Upslope Capital Management, an investment management firm, released its third-quarter 2023 investor letter. A copy of the same can be downloaded here. The fund returned -0.5% (net) in Q3 compared to -4.3% and +0.2% for the S&P Midcap 400 ETF (MDY) and HFRX Equity Hedge Index, respectively. Year-to-date, the fund’s return was -3.0% compared to +4.1% and +3.2%, respectively for the indexes. In the third quarter, the Fund’s portfolio exhibited resilience, as almost all of the losses from longs were offset by shorts. In addition, you can check the top 5 holdings of the fund to know its best picks in 2023.

Upslope Capital Management highlighted stocks like Ball Corporation (NYSE:BALL) in the third quarter 2023 investor letter. Headquartered in Westminster, Colorado, Ball Corporation (NYSE:BALL) is an aluminum packaging products supplier. On October 20, 2023, Ball Corporation (NYSE:BALL) stock closed at $44.14 per share. One-month return of Ball Corporation (NYSE:BALL) was -10.45%, and its shares lost 10.63% of their value over the last 52 weeks. Ball Corporation (NYSE:BALL) has a market capitalization of $13.907 billion.

Upslope Capital Management made the following comment about Ball Corporation (NYSE:BALL) in its Q3 2023 investor letter:

“During the quarter, the Fund (re-)added Ball Corporation (NYSE:BALL) (leading beverage can business) in addition to several “Starter” longs. Details on the refrebashed Ball thesis and a broader update on the Fund’s approach to portfolio construction are provided below.

Ball is the leading global producer of beverage cans. Upslope was long Ball (briefly) in 2022 before I concluded it was too early. No doubt, the company is still facing challenges. Some are temporary and likely to reverse in the near-term (fully leveraged balance sheet, industry over-expansion, overly aggressive carbonated soft drink (CSD) pricing) or medium-term (Budweiser exposure). Others are highly uncertain (GLP-1 weight-loss drug impact) but are being priced with certainty, assuming no actions on the part of bevcan or CSD producers (e.g. Coke, Pepsi) to offset any still-hypothetical pain.

Importantly, Ball’s recent announcement that it is selling its Aerospace unit, which has no strategic relevance to the core bevcan business, for after-tax proceeds of ~30% of the company’s market cap, provides a hard catalyst for shares to stabilize in the year ahead. In addition to de-levering the balance sheet – more important than ever, given the rate environment – the divestiture provides Ball with significant firepower to resume buybacks. The transaction should close in 1H 2024 and seems well-aligned with a bottom or rebound across many of the issues Ball has faced of late.

Risks still remain – the issues noted above are all very real, but they are all well-known and mostly temporary, in my view. To be frank, we have already been whipsawed with the latest purchase, as I assumed the market would show more immediate appreciation for the divestiture. But the combination of: low valuation for an economically defensive business with troughing fundamentals and a significant cash windfall seems like an optimal setup for even moderately patient investors.”

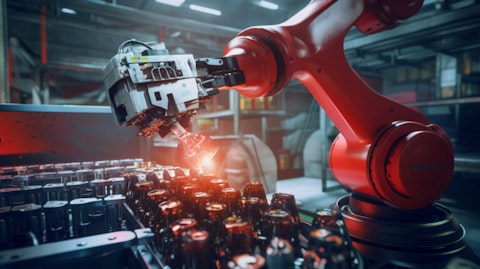

A high-speed robotic arm carefully packing aluminum cans into a cardboard carton. Editorial photo for a financial news article. 8k. –ar 16:9

Ball Corporation (NYSE:BALL) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 27 hedge fund portfolios held Ball Corporation (NYSE:BALL) at the end of second quarter which was 28 in the previous quarter.

We discussed Ball Corporation (NYSE:BALL) in another article and shared ClearBridge Sustainability Leaders Strategy’s views on the company. In addition, please check out our hedge fund investor letters Q3 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 15 Highest Quality Fast Food Chains in the US

- 20 Best Investing Podcasts for Beginners on Spotify

- 25 Biggest Philanthropists in the US in 2023

Disclosure: None. This article is originally published at Insider Monkey.