Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips on the charts, usually don’t make them change their opinion towards a company. The second half of 2015 and the first few months of this year was a stressful period for hedge funds. However, things have been taking a turn for the better in the second half of this year. Small-cap stocks which hedge funds are usually overweight outperformed the market by double digits and it may be a good time to pay attention to hedge funds’ picks before it is too late. In this article we are going to analyze the hedge fund sentiment towards Leucadia National Corp. (NYSE:LUK) to find out whether it was one of their high conviction long-term ideas.

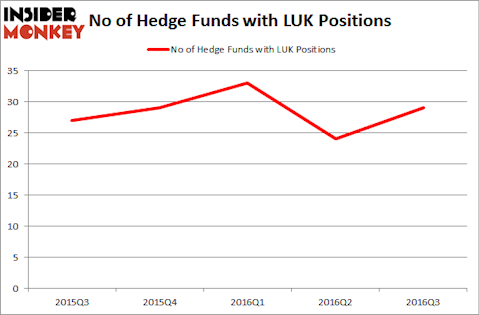

Leucadia National Corp. (NYSE:LUK) was included in the portfolios of 29 funds from our database at the end of September. LUK has seen an increase in support from the world’s elite money managers, as there had been 24 funds with LUK holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as IDEX Corporation (NYSE:IEX), Taro Pharmaceutical Industries Ltd. (NYSE:TARO), and Lennox International Inc. (NYSE:LII) to gather more data points.

Follow Jefferies Financial Group Inc. (NYSE:JEF)

Follow Jefferies Financial Group Inc. (NYSE:JEF)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Onypix/Shutterstock.com

With all of this in mind, let’s analyze the latest action regarding Leucadia National Corp. (NYSE:LUK).

How are hedge funds trading Leucadia National Corp. (NYSE:LUK)?

At the end of the third quarter, 29 funds tracked by Insider Monkey were long Leucadia National, an increase of 21% from one quarter earlier. With hedge funds’ sentiment swirling, there exists a select group of noteworthy hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Robert Rodriguez and Steven Romick’s First Pacific Advisors LLC has the biggest position in Leucadia National Corp. (NYSE:LUK), worth close to $427 million, comprising 3.5% of its total 13F portfolio. Sitting at the No. 2 spot is William Crowley, William Harker, and Stephen Blass of Ashe Capital, with a $123.4 million position; the fund has 13% of its 13F portfolio invested in the stock. Remaining peers that hold long positions encompass Allan Mecham and Ben Raybould’s Arlington Value Capital, Murray Stahl’s Horizon Asset Management and Steve Leonard’s Pacifica Capital Investments.