Immersion Investment Partners, an investment management company, released its third quarter 2023 investor letter. A copy of the same can be downloaded here. The fund fell 8.62% in the third quarter compared to the 5.12% decline for the Russell 2000 Index. In addition, you can check the top 5 holdings of the fund to know its best picks in 2023.

Immersion Investment Partners highlighted stocks like Bel Fuse Inc. (NASDAQ:BELFB) in the third quarter 2023 investor letter. Headquartered in Jersey City, New Jersey, Bel Fuse Inc. (NASDAQ:BELFB) engages in the design, manufacturing, and marketing of products used to power, protect, and connect electronic circuits. On November 24, 2023, Bel Fuse Inc. (NASDAQ:BELFB) stock closed at $55.35 per share. One-month return of Bel Fuse Inc. (NASDAQ:BELFB) was 4.10%, and its shares gained 60.53% of their value over the last 52 weeks. Bel Fuse Inc. (NASDAQ:BELFB) has a market capitalization of $704.058 million.

Immersion Investment Partners made the following comment about Bel Fuse Inc. (NASDAQ:BELFB) in its Q3 2023 investor letter:

“Bel Fuse Inc. (NASDAQ:BELFB) (BELFA/BELFB – Underdog) is the largest position in the partnership. We purchased our first shares in October 2022. The company is a designer and manufacturer of electronic components that power, protect, and connect electronic circuits. The best way to think about Bel Fuse is to frame it as a staple of industry. Like Starbucks sells coffee (a high value, affordable, everyday purchase) to “power” the consumer in their daily routine, Bel Fuse sells products that power and enable the functioning of large and expensive assets, such as trains, airplanes, data centers, medical, and telecom equipment. Like Starbucks, Bel Fuse sells low cost but high value products on a repeat basis to its customers. Additionally, many of Bel’s products are “ruggedized”, meaning they are built for harsh environments and meant to function at extreme altitudes and temperatures and can be bumped and jostled without disabling the component. The company is highly diversified amongst various products (we count 54,500 SKUs in Mouser’s catalog, an electrical component distributor), end markets, and customers but breaks down its business into three segments – Power (49% of sales and 54% of gross profit), Connectivity (31% and 31%), and Magnetics (20% and 15%). Power includes internal and external AC/DC power supplies, DC/DC converters, DC/AC inverters, and circuit protection devices. Connectivity offers high speed and harsh environment copper and optical fiber connectors primarily for use in aerospace, military, and network infrastructure applications. Magnetics sells connectors, transformers, and inductors for a wide range of end markets. Magnetics includes the MagJack connector, which is heavily featured in Cisco network switches. Unlike most public electronic components companies, Bel does not have significant business in the consumer electronics market, nor does it have exposure to the automotive market, but it does have some EV exposure. Network infrastructure and data center is the largest market for Bel, at roughly 40% of sales, followed by general industrial at 18%, and military and aerospace at 12%. Third party distributors account for one-third of Bel’s sales…” (Click here to read the full text)

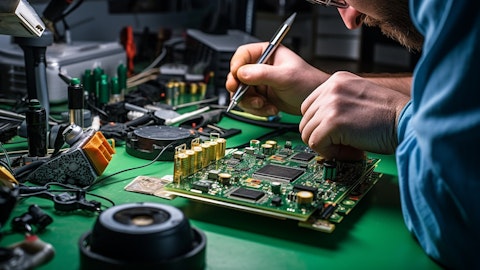

A technician looking at a circuit board of analog semiconductor products.

Bel Fuse Inc. (NASDAQ:BELFB) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 17 hedge fund portfolios held Bel Fuse Inc. (NASDAQ:BELFB) at the end of third quarter which was 16 in the previous quarter.

We discussed Bel Fuse Inc. (NASDAQ:BELFB) in another article and shared Greystone Capital Management’s views on the company. In addition, please check out our hedge fund investor letters Q3 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 11 Best Cannabis Stocks To Buy Now

- 11 Best LNG and LNG Shipping Stocks To Buy Now

- 25 Most Popular Tequila Brands in the World

Disclosure: None. This article is originally published at Insider Monkey.