Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients’ money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth depends on it. Regardless of the various methods used by elite investors like David Tepper and Dan Loeb, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space.

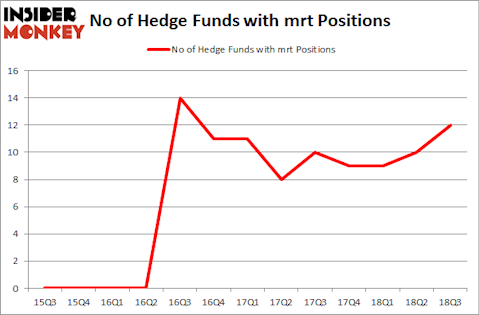

MedEquities Realty Trust, Inc. (NYSE:MRT) has seen an increase in hedge fund sentiment in recent months. MRT was in 12 hedge funds’ portfolios at the end of September. There were 10 hedge funds in our database with MRT holdings at the end of the previous quarter. Our calculations also showed that mrt isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to take a glance at the recent hedge fund action surrounding MedEquities Realty Trust, Inc. (NYSE:MRT).

What does the smart money think about MedEquities Realty Trust, Inc. (NYSE:MRT)?

At the end of the third quarter, a total of 12 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 20% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards MRT over the last 13 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital has the most valuable position in MedEquities Realty Trust, Inc. (NYSE:MRT), worth close to $21.3 million, accounting for 0.4% of its total 13F portfolio. Sitting at the No. 2 spot is Jim Simons of Renaissance Technologies, with a $9.9 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Remaining peers that are bullish include Alexander Medina Seaver’s Stadium Capital Management, Noam Gottesman’s GLG Partners and Dmitry Balyasny’s Balyasny Asset Management.

As one would reasonably expect, specific money managers were breaking ground themselves. Zebra Capital Management, managed by Roger Ibbotson, established the most valuable position in MedEquities Realty Trust, Inc. (NYSE:MRT). Zebra Capital Management had $0.1 million invested in the company at the end of the quarter. Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital also initiated a $0.1 million position during the quarter.

Let’s also examine hedge fund activity in other stocks similar to MedEquities Realty Trust, Inc. (NYSE:MRT). These stocks are Panhandle Oil and Gas Inc. (NYSE:PHX), Capital Southwest Corporation (NASDAQ:CSWC), VelocityShares 3x Long Silver ETN (NASDAQ:USLV), and First Internet Bancorp (NASDAQ:INBK). All of these stocks’ market caps match MRT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PHX | 5 | 47051 | -1 |

| CSWC | 7 | 46473 | 0 |

| USLV | 2 | 1600 | 0 |

| INBK | 5 | 3738 | 0 |

| Average | 4.75 | 24716 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 4.75 hedge funds with bullish positions and the average amount invested in these stocks was $25 million. That figure was $42 million in MRT’s case. Capital Southwest Corporation (NASDAQ:CSWC) is the most popular stock in this table. On the other hand VelocityShares 3x Long Silver ETN (NASDAQ:USLV) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks MedEquities Realty Trust, Inc. (NYSE:MRT) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.