The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge funds have been producing disappointing net returns in recent years, however that was partly due to the poor performance of small-cap stocks in general. Well, small-cap stocks finally turned the corner and have been beating the large-cap stocks by more than 10 percentage points over the last 5 months.This means the relevancy of hedge funds’ public filings became inarguable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards China Biologic Products Inc (NASDAQ:CBPO).

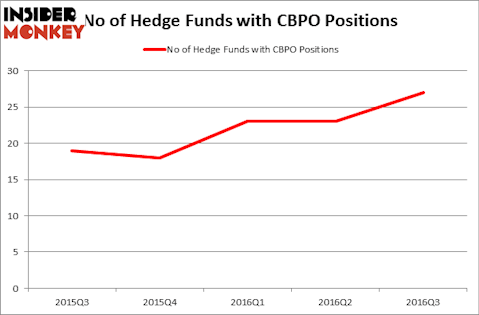

Is China Biologic Products Inc (NASDAQ:CBPO) a good investment today? Money managers are betting on the stock. The number of long hedge fund bets moved up by 4 lately. CBPO was in 27 hedge funds’ portfolios at the end of the third quarter of 2016. There were 23 hedge funds in our database with CBPO holdings at the end of the previous quarter. At the end of this article we will also compare CBPO to other stocks including Molina Healthcare, Inc. (NYSE:MOH), PNM Resources, Inc. (NYSE:PNM), and Physicians Realty Trust (NYSE:DOC) to get a better sense of its popularity.

Follow China Biologic Products Inc. (NASDAQ:CBPO)

Follow China Biologic Products Inc. (NASDAQ:CBPO)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

RAJ CREATIONZS / shutterstock.com

How are hedge funds trading China Biologic Products Inc (NASDAQ:CBPO)?

At Q3’s end, a total of 27 of the hedge funds tracked by Insider Monkey were long this stock, a 17% jump from the previous quarter, as hedge fund ownership of the stock soars to new heights. With the smart money’s capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Renaissance Technologies, managed by Jim Simons, holds the number one position in China Biologic Products Inc (NASDAQ:CBPO). Renaissance Technologies has a $32.6 million position in the stock. On Renaissance Technologies’ heels is Indus Capital, led by David Kowitz and Sheldon Kasowitz, holding a $30.5 million position; the fund has 2.9% of its 13F portfolio invested in the stock. Some other professional money managers with similar optimism comprise Yi Xin’s Ariose Capital, Richard Driehaus’ Driehaus Capital, and Bihua Chen’s Cormorant Asset Management.