At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Third Point because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

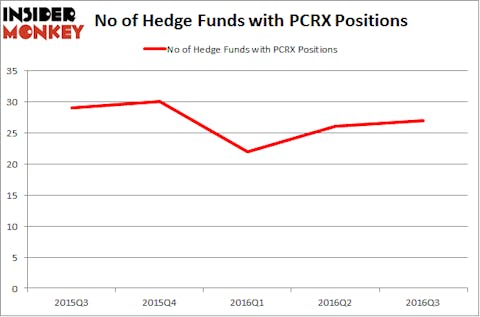

Pacira Pharmaceuticals Inc (NASDAQ:PCRX) was in 27 hedge funds’ portfolios at the end of September. PCRX has seen an increase in support from the world’s most successful money managers lately. There were 26 hedge funds in our database with PCRX positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Third Point Reinsurance Ltd (NYSE:TPRE), SunPower Corporation (NASDAQ:SPWR), and Terreno Realty Corporation (NYSE:TRNO) to gather more data points.

Follow Pacira Biosciences Inc. (NASDAQ:PCRX)

Follow Pacira Biosciences Inc. (NASDAQ:PCRX)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

racorn/Shutterstock.com

How are hedge funds trading Pacira Pharmaceuticals Inc (NASDAQ:PCRX)?

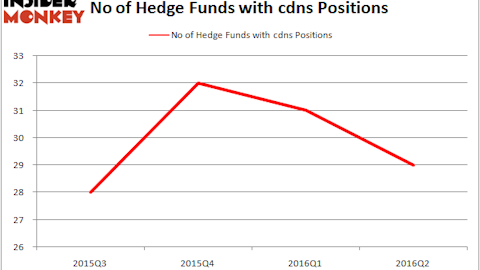

At Q3’s end, a total of 27 of the hedge funds tracked by Insider Monkey held long positions in this stock, a gain of 4% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards PCRX over the last 5 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Citadel Investment Group, led by Ken Griffin, holds the biggest position in Pacira Pharmaceuticals Inc (NASDAQ:PCRX). Citadel Investment Group has a $44.8 million position in the stock. The second most bullish fund manager is Daruma Asset Management, led by Mariko Gordon, holding a $41.8 million position; the fund has 2.5% of its 13F portfolio invested in the stock. Other peers that are bullish consist of David S. Winter and David J. Millstone’s 40 North Management, Arthur B Cohen and Joseph Healey’s Healthcor Management LP and Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Consequently, key money managers were breaking ground themselves. Armistice Capital, led by Steven Boyd, initiated the most valuable position in Pacira Pharmaceuticals Inc (NASDAQ:PCRX). Armistice Capital had $9.2 million invested in the company at the end of the quarter. Solomon Kumin’s Folger Hill Asset Management also made a $8.6 million investment in the stock during the quarter. The other funds with brand new PCRX positions are Kevin Kotler’s Broadfin Capital, Stuart Weisbrod’s Iguana Healthcare Management, and Glenn Russell Dubin’s Highbridge Capital Management.

Let’s now review hedge fund activity in other stocks similar to Pacira Pharmaceuticals Inc (NASDAQ:PCRX). These stocks are Third Point Reinsurance Ltd (NYSE:TPRE), SunPower Corporation (NASDAQ:SPWR), Terreno Realty Corporation (NYSE:TRNO), and AVG Technologies NV (NYSE:AVG). This group of stocks’ market caps resemble PCRX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TPRE | 10 | 24163 | -3 |

| SPWR | 18 | 52526 | -1 |

| TRNO | 9 | 21755 | 0 |

| AVG | 14 | 64320 | -4 |

As you can see these stocks had an average of 13 hedge funds with bullish positions and the average amount invested in these stocks was $41 million. That figure was $266 million in PCRX’s case. SunPower Corporation (NASDAQ:SPWR) is the most popular stock in this table. On the other hand Terreno Realty Corporation (NYSE:TRNO) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks Pacira Pharmaceuticals Inc (NASDAQ:PCRX) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None