The fourth quarter was a rough one for most investors, as fears of a rising interest rate environment in the U.S, a trade war with China, and a more or less stagnant Europe, weighed heavily on the minds of investors. Both the S&P 500 and Russell 2000 sank as a result, with the Russell 2000, which is composed of smaller companies, being hit especially hard. This was primarily due to hedge funds, which are big supporters of small-cap stocks, pulling some of their capital out of the volatile markets during this time. Let’s look at how this market volatility affected the sentiment of hedge funds towards Toronto-Dominion Bank (NYSE:TD), and what that likely means for the prospects of the company and its stock.

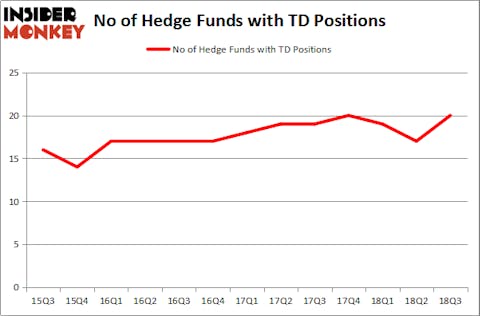

Is Toronto-Dominion Bank (NYSE:TD) a good investment now? Investors who are in the know are getting more optimistic. The number of bullish hedge fund bets went up by 3 in recent months. Our calculations also showed that TD isn’t among the 30 most popular stocks among hedge funds. TD was in 20 hedge funds’ portfolios at the end of the third quarter of 2018. There were 17 hedge funds in our database with TD holdings at the end of the previous quarter.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s check out the latest hedge fund action regarding Toronto-Dominion Bank (NYSE:TD).

What does the smart money think about Toronto-Dominion Bank (NYSE:TD)?

Heading into the fourth quarter of 2018, a total of 20 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 18% from the previous quarter. The graph below displays the number of hedge funds with bullish position in TD over the last 13 quarters. With the smart money’s capital changing hands, there exists a few notable hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

More specifically, Arrowstreet Capital was the largest shareholder of Toronto-Dominion Bank (NYSE:TD), with a stake worth $551.8 million reported as of the end of September. Trailing Arrowstreet Capital was Renaissance Technologies, which amassed a stake valued at $263.3 million. AQR Capital Management, GLG Partners, and Viking Global were also very fond of the stock, giving the stock large weights in their portfolios.

Now, key money managers were leading the bulls’ herd. Millennium Management, managed by Israel Englander, assembled the most outsized position in Toronto-Dominion Bank (NYSE:TD). Millennium Management had $2.1 million invested in the company at the end of the quarter. Matthew Tewksbury’s Stevens Capital Management also made a $1.3 million investment in the stock during the quarter. The other funds with new positions in the stock are Jeffrey Talpins’s Element Capital Management and Frederick DiSanto’s Ancora Advisors.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Toronto-Dominion Bank (NYSE:TD) but similarly valued. These stocks are Accenture Plc (NYSE:ACN), British American Tobacco plc (NYSEAMEX:BTI), QUALCOMM, Incorporated (NASDAQ:QCOM), and Texas Instruments Incorporated (NASDAQ:TXN). This group of stocks’ market valuations are similar to TD’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ACN | 34 | 1002113 | 11 |

| BTI | 15 | 157231 | 2 |

| QCOM | 48 | 3172091 | 7 |

| TXN | 48 | 2380065 | 10 |

| Average | 36.25 | 1677875 | 7.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 36.25 hedge funds with bullish positions and the average amount invested in these stocks was $1.68 billion. That figure was $1.42 billion in TD’s case. QUALCOMM, Incorporated (NASDAQ:QCOM) is the most popular stock in this table. On the other hand British American Tobacco plc (NYSEAMEX:BTI) is the least popular one with only 15 bullish hedge fund positions. Toronto-Dominion Bank (NYSE:TD) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard QCOM might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.