Most investors tend to think that hedge funds and other asset managers are worthless, as they cannot beat even simple index fund portfolios. In fact, most people expect hedge funds to compete with and outperform the bull market that we have witnessed over the past few years. However, hedge funds are generally partially hedged and aim at delivering attractive risk-adjusted returns rather than following the ups and downs of equity markets hoping that they will outperform the broader market. Our research shows that hedge funds do have great stock picking skills, so let’s take a glance at the smart money sentiment towards Stamps.com Inc. (NASDAQ:STMP).

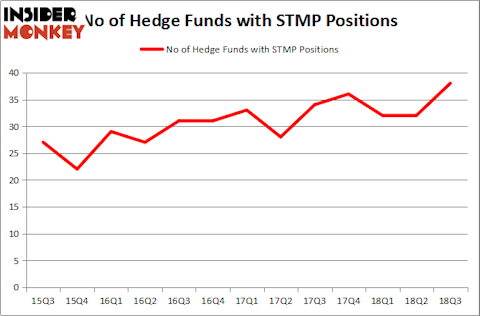

Stamps.com Inc. (NASDAQ:STMP) investors should pay attention to an increase in activity from the world’s largest hedge funds of late. STMP was in 38 hedge funds’ portfolios at the end of the third quarter of 2018. There were 32 hedge funds in our database with STMP holdings at the end of the previous quarter. Our calculations also showed that STMP isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a gander at the recent hedge fund action regarding Stamps.com Inc. (NASDAQ:STMP).

How are hedge funds trading Stamps.com Inc. (NASDAQ:STMP)?

At Q3’s end, a total of 38 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 19% from the previous quarter. The graph below displays the number of hedge funds with bullish position in STMP over the last 13 quarters. With hedge funds’ capital changing hands, there exists a few key hedge fund managers who were adding to their stakes significantly (or already accumulated large positions).

Among these funds, PAR Capital Management held the most valuable stake in Stamps.com Inc. (NASDAQ:STMP), which was worth $104.5 million at the end of the third quarter. On the second spot was Renaissance Technologies which amassed $87 million worth of shares. Moreover, SQN Investors, Light Street Capital, and P2 Capital Partners were also bullish on Stamps.com Inc. (NASDAQ:STMP), allocating a large percentage of their portfolios to this stock.

As one would reasonably expect, key hedge funds were leading the bulls’ herd. Maverick Capital, managed by Lee Ainslie, created the most valuable position in Stamps.com Inc. (NASDAQ:STMP). Maverick Capital had $8 million invested in the company at the end of the quarter. Joseph A. Jolson’s Harvest Capital Strategies also initiated a $6.3 million position during the quarter. The following funds were also among the new STMP investors: Steve Cohen’s Point72 Asset Management, Matthew Tewksbury’s Stevens Capital Management, and Dmitry Balyasny’s Balyasny Asset Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Stamps.com Inc. (NASDAQ:STMP) but similarly valued. These stocks are Chesapeake Energy Corporation (NYSE:CHK), Entegris Inc (NASDAQ:ENTG), Intelsat S.A. (NYSE:I), and Lancaster Colony Corporation (NASDAQ:LANC). This group of stocks’ market caps are closest to STMP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CHK | 22 | 213997 | 3 |

| ENTG | 25 | 478841 | 0 |

| I | 37 | 1128740 | 14 |

| LANC | 16 | 230249 | 4 |

| Average | 25 | 512957 | 5.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25 hedge funds with bullish positions and the average amount invested in these stocks was $513 million. That figure was $601 million in STMP’s case. Intelsat S.A. (NYSE:I) is the most popular stock in this table. On the other hand Lancaster Colony Corporation (NASDAQ:LANC) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks Stamps.com Inc. (NASDAQ:STMP) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.