Diamond Hill Capital, an investment management company, released its “Large Cap Concentrated Fund” fourth-quarter 2024 investor letter. A copy of the letter can be downloaded here. Q4 saw an uneven increase in markets, capping off yet another strong year for the markets. Stocks broadly increased after the US election, but some gave up most or all of those gains before the end of the year. Against this backdrop, the portfolio trailed the Russell 1000 Index in Q4 and for the full year. The fund returned -2.00% (net) in Q4 vs 2.75% for the index. For the full year, the fund returned 14.24% compared to 24.51% for the index. In addition, you can check the top 5 holdings of the strategy to know its best picks in 2024.

In its fourth quarter 2024 investor letter, Diamond Hill Large Cap Concentrated Fund emphasized stocks such as Texas Instruments Incorporated (NASDAQ:TXN). Texas Instruments Incorporated (NASDAQ:TXN) is a semiconductor manufacturer. The one-month return of Texas Instruments Incorporated (NASDAQ:TXN) was -3.61%, and its shares gained 4.26% of their value over the last 52 weeks. On March 14, 2025, Texas Instruments Incorporated (NASDAQ:TXN) stock closed at $176.42 per share with a market capitalization of $160.53 billion.

Diamond Hill Large Cap Concentrated Fund stated the following regarding Texas Instruments Incorporated (NASDAQ:TXN) in its Q4 2024 investor letter:

“Other bottom Q4 contributors included Extra Space Storage, Texas Instruments Incorporated (NASDAQ:TXN) and Union Pacific. Semiconductor manufacturer Texas Instruments saw weaker demand in Q4, which pressured shares. However, we expect these demand trends to be transitory and maintain our favorable outlook on the company’s long term prospects and superior competitive position.”

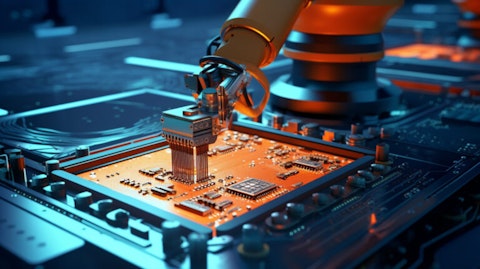

A robotic arm in the process of assembling a complex circuit board – showing the industrial scale the company operates at.

Texas Instruments Incorporated (NASDAQ:TXN) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 66 hedge fund portfolios held Texas Instruments Incorporated (NASDAQ:TXN) at the end of the fourth quarter compared to 57 in the third quarter. Texas Instruments Incorporated (NASDAQ:TXN) reported fourth quarter revenue of $4 billion, marking a 3% decline compared to the previous quarter and a 3% decrease from the same quarter last year. While we acknowledge the potential of Texas Instruments Incorporated (NASDAQ:TXN) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

In another article, we discussed Texas Instruments Incorporated (NASDAQ:TXN) and shared the list of best dividend stocks according to billionaires. In addition, please check out our hedge fund investor letters Q4 2024 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.