Amid an overall market correction, many stocks that smart money investors were collectively bullish on tanked during the fourth quarter. Among them, Amazon and Netflix ranked among the top 30 picks and both lost around 20%. Facebook, which was the second most popular stock, lost 14% amid uncertainty regarding the interest rates and tech valuations. Nevertheless, our research shows that most of the stocks that smart money likes historically generate strong risk-adjusted returns. This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

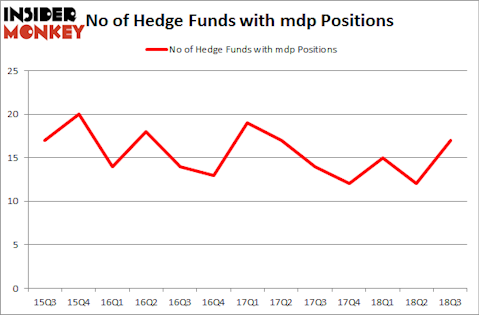

Meredith Corporation (NYSE:MDP) has experienced an increase in enthusiasm from smart money lately. MDP was in 17 hedge funds’ portfolios at the end of the third quarter of 2018. There were 12 hedge funds in our database with MDP positions at the end of the previous quarter. Our calculations also showed that mdp isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s analyze the fresh hedge fund action regarding Meredith Corporation (NYSE:MDP).

How have hedgies been trading Meredith Corporation (NYSE:MDP)?

At Q3’s end, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 42% from the previous quarter. On the other hand, there were a total of 12 hedge funds with a bullish position in MDP at the beginning of this year. With the smart money’s sentiment swirling, there exists a few key hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Chuck Royce’s Royce & Associates has the largest position in Meredith Corporation (NYSE:MDP), worth close to $115 million, comprising 0.8% of its total 13F portfolio. The second largest stake is held by Ariel Investments, managed by John W. Rogers, which holds a $71.7 million position; the fund has 0.8% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that are bullish include Robert Joseph Caruso’s Select Equity Group, Parag Vora’s HG Vora Capital Management and Michael Price’s MFP Investors.

Consequently, some big names were breaking ground themselves. BlueCrest Capital Mgmt., managed by Michael Platt and William Reeves, initiated the biggest position in Meredith Corporation (NYSE:MDP). BlueCrest Capital Mgmt. had $0.3 million invested in the company at the end of the quarter. Matthew Hulsizer’s PEAK6 Capital Management also made a $0.3 million investment in the stock during the quarter. The other funds with new positions in the stock are Noam Gottesman’s GLG Partners, Israel Englander’s Millennium Management, and Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Meredith Corporation (NYSE:MDP) but similarly valued. We will take a look at BEST Inc. (NYSE:BSTI), Callaway Golf Company (NYSE:ELY), Cavco Industries, Inc. (NASDAQ:CVCO), and Glaukos Corporation (NYSE:GKOS). This group of stocks’ market valuations resemble MDP’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BSTI | 12 | 53685 | 2 |

| ELY | 27 | 218969 | 1 |

| CVCO | 19 | 207373 | -1 |

| GKOS | 14 | 155052 | 5 |

| Average | 18 | 158770 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18 hedge funds with bullish positions and the average amount invested in these stocks was $159 million. That figure was $311 million in MDP’s case. Callaway Golf Company (NYSE:ELY) is the most popular stock in this table. On the other hand BEST Inc. (NYSE:BSTI) is the least popular one with only 12 bullish hedge fund positions. Meredith Corporation (NYSE:MDP) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ELY might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.