Greystone Capital Management, an investment management company, released its third-quarter 2023 investor letter. A copy of the same can be downloaded here. In the third quarter, the return for separate accounts managed by the firm was -11.4%, net of fees compared to S&P 500’s and Russell 2000’s returns of -3.2% and -5.1%, respectively. Client portfolios are invested in small companies outside of major indices, resulting in returns that differ from those indices. In addition, please check the fund’s top five holdings to know its best picks in 2023.

Greystone Capital Management highlighted stocks like Bel Fuse Inc. (NASDAQ:BELFB) in the third quarter 2023 investor letter. Headquartered in Jersey City, New Jersey, Bel Fuse Inc. (NASDAQ:BELFB) engages in the design, manufacturing, and marketing of products used to power, protect, and connect electronic circuits. On November 1, 2023, Bel Fuse Inc. (NASDAQ:BELFB) stock closed at $54.92 per share. One-month return of Bel Fuse Inc. (NASDAQ:BELFB) was 15.74%, and its shares gained 61.34% of their value over the last 52 weeks. Bel Fuse Inc. (NASDAQ:BELFB) has a market capitalization of $696.66 million.

Greystone Capital Management made the following comment about Bel Fuse Inc. (NASDAQ:BELFB) in its Q3 2023 investor letter:

“Market drawdowns provide good opportunities to buy shares in growing, cash generative, well-managed businesses at cheap prices. Our newest investment in Bel Fuse Inc. (NASDAQ:BELFB) is no exception. Bel Fuse is a 75-year-old manufacturer of electronic components that designs products fit for use in telecom, aerospace, transportation, and consumer electronics end markets. For those with a non-technical background like your portfolio manager, Bel Fuse makes a lot of little pieces that go into bigger electrical systems. These little pieces are often very necessary for Bel Fuse’s customers as they help electrical systems function or prevent them from malfunctioning. Bel Fuse operates through three segments, Power Solutions, Connectivity Solutions, and Magnetic Solutions where they provide a broad array of SKUs with a wide range of applications. The company sells its products directly through various brands as well as through distributors where they have favorable end market exposure among industrial, automotive, aerospace and network technology customers.

When thinking about electronic components, the word commoditized might come to mind. At first glance, Bel Fuse seemed to fit that description given their large SKU count, low organic growth, and margins below peers. However, a deeper look into the business and industry dynamics revealed that BELFB has positioned themselves nicely between product design, implementation, and distribution, garnering a strong reputation for quality, which has led to trust and repeat business among their customers. I haven’t discussed Bel Fuse products in depth, but Bel Fuse products need to work, often for safety reasons. Circuit protectors, cables that are needed to work in harsh environments, and fuel gauge monitors for military aircraft are all examples of products that may not cost much, but where there is a high cost of failure…” (Click here to read the full text)

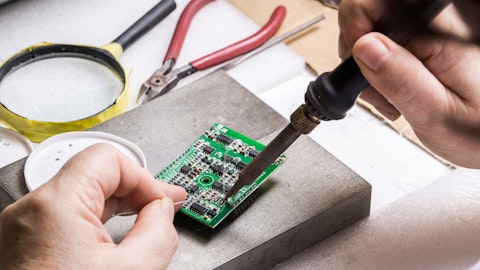

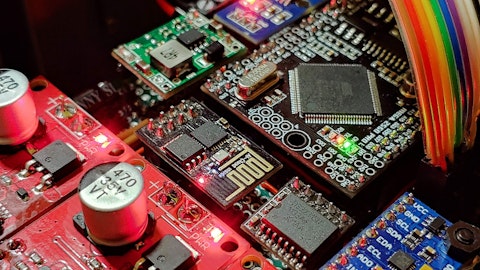

A technician looking at a circuit board of analog semiconductor products.

Bel Fuse Inc. (NASDAQ:BELFB) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 16 hedge fund portfolios held Bel Fuse Inc. (NASDAQ:BELFB) at the end of second quarter which was 17 in the previous quarter.

We discussed Bel Fuse Inc. (NASDAQ:BELFB) in another article and shared Liberty Park Capital’s views on the company. In addition, please check out our hedge fund investor letters Q3 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 15 African Countries With The Highest Investments In The Hotel Business

- 12 Best Performing Dividend Stocks in 2023

- 15 Countries with the Highest Number of Military Satellites in Orbit

Disclosure: None. This article is originally published at Insider Monkey.