Many investors, including Paul Tudor Jones or Stan Druckenmiller, have been saying before last year’s Q4 market crash that the stock market is overvalued due to a low interest rate environment that leads to companies swapping their equity for debt and focusing mostly on short-term performance such as beating the quarterly earnings estimates. In the first half of 2019, most investors recovered all of their Q4 losses as sentiment shifted and optimism dominated the US China trade negotiations. Nevertheless, many of the stocks that delivered strong returns in the first half still sport strong fundamentals and their gains were more related to the general market sentiment rather than their individual performance and hedge funds kept their bullish stance. In this article we will find out how hedge fund sentiment to GATX Corporation (NYSE:GATX) changed recently.

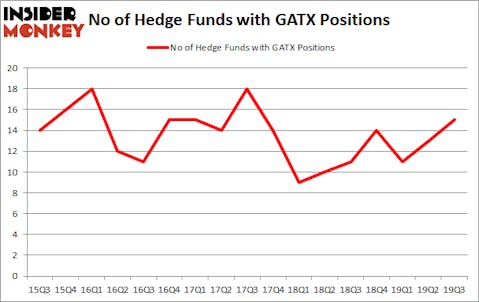

GATX Corporation (NYSE:GATX) was in 15 hedge funds’ portfolios at the end of September. GATX has seen an increase in support from the world’s most elite money managers lately. There were 13 hedge funds in our database with GATX positions at the end of the previous quarter. Our calculations also showed that GATX isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most investors, hedge funds are seen as underperforming, outdated investment tools of yesteryear. While there are more than 8000 funds trading today, Our experts look at the bigwigs of this club, about 750 funds. These hedge fund managers handle most of all hedge funds’ total asset base, and by paying attention to their matchless investments, Insider Monkey has discovered various investment strategies that have historically outrun Mr. Market. Insider Monkey’s flagship short hedge fund strategy beat the S&P 500 short ETFs by around 20 percentage points a year since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. We’re going to take a peek at the latest hedge fund action encompassing GATX Corporation (NYSE:GATX).

Hedge fund activity in GATX Corporation (NYSE:GATX)

At the end of the third quarter, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a change of 15% from one quarter earlier. On the other hand, there were a total of 11 hedge funds with a bullish position in GATX a year ago. With the smart money’s sentiment swirling, there exists a few noteworthy hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

Among these funds, GAMCO Investors held the most valuable stake in GATX Corporation (NYSE:GATX), which was worth $160.3 million at the end of the third quarter. On the second spot was AQR Capital Management which amassed $14.8 million worth of shares. D E Shaw, Citadel Investment Group, and Marshall Wace were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position GAMCO Investors allocated the biggest weight to GATX Corporation (NYSE:GATX), around 1.34% of its 13F portfolio. Skylands Capital is also relatively very bullish on the stock, setting aside 0.3 percent of its 13F equity portfolio to GATX.

As industrywide interest jumped, key hedge funds were leading the bulls’ herd. Stevens Capital Management, managed by Matthew Tewksbury, initiated the largest position in GATX Corporation (NYSE:GATX). Stevens Capital Management had $0.4 million invested in the company at the end of the quarter. Michael Gelband’s ExodusPoint Capital also initiated a $0.3 million position during the quarter. The only other fund with a new position in the stock is Paul Tudor Jones’s Tudor Investment Corp.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as GATX Corporation (NYSE:GATX) but similarly valued. These stocks are Cathay General Bancorp (NASDAQ:CATY), Inphi Corporation (NYSE:IPHI), Potlatch Corporation (NASDAQ:PCH), and Ryder System, Inc. (NYSE:R). This group of stocks’ market caps match GATX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CATY | 17 | 43998 | 5 |

| IPHI | 30 | 388332 | 4 |

| PCH | 19 | 327723 | 7 |

| R | 21 | 356404 | 0 |

| Average | 21.75 | 279114 | 4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.75 hedge funds with bullish positions and the average amount invested in these stocks was $279 million. That figure was $214 million in GATX’s case. Inphi Corporation (NYSE:IPHI) is the most popular stock in this table. On the other hand Cathay General Bancorp (NASDAQ:CATY) is the least popular one with only 17 bullish hedge fund positions. Compared to these stocks GATX Corporation (NYSE:GATX) is even less popular than CATY. Hedge funds dodged a bullet by taking a bearish stance towards GATX. Our calculations showed that the top 20 most popular hedge fund stocks returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately GATX wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); GATX investors were disappointed as the stock returned 4.3% during the fourth quarter (through the end of November) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market so far in Q4.

Disclosure: None. This article was originally published at Insider Monkey.