Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in Euronet Worldwide, Inc. (NASDAQ:EEFT)? The smart money sentiment can provide an answer to this question.

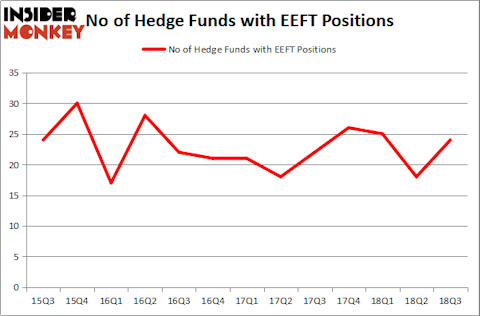

Euronet Worldwide, Inc. (NASDAQ:EEFT) investors should be aware of an increase in enthusiasm from smart money in recent months. EEFT was in 24 hedge funds’ portfolios at the end of the third quarter of 2018. There were 18 hedge funds in our database with EEFT holdings at the end of the previous quarter. Our calculations also showed that EEFT isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are tons of signals stock market investors have at their disposal to assess stocks. A duo of the less known signals are hedge fund and insider trading interest. We have shown that, historically, those who follow the best picks of the elite fund managers can outperform the broader indices by a solid amount (see the details here).

Let’s take a look at the latest hedge fund action encompassing Euronet Worldwide, Inc. (NASDAQ:EEFT).

Hedge fund activity in Euronet Worldwide, Inc. (NASDAQ:EEFT)

At the end of the third quarter, a total of 24 of the hedge funds tracked by Insider Monkey were long this stock, a change of 33% from one quarter earlier. On the other hand, there were a total of 26 hedge funds with a bullish position in EEFT at the beginning of this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Balyasny Asset Management held the most valuable stake in Euronet Worldwide, Inc. (NASDAQ:EEFT), which was worth $27.7 million at the end of the third quarter. On the second spot was Citadel Investment Group which amassed $25.2 million worth of shares. Moreover, Greenhouse Funds, Point72 Asset Management, and Crosslink Capital were also bullish on Euronet Worldwide, Inc. (NASDAQ:EEFT), allocating a large percentage of their portfolios to this stock.

With a general bullishness amongst the heavyweights, key hedge funds were breaking ground themselves. Renaissance Technologies, managed by Jim Simons, assembled the biggest position in Euronet Worldwide, Inc. (NASDAQ:EEFT). Renaissance Technologies had $9 million invested in the company at the end of the quarter. Ira Unschuld’s Brant Point Investment Management also made a $3 million investment in the stock during the quarter. The other funds with new positions in the stock are Brian Ashford-Russell and Tim Woolley’s Polar Capital, Ira Unschuld’s Brant Point Investment Management, and John Overdeck and David Siegel’s Two Sigma Advisors.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Euronet Worldwide, Inc. (NASDAQ:EEFT) but similarly valued. These stocks are EPR Properties (NYSE:EPR), New York Community Bancorp, Inc. (NYSE:NYCB), VEON Ltd. (NASDAQ:VEON), and Ares Management L.P. (NYSE:ARES). This group of stocks’ market values are closest to EEFT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EPR | 13 | 56577 | 1 |

| NYCB | 12 | 66274 | 0 |

| VEON | 7 | 18060 | -3 |

| ARES | 15 | 305352 | 7 |

| Average | 11.75 | 111566 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.75 hedge funds with bullish positions and the average amount invested in these stocks was $112 million. That figure was $213 million in EEFT’s case. Ares Management L.P. (NYSE:ARES) is the most popular stock in this table. On the other hand VEON Ltd. (NASDAQ:VEON) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Euronet Worldwide, Inc. (NASDAQ:EEFT) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.