stood at about $16.48 million on June 30 and ranked as the fund’s top pick. The stock returned 12.3% during the third quarter.

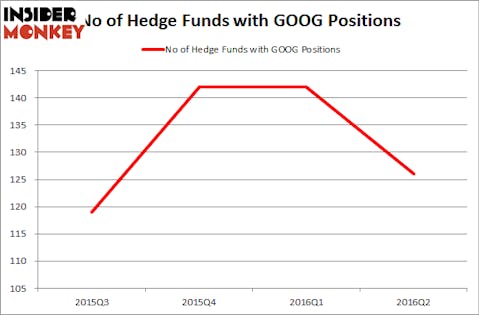

At the end of the second quarter, a total of 126 of the hedge funds tracked by Insider Monkey were long Google’s class C shares, an 11% drop from the end of the first quarter of 2016, while 135 were long its class A shares. Of the funds tracked by Insider Monkey, Boykin Curry’s Eagle Capital Management has the most valuable position in Alphabet Inc (NASDAQ:GOOG), worth close to $1.28 billion, comprising 5.5% of its total 13F portfolio. Sitting at the No. 2 spot is Southeastern Asset Management, led by Mason Hawkins, holding a $669.8 million position; the fund has 6.8% of its 13F portfolio invested in the stock. Other peers with similar optimism consist of John Armitage’s Egerton Capital Limited, Stephen Mandel’s Lone Pine Capital, and Andreas Halvorsen’s Viking Global.

Follow Alphabet Inc. (NASDAQ:GOOG)

Follow Alphabet Inc. (NASDAQ:GOOG)

Receive real-time insider trading and news alerts

Follow American Airlines Group Inc. (NASDAQ:AAL)

Follow American Airlines Group Inc. (NASDAQ:AAL)

Receive real-time insider trading and news alerts

Kamunting Street loaded up on American Airlines Group Inc (NASDAQ:AAL) in the second quarter, increasing its holding in the company by 131% to end the quarter with a total of 211,300 shares of the company, which had a total worth of about $5.98 million at the end of June. Those shares shot up in value in the third quarter, as the stock returned 29.7%.

The number of bullish hedge fund bets on American Airlines retreated by 5 in Q2, to close the quarter at 56. Among these funds, Adage Capital Management held the most valuable stake in American Airlines Group Inc (NASDAQ:AAL), which was worth $178.2 million at the end of the second quarter. On the second spot was Stelliam Investment Management which amassed $174 million worth of shares. Moreover, Masters Capital Management, Cyrus Capital Partners, and Highland Capital Management were also bullish on American Airlines Group Inc (NASDAQ:AAL).

Follow Goldman Sachs Group Inc (NYSE:GS)

Follow Goldman Sachs Group Inc (NYSE:GS)

Receive real-time insider trading and news alerts

We’ll check out two more of the fund’s stock picks on the next page.

Kamunting Street sold 25% of its stake in Goldman Sachs Group, Inc. (NYSE:GS) in the second quarter. The fund started the third quarter with a total of 30,000 shares of the company, which had a total value of $4.46 million. The stock returned 9% during the third quarter and has pushed even higher in the fourth quarter on positive sentiment for banks following Donald Trump’s upset win in the Presidential elections.

At the end of the second quarter, a total of 68 of the hedge funds tracked by Insider Monkey were long Goldman Sachs, down by 1% quarter-over-quarter. More specifically, Berkshire Hathaway was the largest shareholder of Goldman Sachs Group, Inc. (NYSE:GS), with a stake worth $1.63 billion as of the end of June. Trailing Berkshire Hathaway was Greenhaven Associates, which amassed a stake valued at $556.8 million. Eagle Capital Management, Pzena Investment Management, and Masters Capital Management also held valuable positions in the company.

Lastly, Kamunting had 164,946 shares of Endo Health Solutions, Inc (NASDAQ:ENDP) in its equity portfolio at the end of the June quarter. The value of the position was over $2.57 million on June 30 and the bet paid off, as the stock returned 29.2% during the third quarter.

At Q2’s end, 36 hedge funds in our database were bullish on Endo, a 27% slide from one quarter earlier. The largest stake in Endo Health Solutions Inc (NASDAQ:ENDP) was held by Paulson & Co, which reported holding $139.6 million worth of stock as of the end of June. It was followed by Camber Capital Management with a $78.7 million position. Other investors bullish on the company included AQR Capital Management, Point State Capital, and Point72 Asset Management.

Follow Endo Health Solutions Inc. (NASDAQ:ENDP)

Follow Endo Health Solutions Inc. (NASDAQ:ENDP)

Receive real-time insider trading and news alerts

Disclosure: None