Conestoga Capital Advisors, an asset management company, released its “Micro Cap Strategy” fourth-quarter 2023 investor letter. A copy of the same can be downloaded here. Despite growing by 12.70% net of fees in the fourth quarter, the strategy was unable to match the 15.64% return of the Russell Micro Cap Growth Index. Underperformance was mostly caused by poor stock selection in the Health Care and Industrials. Micro Cap Composite declined -1.02% net-of-fees, trailing the Russell Micro Cap Growth Index’s gain of 9.11% for 2023. Positive effects on sector allocation and stock selection in the technology and basic materials sectors did help the portfolio. The majority of the underperformance was mostly centered in the consumer discretionary, health care, and industrial sectors, where choosing stocks proved to be difficult. In addition, please check the fund’s top five holdings to know its best picks in 2023.

Conestoga Capital Advisors Micro Cap Strategy featured stocks such as IRadimed Corporation (NASDAQ:IRMD) in the fourth quarter 2023 investor letter. Headquartered in Springs, Florida, IRadimed Corporation (NASDAQ:IRMD) manufactures and distributes magnetic resonance imaging (MRI) compatible medical devices. On February 16, 2024, IRadimed Corporation (NASDAQ:IRMD) stock closed at $45.48 per share. One-month return of IRadimed Corporation (NASDAQ:IRMD) was 2.50%, and its shares gained 21.67% of their value over the last 52 weeks. IRadimed Corporation (NASDAQ:IRMD) has a market capitalization of $573.303 million.

Conestoga Capital Advisors Micro Cap Strategy stated the following regarding IRadimed Corporation (NASDAQ:IRMD) in its fourth quarter 2023 investor letter:

“IRadimed Corporation (NASDAQ:IRMD): IRMD is a commercial stage medical technology company focused on innovating MRI patient care. The company’s three main products include an MRI compatible patient monitor, an MRI compatible IV infusion pump, and a smart ferrous metal detector. The company has three revenue line items, including devices, disposables, and services. We believe a recent competitive landscape change favoring IRMD will fuel a new leg of durable growth and impressive profitability. Primary competitor Invivo, owned by Philips is pulling back from the market, and we expect IRMD to be the primary beneficiary.”

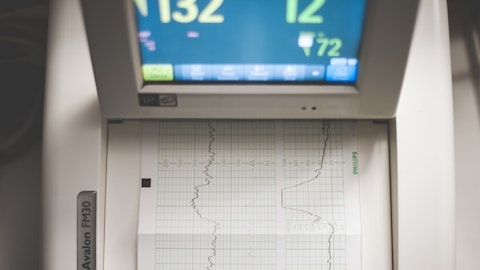

A radiographer looking through the viewfinder of a MRI machine.

IRadimed Corporation (NASDAQ:IRMD) is not on our list of 30 Most Popular Stocks Among Hedge Funds. At the end of the fourth quarter, IRadimed Corporation (NASDAQ:IRMD) was held by 13 hedge fund portfolios, up from 12 in the previous quarter, according to our database. In addition, please check out our hedge fund investor letters Q4 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 20 Most Expensive Countries to Fly to

- 15 Best Countries to Move to from US that Speak English

- 50 Best Albert Einstein quotes about Life and More

Disclosure: None. This article is originally published at Insider Monkey.