Hedge funds and other investment firms run by legendary investors like Israel Englander and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

Hedge fund interest in Oxford Industries, Inc. (NYSE:OXM) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as BJ’s Restaurants, Inc. (NASDAQ:BJRI), Editas Medicine, Inc. (NASDAQ:EDIT), and First Busey Corporation (NASDAQ:BUSE) to gather more data points.

In the eyes of most investors, hedge funds are assumed to be underperforming, old financial vehicles of the past. While there are more than 8,000 funds trading today, We choose to focus on the top tier of this club, around 700 funds. Most estimates calculate that this group of people direct the majority of the smart money’s total asset base, and by keeping an eye on their best picks, Insider Monkey has determined a number of investment strategies that have historically beaten Mr. Market. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by 6 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s view the recent hedge fund action surrounding Oxford Industries, Inc. (NYSE:OXM).

Hedge fund activity in Oxford Industries, Inc. (NYSE:OXM)

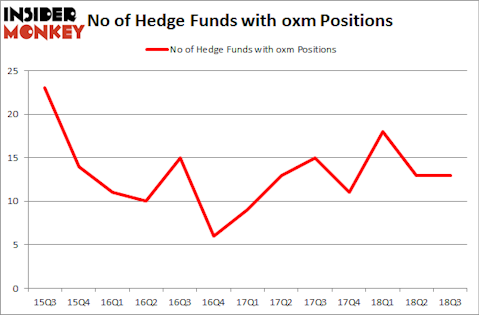

At Q3’s end, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, no change from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in OXM over the last 13 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Cardinal Capital, managed by Amy Minella, holds the number one position in Oxford Industries, Inc. (NYSE:OXM). Cardinal Capital has a $48 million position in the stock, comprising 1.5% of its 13F portfolio. Coming in second is Renaissance Technologies, managed by Jim Simons, which holds a $8.8 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Some other professional money managers that hold long positions include Ken Griffin’s Citadel Investment Group, Michael Platt and William Reeves’s BlueCrest Capital Mgmt. and Cliff Asness’s AQR Capital Management.

Due to the fact that Oxford Industries, Inc. (NYSE:OXM) has experienced a decline in interest from the aggregate hedge fund industry, it’s safe to say that there was a specific group of money managers who were dropping their entire stakes last quarter. Intriguingly, Israel Englander’s Millennium Management dumped the biggest stake of the 700 funds followed by Insider Monkey, worth about $3.5 million in stock, and Noam Gottesman’s GLG Partners was right behind this move, as the fund cut about $0.6 million worth. These moves are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Oxford Industries, Inc. (NYSE:OXM) but similarly valued. We will take a look at BJ’s Restaurants, Inc. (NASDAQ:BJRI), Editas Medicine, Inc. (NASDAQ:EDIT), First Busey Corporation (NASDAQ:BUSE), and Mirati Therapeutics, Inc. (NASDAQ:MRTX). This group of stocks’ market caps are similar to OXM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BJRI | 20 | 195394 | 4 |

| EDIT | 17 | 148184 | 0 |

| BUSE | 14 | 52759 | 1 |

| MRTX | 24 | 661199 | 5 |

| Average | 18.75 | 264384 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.75 hedge funds with bullish positions and the average amount invested in these stocks was $264 million. That figure was $71 million in OXM’s case. Mirati Therapeutics, Inc. (NASDAQ:MRTX) is the most popular stock in this table. On the other hand First Busey Corporation (NASDAQ:BUSE) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Oxford Industries, Inc. (NYSE:OXM) is even less popular than BUSE. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.