A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended September 30, so let’s proceed with the discussion of the hedge fund sentiment on Standex Int’l Corp. (NYSE:SXI).

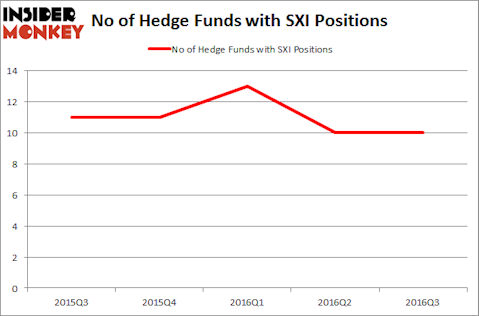

Standex Int’l Corp. (NYSE:SXI) shares didn’t see a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 10 hedge funds’ portfolios at the end of the third quarter of 2016. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Benefitfocus Inc (NASDAQ:BNFT), Medpace Holdings Inc (NASDAQ:MEDP), and Nextera Energy Partners LP (NYSE:NEP) to gather more data points.

Follow Standex International Corp (NYSE:SXI)

Follow Standex International Corp (NYSE:SXI)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

bluebay/Shutterstock.com

What does the smart money think about Standex Int’l Corp. (NYSE:SXI)?

At Q3’s end, a total of 10 of the hedge funds tracked by Insider Monkey were bullish on this stock, unchanged from one quarter earlier. On the other hand, there were a total of 11 hedge funds with a bullish position in SXI at the beginning of this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, AQR Capital Management, led by Cliff Asness, holds the number one position in Standex Int’l Corp. (NYSE:SXI). AQR Capital Management has a $7.1 million position in the stock. The second largest stake is held by GAMCO Investors, led by Mario Gabelli, which holds a $6.6 million position. Some other hedge funds and institutional investors that are bullish include Chuck Royce’s Royce & Associates, Renaissance Technologies, one of the largest hedge funds in the world and John Overdeck and David Siegel’s Two Sigma Advisors. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.