It’s no secret that hedge funds have been underperforming the market for years in aggregate, as many in the media are only all too happy to pound home. That could lead the average reader to think that hedge funds are bad stock pickers, which is not actually the case. When we look at the third-quarter returns of the hedge funds in our database which had at least 5 long positions in companies valued at $1 billion or more, we see their long picks returned 8.3% on average, a full 5.0 percentage points clear of S&P 500 ETFs. However, that long stock-picking prowess is often overshadowed by the hedged portion of their portfolios, in options, bonds, and short positions. We believe that investors should pay attention to hedge funds’ top picks for a chance to beat the market, and will share four such picks today, courtesy of the 13F portfolio of Philip Uhde‘s Echinus Advisors.

Echinus Advisors’ equity portfolio was valued at $276.70 million on June 30 and consisted of 10 long positions in companies with a market cap of at least $1 billion. Based on the size of those holdings on June 30, those 10 positions delivered weighted average returns of 12.5% during the third quarter, pushing its year-to-date performance using the same metric to 3.2% gains after about 4% losses in each of the first two quarters. It should be noted that our calculations may be different from the fund’s actual returns, as they do not factor in changes to positions during the quarter, or positions that don’t get reported on Form 13Fs, like short positions.

In this article, we’ll take a look at four of the favorite stock picks of Echinus Advisors and see how they performed during the third quarter.

First up is Tempur-Pedic International Inc. (NYSE:TPX), the fund’s top pick at the end of June. Echinus Advisors owned 962,412 shares of the stock at that time, worth $53.24 million. The stock returned 2.6% during the third quarter, an extremely volatile one for the stock during which it touched 50% gains for the quarter at one point before giving most of them back late in September.

Hedge fund ownership of Tempur-Pedic has also been quite volatile of late, as you can see in the above chart. Heading into the third quarter of 2016, a total of 37 of the hedge funds tracked by Insider Monkey were long the stock, up from 33 a quarter earlier. Rehan Jaffer’s H Partners Management has the largest position in Tempur-Pedic International Inc. (NYSE:TPX), worth close to $387.2 million, corresponding to 30.4% of its total 13F portfolio. The second most bullish fund manager is John Shapiro of Chieftain Capital, with a $205.5 million position. Other peers with similar optimism consist of Rob Citrone’s Discovery Capital Management and Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital.

Follow Somnigroup International Inc. (NYSE:SGI)

Follow Somnigroup International Inc. (NYSE:SGI)

Receive real-time insider trading and news alerts

IBKR FINANCE 1,139,765 $ 40,348,000 14.58% 14.76% 3 No Change 0%

Let’s move on to Interactive Brokers Group, Inc. (NASDAQ:IBKR), Echinus Advisors’ third-most valuable holding on June 30. The fund’s position in the stock was unchanged during the second quarter, holding steady at 1.14 million shares which were valued at $40.35 million at the end of June. The fund’s strong returns for the quarter were achieved despite IBKR, which accounted for nearly 15% of the value of the fund’s portfolio, being 0.1% in the red for the quarter.

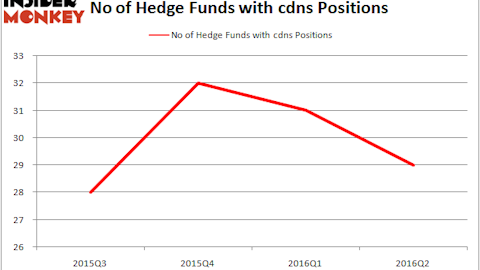

Is Interactive Brokers Group, Inc. (NASDAQ:IBKR) a safe stock to buy now? Prominent investors are becoming more bullish. The number of long hedge fund positions inched up by four in the second quarter, settling at 30 as of the 30th of June. When looking at the institutional investors followed by Insider Monkey, Quincy Lee’s Ancient Art (Teton Capital) has the number one position in Interactive Brokers Group, Inc. (NASDAQ:IBKR), worth close to $117.5 million, comprising 20.9% of its total 13F portfolio. The second most bullish fund manager is Scopia Capital, managed by Matt Sirovich and Jeremy Mindich, which holds a $99.3 million position. Some other professional money managers that are bullish contain Brian Bares’ Bares Capital Management, Ted Kang’s Kylin Management, and Allan Mecham and Ben Raybould’s Arlington Value Capital.

Follow Interactive Brokers Group Inc. (NASDAQ:IBKR)

Follow Interactive Brokers Group Inc. (NASDAQ:IBKR)

Receive real-time insider trading and news alerts

We’ll check out two more of the fund’s stock picks on the next page.