During the first half of the fourth quarter the Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by about 4 percentage points as investors worried over the possible ramifications of rising interest rates. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only 298 S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of Neurocrine Biosciences, Inc. (NASDAQ:NBIX) and see how the stock is affected by the recent hedge fund activity.

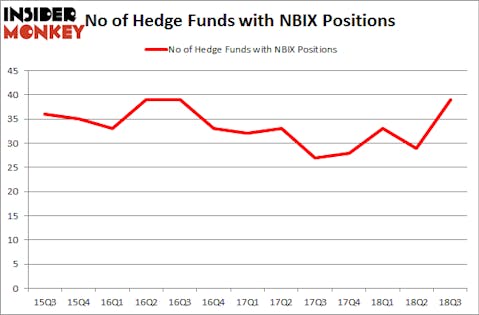

Neurocrine Biosciences, Inc. (NASDAQ:NBIX) has seen an increase in hedge fund sentiment in recent months. Our calculations also showed that NBIX isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are plenty of metrics investors can use to size up stocks. A duo of the less known metrics are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the best picks of the best hedge fund managers can outpace their index-focused peers by a superb margin (see the details here).

Let’s go over the new hedge fund action encompassing Neurocrine Biosciences, Inc. (NASDAQ:NBIX).

What does the smart money think about Neurocrine Biosciences, Inc. (NASDAQ:NBIX)?

Heading into the fourth quarter of 2018, a total of 39 of the hedge funds tracked by Insider Monkey were long this stock, a change of 34% from the second quarter of 2018. On the other hand, there were a total of 28 hedge funds with a bullish position in NBIX at the beginning of this year. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Perceptive Advisors, managed by Joseph Edelman, holds the biggest position in Neurocrine Biosciences, Inc. (NASDAQ:NBIX). Perceptive Advisors has a $587.4 million position in the stock, comprising 15.7% of its 13F portfolio. The second largest stake is held by Baker Bros. Advisors, managed by Julian Baker and Felix Baker, which holds a $116.1 million position; 0.8% of its 13F portfolio is allocated to the company. Some other professional money managers that are bullish include Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management, John Overdeck and David Siegel’s Two Sigma Advisors and Ken Griffin’s Citadel Investment Group.

As industrywide interest jumped, some big names have jumped into Neurocrine Biosciences, Inc. (NASDAQ:NBIX) headfirst. Polar Capital, managed by Brian Ashford-Russell and Tim Woolley, assembled the biggest position in Neurocrine Biosciences, Inc. (NASDAQ:NBIX). Polar Capital had $32.6 million invested in the company at the end of the quarter. Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners also initiated a $10.1 million position during the quarter. The other funds with new positions in the stock are Paul Marshall and Ian Wace’s Marshall Wace LLP, Louis Navellier’s Navellier & Associates, and Paul Tudor Jones’s Tudor Investment Corp.

Let’s now take a look at hedge fund activity in other stocks similar to Neurocrine Biosciences, Inc. (NASDAQ:NBIX). These stocks are The Gap Inc. (NYSE:GPS), Huntington Ingalls Industries Inc (NYSE:HII), PVH Corp (NYSE:PVH), and Tractor Supply Company (NASDAQ:TSCO). All of these stocks’ market caps match NBIX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GPS | 29 | 201712 | 1 |

| HII | 26 | 746339 | -1 |

| PVH | 44 | 1292262 | 8 |

| TSCO | 34 | 968657 | 2 |

| Average | 33.25 | 802243 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 33.25 hedge funds with bullish positions and the average amount invested in these stocks was $802 million. That figure was $1.29 billion in NBIX’s case. PVH Corp (NYSE:PVH) is the most popular stock in this table. On the other hand Huntington Ingalls Industries Inc (NYSE:HII) is the least popular one with only 26 bullish hedge fund positions. Neurocrine Biosciences, Inc. (NASDAQ:NBIX) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard PVH might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.