A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended June 28, so let’s proceed with the discussion of the hedge fund sentiment on Energy Transfer L.P. (NYSE:ET).

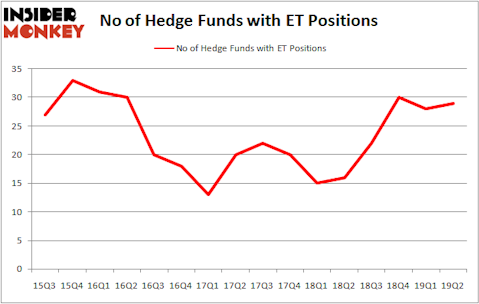

Is Energy Transfer L.P. (NYSE:ET) going to take off soon? Money managers are becoming hopeful. The number of long hedge fund positions inched up by 1 lately. Our calculations also showed that ET isn’t among the 30 most popular stocks among hedge funds (see the video below). ET was in 29 hedge funds’ portfolios at the end of June. There were 28 hedge funds in our database with ET positions at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to check out the new hedge fund action surrounding Energy Transfer L.P. (NYSE:ET).

How have hedgies been trading Energy Transfer L.P. (NYSE:ET)?

At the end of the second quarter, a total of 29 of the hedge funds tracked by Insider Monkey were long this stock, a change of 4% from the previous quarter. By comparison, 16 hedge funds held shares or bullish call options in ET a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Stuart J. Zimmer’s Zimmer Partners has the number one position in Energy Transfer L.P. (NYSE:ET), worth close to $143.6 million, comprising 1.5% of its total 13F portfolio. Coming in second is David Tepper of Appaloosa Management LP, with a $82.4 million position; the fund has 0.9% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors with similar optimism consist of Alec Litowitz and Ross Laser’s Magnetar Capital, Matthew Knauer and Mina Faltas’s Nokota Management and John M. Angelo and Michael L. Gordon’s Angelo Gordon & Co.

As one would reasonably expect, specific money managers have been driving this bullishness. Everett Capital Advisors, managed by Kelly Hampaul, established the most valuable call position in Energy Transfer L.P. (NYSE:ET). Everett Capital Advisors had $40.8 million invested in the company at the end of the quarter. Perella Weinberg Partners also initiated a $40.7 million position during the quarter. The other funds with brand new ET positions are Steve Cohen’s Point72 Asset Management, William C. Martin’s Raging Capital Management, and Himanshu Gulati’s Antara Capital.

Let’s also examine hedge fund activity in other stocks similar to Energy Transfer L.P. (NYSE:ET). We will take a look at National Grid plc (NYSE:NGG), The Dow Inc. (NYSE:DOW), Banco Bilbao Vizcaya Argentaria SA (NYSE:BBVA), and Activision Blizzard, Inc. (NASDAQ:ATVI). This group of stocks’ market valuations resemble ET’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NGG | 8 | 532366 | 0 |

| DOW | 33 | 325782 | 25 |

| BBVA | 7 | 181357 | 3 |

| ATVI | 46 | 2957305 | -4 |

| Average | 23.5 | 999203 | 6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.5 hedge funds with bullish positions and the average amount invested in these stocks was $999 million. That figure was $763 million in ET’s case. Activision Blizzard, Inc. (NASDAQ:ATVI) is the most popular stock in this table. On the other hand Banco Bilbao Vizcaya Argentaria SA (NYSE:BBVA) is the least popular one with only 7 bullish hedge fund positions. Energy Transfer L.P. (NYSE:ET) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately ET wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on ET were disappointed as the stock returned -5.1% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.